2020 Salary Budget Growth Expected to Notch Just Above 3%

Wage growth stays restrained despite low unemployment and tight labor market

Salary Budget Forecasts

updated September 17, 2019

Recent pay-forecast studies are in broad agreement that 2020 pay raises will be, on average, only minimally larger than employees pocketed this year.

Salary-increase budgets for U.S. employers are projected to grow next year by just 0.1 percent above the actual average budget increase for 2019, confirming that wage growth isn't accelerating much despite record-low unemployment, shows WorldatWork's 2019-2020 Salary Budget Survey: Top-Level Results.

U.S. salary budgets are projected to rise by an average (mean) of 3.3 percent in 2020, up from an actual year-over-year increase of 3.2 percent for 2019 and 3.1 percent in 2018, according to the WorldatWork's survey data, collected through May 2019 from more than 6,000 responses, including from companies making no salary adjustments.

In the table below, the mean is the mathematical average, and the median is the middle value after listing expected budget increases in successive order. Outliers, or extreme values on either the high or low end, have the bigger effect on the mean and less on the median.

Total U.S. Salary Budget Increases

| Employee Category | Projected 2020 Mean | Projected 2020 Median | Actual 2019 Mean | Actual 2019 Median |

| Nonexempt hourly, nonunion | 3.3% | 3.0% | 3.2% | 3.0% |

| Nonexempt salaried | 3.2% | 3.0% | 3.1% | 3.0% |

| Exempt salaried | 3.3% | 3.0% | 3.2% | 3.0% |

| Officers/executives | 3.3% | 3.0% | 3.3% | 3.0% |

| All | 3.3% | 3.0% | 3.2% | 3.0% |

Source: WorldatWork 2019-2020 Salary Budget Survey: Top-Level Results.

WorldatWork, an association of total rewards professionals, also reports that:

- In 2019, the overall average salary structure adjustment is 2.2 percent, representing an upward shift from 2 percent in 2018. The projection for 2020 is holding steady at 2.2 percent.

- For employees receiving promotional increases, the size of the average base pay increase rose to 8.9 percent, up from 8.7 percent a year earlier.

"Companies need to recognize that while the salary budget increases are relatively modest, in the current work landscape salaries are just one component in a compensation package," said Alison Avalos, director at WorldatWork. "Other recent research indicates that beyond salary, total rewards benefits that provide a great work experience and a great life experience are valued highly by employees, and companies are addressing these needs to remain competitive."

Salary.com, which provides compensation data and analytics, similarly projects that salary-increase budgets will again see median growth of 3 percent in 2020 in all employee categories. The firm expects the following mean salary-budged increases for 2020:

- Executives: a 3.2 percent rise, unchanged from 2019.

- Other managers: a 3.3 percent rise, up from 3.1 percent.

- Exempt employees: a 3.3 percent rise, up from 3.2 percent.

- Nonexempt employees: a 3.3 percent rise, unchanged from 2019.

More than 1,600 HR professionals across diverse industries participated in Salary.com's 2019-2020 U.S. and Canada National Salary Budget Survey, which closed in June.

"In today's war for talent, market pay rates for many jobs are far outpacing annual salary-increase budgets," said Chris Fusco, Salary.com senior vice president of compensation. "Given that median increases have remained flat at 3 percent for nine years in a row, organizations competing for talent in today's market must think differently about how they allocate increases across top performers, employees with hot jobs and skills and high-potential employees."

Consultancy Willis Towers Watson's 2019 General Industry Salary Budget Survey—U.S., conducted in late April through early July 2019, with responses from 858 organizations, similarly found that among companies granting salary increases, 2020 average base pay raises are projected as follows:

- Executives: 3.2 percent, up from 3.1 percent in 2019.

- Management, excluding executives: 3.2 percent, unchanged.

- Exempt, nonmanagement employees: 3.2 percent, up from 3.1 percent.

- Nonexempt salaried employees: 3.1 percent, unchanged.

- Nonexempt hourly employees: 3.1 percent, up from 3.0 percent.

