Short-Term Pay Incentives Offered to More Workers at Private and Smaller Companies

Small and midsize employers favor simpler incentives that are easily explained

New survey findings confirm what many U.S. workers have already learned: As annual salary raises have held steady at around 3 percent, annual bonuses tied to performance have become a bigger part of compensation.

While use of cash-based short-term incentives (STIs) is well-documented at large, publicly traded corporations, it is also becoming a common way to motivate and reward employees at private companies, especially at small and midsize firms as well as at nonprofit employers, new research shows.

WorldatWork, an association of total rewards professionals, recently surveyed incentive pay plans at privately held companies (those without publicly traded stock) and noted the findings in the report Incentive Pay Practices: Privately Held Companies. A companion report focused on nonprofit organizations and government agencies: Incentive Pay Practices: Nonprofit/Government. Both studies draw on polling of WorldatWork members (total rewards professionals mostly at large U.S. employers) in December 2017. Approximately 215 private, for-profit companies responded to the survey, as did more than 110 nonprofit and government organizations.

Private Companies' Incentives

To put the number of companies using short-term incentives in perspective, consider these numbers: There are more than 6 million privately held companies in the U.S. and more than 1.5 million nonprofit organizations. Fewer than 4,000 U.S. companies are publicly traded, according to government statistics.

"Spending on short-term incentives increased modestly at private companies from 2015 to 2017, which reflects the tight labor market and competition for talent," said Bonnie Schindler, partner and co-founder of Vivient Consulting, which partnered with WorldatWork on the research.