Even with low unemployment rates, "some clients are feeling uncertain about what the market will bear in 2020 and, therefore, continue to be selective on where they spend their compensation dollars," said Catherine Hartmann, North America Rewards leader at Willis Towers Watson. For instance, "some employers are carving out increase pools for their high-potential and top performing employees, setting aside premium pay for highly valued skills, considering market adjustments for critical segments and providing more frequent increases outside of the annual cycle for in-demand jobs."

More of the Same

Fewer than one-fourth (21 percent) of U.S. employers are increasing merit increase budgets for 2020, with the majority opting to keep merit increase budgets the same, according to HR consultancy Mercer's 2019/2020 US Compensation Planning Survey, which likewise pegs 2020 salary budgets to increase 3.0 percent, up from 2.9 percent in 2019. Mercer's survey includes responses from more than 1,300 mid-size and large employers across the U.S.

"Employers are taking a more holistic 'employee experience' view when it comes to investments in the workforce, but the annual merit increase budget is a line item that doesn't appear to be moving much," said Mary Ann Sardone, Mercer's U.S. talent solutions leader. "Investments in other programs related to wellbeing, career development and technology are getting the attention of employers in an effort to better meet the needs of their employees."

Compensation advisory firm Empsight's August 2019 Policies, Practices & Merit Survey Report, based on responses from 251 large U.S. companies, looks at 2020 pay from a variety of perspectives, including the outlooks below.

______________

Forecasted Merit Increase Budget for 2020

Participating companies were asked to indicated the forecasted merit increase budget for 2020, if known.

| Mean | 25th Percentile | Median | 75th Percentile | |

| Overall Forecasted Merit Increase Budget | 2.93% | 3.00% | 3.00% | 3.00% |

| Executive | 2.95% | 3.00% | 3.00% | 3.00% |

| Management | 2.95% | 3.00% | 3.00% | 3.00% |

| Professionals | 2.94% | 3.00% | 3.00% | 3.00% |

| Support / Nonexempt | 2.92% | 3.00% | 3.00% | 3.00% |

Source: Empsight, Policies, Practices & Merit Survey Report.

______________

Forecasted Total Increase Budget for 2020

Participating companies were asked to provide the forecasted total percentage salary increase budget (merit + promotional + special competitive adjustment) for 2020

| | Mean | 25th Percentile | Median | 75th Percentile |

| Forecasted Total Increase Budget | 3.28% | 3.00% | 3.00% | 3.50% |

| Executive | 3.22% | 3.00% | 3.00% | 3.50% |

| Management | 3.23% | 3.00% | 3.00% | 3.50% |

| Professionals | 3.22% | 3.00% | 3.00% | 3.50% |

| Support / Nonexempt | 3.21% | 3.00% | 3.00% | 3.50% |

Source: Empsight, Policies, Practices & Merit Survey Report.

Mercer's survey also reports total increase budget data as a combination of merit increases, cost of living adjustments, across the board increases, promotional increase budgets and additional or other increase budgets. Mercer projects total increase budgets to rise 3.6 percent in 2020, up from 3.5 percent in 2019 tand 3.3 percent in 2018.

"This signals that companies are seeing the need for pay increases beyond merit-based raises to address market and pay equity adjustments given today's hypercompetitive labor market," said Sardone.

Mercer's survey also showed that:

- 54 percent of organizations budget separately for promotional increases, up from 51 percent last year. The average promotional budget represented 1.0 percent of payroll in 2019, down slightly by 0.2 percent vs. 2018.

- All employee groups saw a year-over-year increase in promotional increases. The average promotional increase received by an employee was 9.3 percent, climbing 1.5 percent from last year.