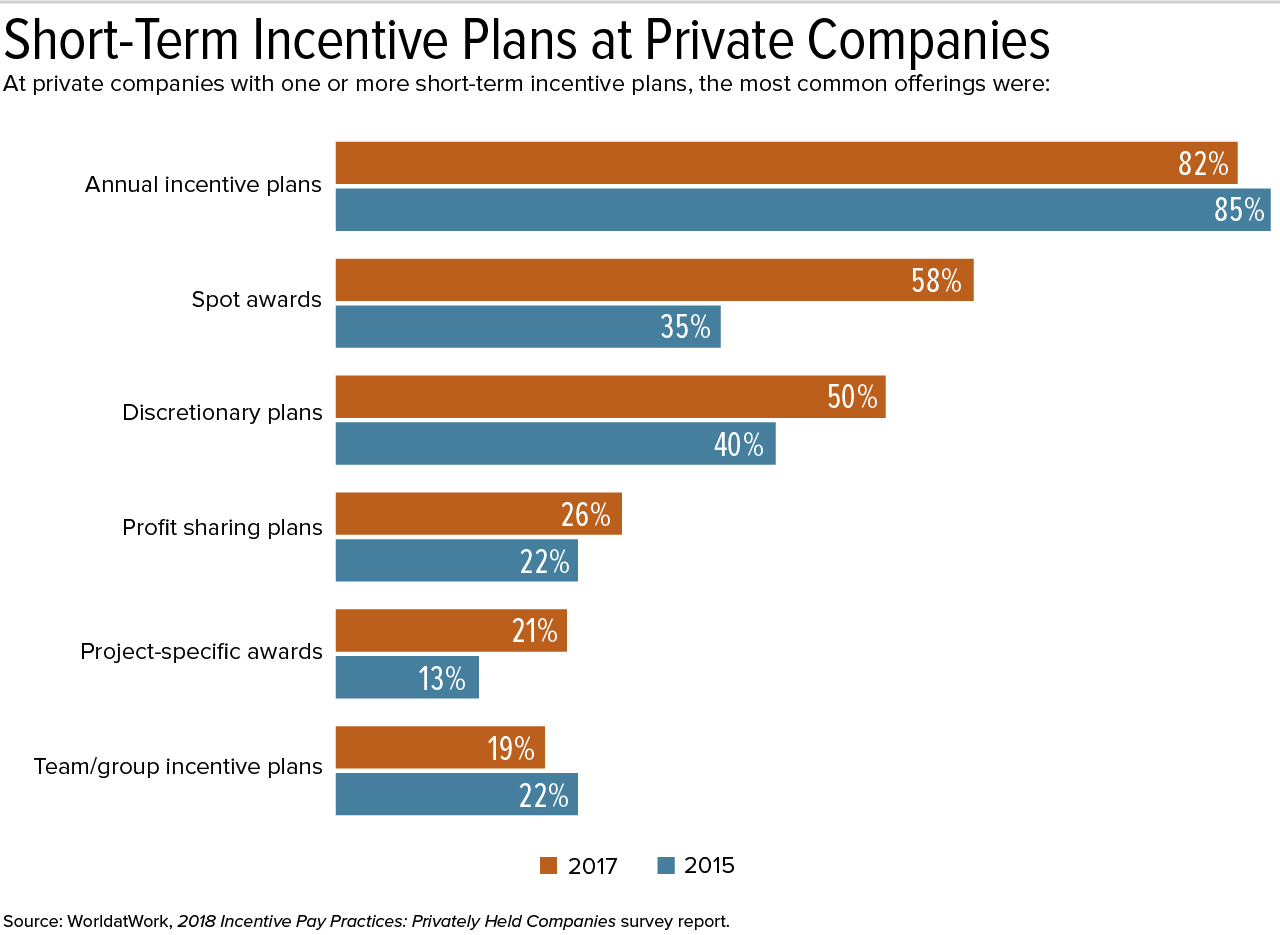

In 2017 versus 2015, among private companies responding to the WorldatWork survey:

- 96 percent had STI programs, up from 94 percent.

- Spending on short-term incentives increased to a median of 6 percent of operating profits, up from 5 percent.