Bureau of Labor Statistics Finds Modest Wage Growth In a finding that's along the same lines as the surveys noted above, wages and salaries for private industry workers increased 3.0 percent for the 12-month period ending in June 2019 compared with an annual increase of 2.9 percent in June 2018, the U.S. Bureau of Labor Statistics (BLS) reported July 31 in its quarterly Employment Cost Index. Update: In August, average hourly earnings for all employees on private nonfarm payrolls rose by 11 cents to $28.11, following 9-cent gains in both June and July, the BLS reported Sept. 6 in its Employment Situation release. Over the past 12 months, average hourly earnings have increased by 3.2 percent.

|

[SHRM members-only how-to guide: How to Establish Salary Ranges]

Performance Ratings Matter

Salary-increase budgets measure the pool of money organizations are making available annually for base pay raises. Top performers generally receive bigger pay raises than average and low-performing workers. WorldatWork reported the following:

______________

Merit Increase Differentiation

| Middle Performers Mean | High Performers Mean | Differentiation | |

| 2019 (est.) | 2.8% | 4.2% | 50% |

| 2018 | 2.8% | 4.1% | 46% |

Source: WorldatWork 2019-2020 Salary Budget Survey: Executive Report & Analysis.

Willis Towers Watson found that employees receiving the highest possible rating were granted an average increase of 4.6 percent, significantly more than the 2.7 percent increase granted to those receiving an average rating.

______________

2019 Average Salary Increases Based on Employee Ratings

| Highest Possible Rating | Above-Average Rating | Average Rating | Below-Average Rating | |

| Management, excluding executives | 4.6% | 3.6 | 2.7% | 0.7% |

| Exempt, nonmanagement | 4.6% | 3.7% | 2.7% | 0.7% |

| Nonexempt salaried | 4.7% | 3.7% | 2.8% | 0.7% |

| Nonexempt hourly | 4.5% | 3.6% | 2.7% | 0.7% |

Source: Willis Towers Watson, 2019 General Industry Salary Budget Survey—U.S.

______________

2019 Performance Ratings for Exempt, Nonmanagement Employees

| Performance Rating | Average Percent Rated at This Level | Average Salary Increase Granted |

| Highest possible rating | 11.7% | 4.6% |

| Above-average rating | 33.1% | 3.7% |

| Average rating | 58.2% | 2.7% |

| Below-average rating | 5.2% | 0.7% |

Source: Willis Towers Watson, 2019 General Industry Salary Budget Survey—U.S.

"Despite an extremely tight labor market, most employers are either not willing or fiscally unable to increase their fixed costs across-the-board by bolstering their salary budgets," Hartmann noted. "Instead, many companies are doubling down on providing significantly larger market adjustments to employees in high-skill roles and selective pay raises to their top performers. Some employers are also recognizing the contributions of these employees with better annual incentives and discretionary bonuses."

In its survey, Mercer found that:

- A small portion of employers, 14 percent in 2019, do not use performance ratings. Of those, the majority distribute merit pay based on manager discretion with oversight/review by business leader or HR/compensation group.

- Organizations continue to differentiate base pay by performance. The majority (90 percent) still use individual performance to drive base salary adjustments, up from 2018 (88 percent). In 2019, high performers received 1.6 times the salary increase of average performers.

Focus on Variable Pay

As annual budgets for salary increases have not significantly increased year over year, organizations are directing more of their compensation budgets to variable pay programs. "In looking to reward and retain top talent, organizations that leverage performance-based variable pay programs hold a competitive advantage," Fusco said.

Salary.com's survey had the following results:

______________

Variable Pay in the U.S. as a Percentage of Base Pay

| Employee Category | Planned 2020 Mean | Planned 2020 Median | Actual 2019 Mean | Actual 2019 Median |

| Executives | 39.0% | 35.0% | 39.4% | 34.0% |

| Other managers | 17.9% | 15.0% | 16.8% | 15.0% |

| Exempt employees | 12.5% | 10.0% | 11.9% | 9.0% |

| Nonexempt employees | 7.9% | 5.0% | 6.9% | 5.0% |

Source: Salary.com 2019-2020 U.S. and Canada National Salary Budget Survey.