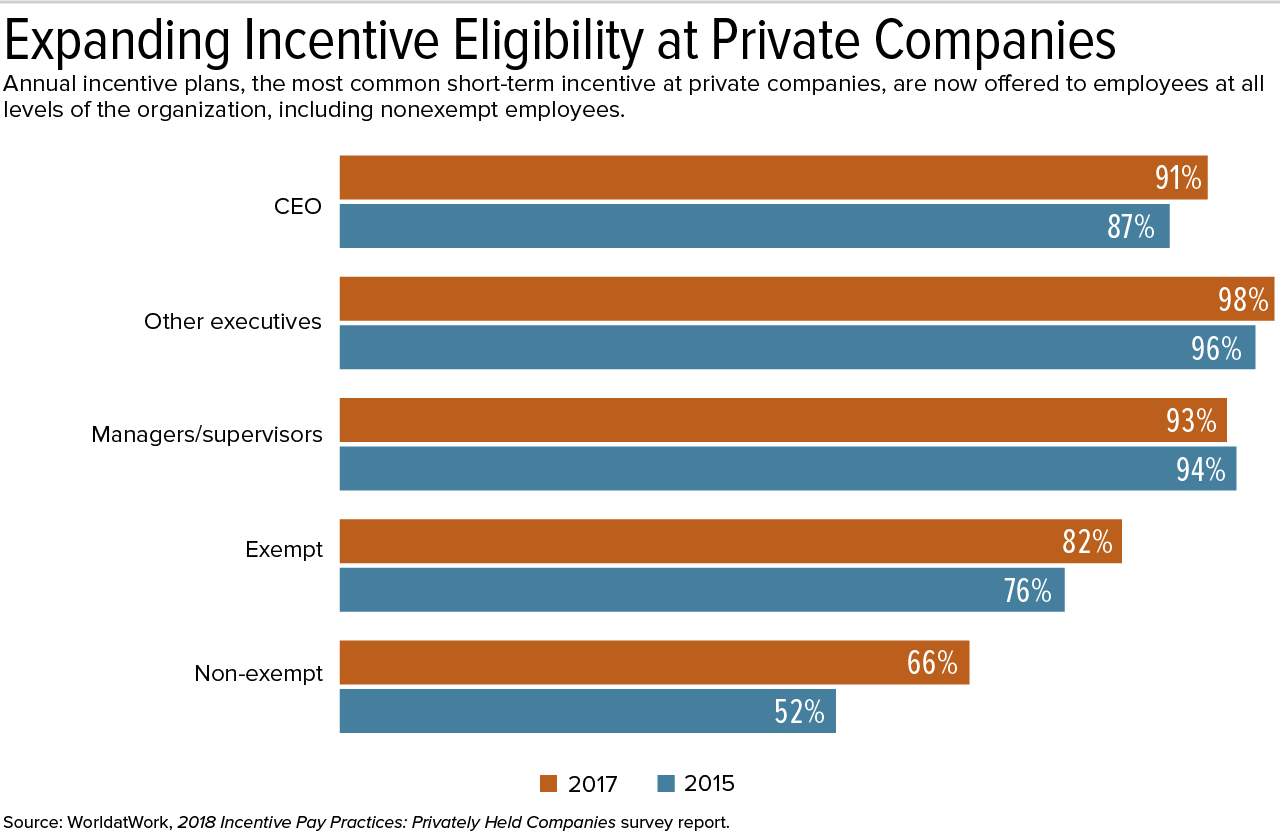

- About 66 percent of nonexempt employees were eligible for annual incentives, up from 52 percent.

Nineteen percent of private companies used team or group incentive plans in 2017, a drop from 22 percent in 2015, perhaps in part because of concerns that such payments benefited workers who may not have put in as much effort as their colleagues.

"So-called free-riders can definitely be a problem with team/group incentives," Schindler said. "We did see an increase in spot awards and discretionary awards," which focus on individual efforts, she noted.

Most private-company respondents were cautious about giving managers discretion in granting annual incentive-plan awards, noting that the rationale for discretion was often poorly communicated, and its use tended to undermine the fairness and consistency of award payouts.

(Click on graphics to view in a separate window.)

As used in the chart:

- Annual incentive plans, by far the most commonly awarded short-term incentive, are given to individuals based on achieving results identified at the beginning of the performance cycle.

- In discretionary bonus plans, management determines the size of the bonus pool, but these plans have no predetermined formula, and awards are not guaranteed.

- Spot awards recognize special contributions as they occur for a specific project or task.

- Profit sharing plans provide for employee participation in an organization's profits.

- Team/small-group incentives focus on the performance of a work team.

While long-term incentives based on meeting performance goals over a multiyear period are a common component of executive pay, they remain seldom used for nonexecutive employees. STI programs, however, are becoming more popular and are used for employees at all levels of an organization.

Median Target Annual Incentive Plan Awards At private companies, the median annual incentive plan award level for CEOs is 80 percent of salary, with targets decreasing by about half for each lower position level in the organization. | |

Position | Incentive Plan Awards as a Percent of Salary |

CEO | 80% |

Other executives/officers | 40% |

Managers/supervisors | 15% |

Exempt salaried | 10% |

Nonexempt salaried and hourly | 5% |

Source: WorldatWork, 2018 Incentive Pay Practices: Privately Held Companies survey report. | |

Despite the growth of short-term incentives, most private-company respondents consider their annual incentive plans to be only moderately effective, with plan communication, the level of discretion, goal setting and the risk/reward trade-off noted as areas for improvement.

[SHRM members-only toolkit Designing and Managing Incentive Compensation Programs]

Simpler Incentives at Smaller Firms

"There continues to be focus on reducing the complexity of short-term incentive design and establishing a more rigorous process for setting company and individual performance goals," a recent report on executive compensation by consultancy Willis Towers Watson stated. Other research shows simplicity is especially valued when implementing broad-based employee incentives, particularly at smaller organizations.

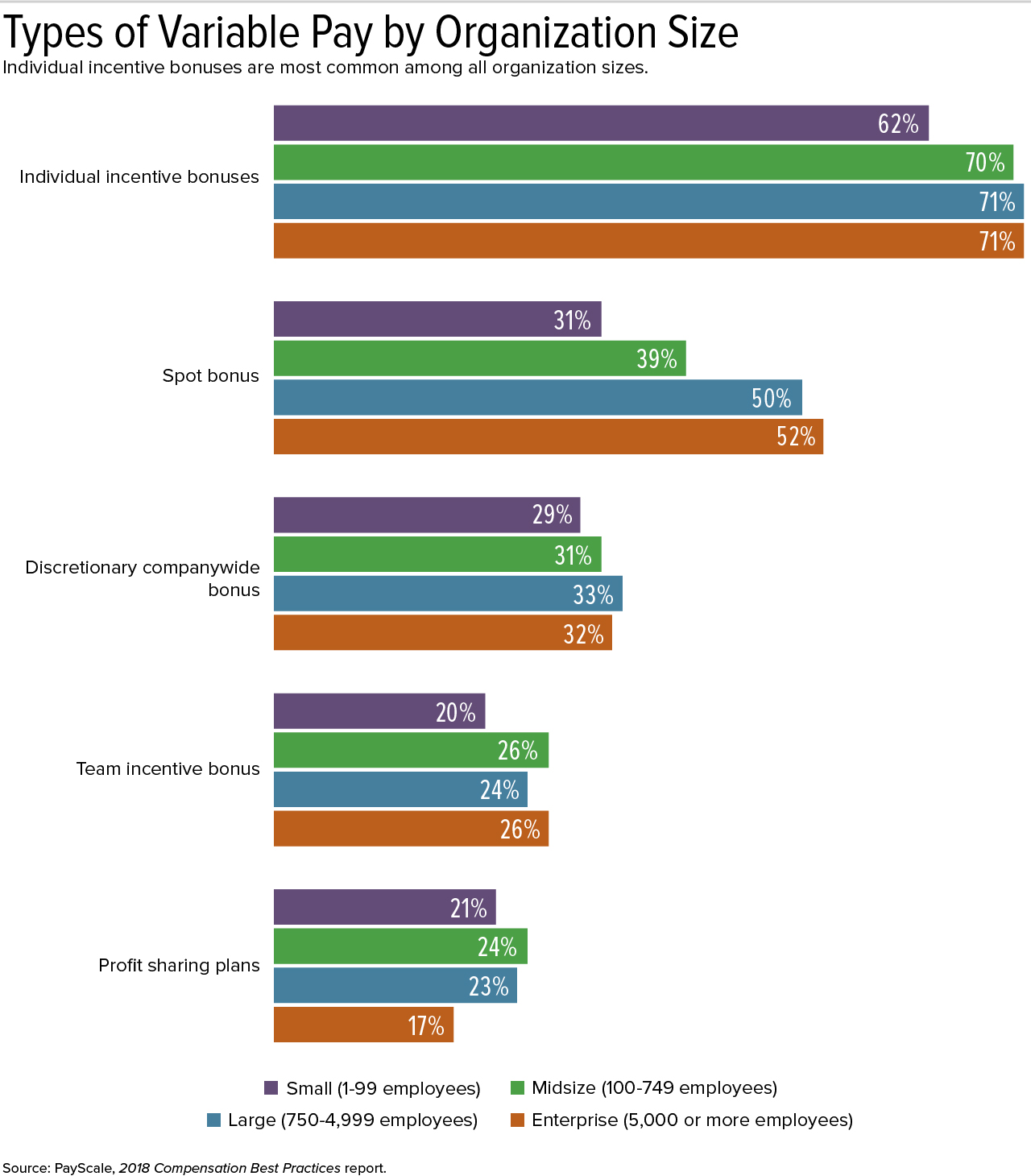

"Most small and midsize companies lack a sophisticated compensation team to design, monitor and communicate complex incentive plans," said Michele Kvintus, client manager at PayScale, a Seattle-based pay consultancy.

Smaller organizations do less of every kind of variable pay except for profit sharing, where small and midsize organizations beat out their larger counterparts, PayScale's 2018 Variable Pay Playbook shows. The report draws on the firm's survey of 7,100 pay managers at companies of all sizes, conducted in November and December last year.

"Profit sharing incentive plans that deliver cash to employees based on company profitability are terrific for small and midsize companies because they don't require intensive design work. It's also easy to explain a profit sharing incentive plan to employees," Kvintus said.

These programs "provide a look back after the close of a business year and foster a 'we grow, you share in it' perspective," she added. "For small to midsize companies, a business-owner mentality among employees is frequently a key factor" for engagement.

Related SHRM Article:

Evolving Company Culture from Base Pay to Variable Rewards, SHRM Online Compensation, June 2017

Employers Try Better Ways to Measure and Reward Performance, SHRM Online Compensation, August 2017

3% Salary Increases Put Greater Focus on Variable Pay, SHRM Online Compensation, August 2017

Related Resource:

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.