Willis Towers Watson's survey found the following:

______________

Short-Term Incentive/Bonus as a Percentage of Base Pay

| Employee Category | Projected 2020 Mean | Projected 2020 Median | Budgeted 2019 Mean | Budgeted 2019 Median |

| Executives | 48.8% | 45.0% | 48.4% | 45.0% |

| Management, excluding executives | 20.4% | 18.0% | 21.0% | 18.0% |

| Exempt, nonmanagement | 10.8% | 10.0% | 11.0% | 10.0% |

| Nonexempt salaried | 6.3% | 5.0% | 6.4% | 5.2% |

| Nonexempt hourly | 5.7% | 5.0% | 5.8% | 5.0% |

Source: Willis Towers Watson, 2019 General Industry Salary Budget Survey—U.S.

A base pay increase in the 2.8 percent to 3.1 percent range "is no way to reward your best and brightest employees," said pay consultant John Rubino, SHRM-SCP, founder and president of Rubino Consulting Services, at the Society for Human Resource Management 2019 Annual Conference & Exposition in June.

WorldatWork found that 84 percent of surveyed organizations used variable pay as part of their compensation program in 2019. Among those doing so, 69 percent based rewards on a combination of organization/unit success and individual performance.

Empsight's survey summarized the weighting of short-term incentive payouts by individual, company and business unit performance, and by employee level. Company performance was weighted the highest for executives, while individual performance was weighted the highest for professionals.

______________

Weighting of Short-Term Incentive Payouts

| Employee Level | Individual Performance | Company Performance | Business Unit Performance |

| Executives | 19.0% | 64.6% | 16.4% |

| Management | 27.6% | 54.8% | 18.5% |

| Professionals | 27.9% | 55.2% | 16.9% |

| Support / Nonexempt | 26.9% | 50.0% | 23.0% |

| Covered by Collective Bargaining | 15.2% | 51.6% | 33.3% |

Source: Empsight, Policies, Practices & Merit Survey Report.

Hourly Wage Gains: Another View

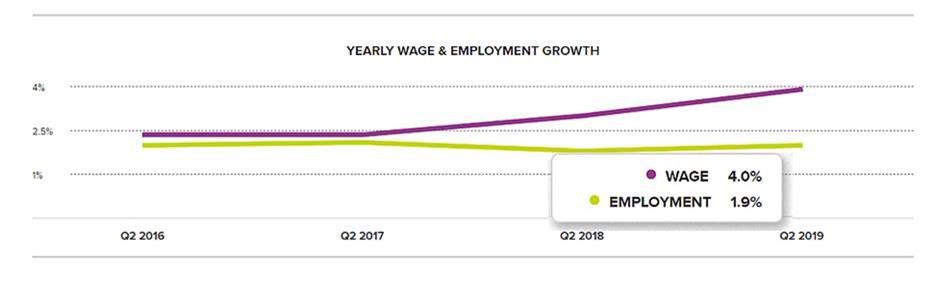

Another new report finds higher growth for U.S. workers' hourly wages than noted in the forecasts above. Hourly pay grew 4 percent annually as of the second quarter of 2019, increasing the average wage level by $1.09 to $28.54 an hour, according to the ADP Research Institute's Workforce Vitality Report for the second quarter of 2019, released July 24.

Annual hourly wage growth had been 3.8 percent through the second quarter of 2018, according to the ADP report, which is derived each month from a sample of approximately 250,000 companies and 18 million employees.

Source: ADP Research Institute second quarter 2019 Workforce Vitality Report.

"The tight labor market is pushing companies to pay more," said Ahu Yildirmaz, co-head of the ADP Research Institute, an affiliate of HR and payroll software and services firm ADP. "As labor shortages are apparent in most of the sectors, businesses are holding on to their skilled workers by increasing their wages," she said.

The Midwest outpaced other regions with 4.5 percent wage growth, although the average hourly wage rate there was the lowest in the U.,S. at $26.57, ADP found. Workers in the South and Northeast had the lowest wage growth at 3.6 percent.

Hourly wage growth at large U.S. companies outpaces wage raises at smaller employers.

U.S. Hourly Wage Growth by Company Size

| Company Size | Average Hourly Wages | Year-Over-Year Wage Growth |

| 49 or fewer employees | $26.05 | 2.9% |

| 50 to 499 employees | $28.49 | 3.2% |

| 500 to 999 employees | $29.56 | 3.0% |

| 1,000 or more employees | $29.91 | 5.1% |

| All | $28.54 | 4.0% |

Source: ADP Research Institute second quarter 2019 Workforce Vitality Report.

Wage growth overall was driven by strong gains for workers in manufacturing (4.4 percent annual wage growth, $29.83 average hourly wage) and construction (4.4 percent annual wage growth, $28.65 average hourly wage), ADP reported.

In the service sector, annual wage growth was strongest in information (4.2 percent, $41.56 average hourly wage), trade (4.3 percent, $25.27 average hourly wage), and professional and business services (4.1 percent, $36.45 average hourly wage).

Inflation's Bite

As of the first half of 2019, the rate of inflation as measured by the consumer price index had been 2.1 percent over the previous 12 months, the Bureau of Labor Statistics reported.

By one account, inflation-adjusted "real" wages were only slightly up in the 12 months through June 2019, rising just 0.2 percent, meaning that "the average person cannot purchase much more than they could a year ago when wage growth is measured in relation to inflation," according to a report by PayScale, a compensation data and software firm.

"While there are some encouraging signs with nominal [before inflation] wages growing in select industries and job families, this increase is still not enough to impact real wage growth in a meaningful way," said Sudarshan Sampath, PayScale's director of research. "There are some bright spots in the economy, but many industries—those with a high proportion of blue-collar jobs, in particular—are still struggling," he said.

The second quarter 2019 PayScale Index, which evaluates pay figures from more than 300,000 employee profiles, showed U.S. wage growth of 2 percent year over year through the second quarter, significantly lower than the wage growth cited in the reports above. The index tracks changes in total cash compensation for full-time, private industry employees and education professionals in the U.S., including hourly and salaried workers.

Wage growth was stronger in select jobs and industries, such as media/publishing and retail jobs, where wages grew 2.8 percent before inflation year over year, and less so for blue-collar jobs across the country, such as manufacturing/production, where wage growth was just 0.9 percent.

Nominal wage growth also varied widely among regions and metropolitan areas, PayScale reported. In San Francisco, for instance, compensation grew by 4.5 percent year over year, and in Milwaukee by 3.5 percent, the index showed. But in Pittsburgh and Cleveland the increases were just 0.8 percent and 0.7 percent, respectively.

Ninth Year in a Row that Salary Growth Has Stayed Consistent Pay consultancy Korn Ferry also weighed in with a 2020 salary increase forecast in mid-September, striking many of the same chords as other 2020 pay projections. For the ninth year in a row U.S. employees can expect to see a 3.0 percent median base salary increase in 2020, based on data from Korn Ferry's U.S. pay database, collected from March through June 2019. While the 3.0 percent anticipated median growth in base salaries is consistent across employee groups from clerical support to executives, there are variations in pay increase practices across organizations. Companies in the top 10th percentile of surveyed organizations estimate a 3.5 percent increase across employee groups in 2020, while the organizations that pay in the bottom 10th percentile predict a 2.5 percent increase, according to the firm's analysis. "Even though the U.S. economy remains strong and we are experiencing very low unemployment levels, there are mixed views on anticipated economic growth, which has an impact on wage growth," said Korn Ferry Senior Client Partner Tom McMullen. "One factor may be that feelings of uncertainty about the future are keeping employers cautious in terms of offering higher growth in fixed costs and base wages," he noted. "While the 3.0 percent median salary increase number has become typical over the years, that doesn't mean that top performers aren't being rewarded," added McMullen. "Companies are relying more on short and long-term incentive plans and pay-for-performance programs to provide meaningful pay differentiation for top talent. In addition, we typically see highly rated talent receiving double the base pay increases of average-rated talent." |

Related SHRM Resources:

Salary Increase Projections 2020 (and 2019), SHRM Express Requests

Need the most current HR-reported salary data? The SHRM Compensation Data Center now offers real-time compensation data reports to help recruit and retain top talent in today's market.