The Pandemic Alters Pay

In 2021, the impact of the COVID-19 pandemic on pay will vary by industry and region—and even by job within companies.

The coronavirus pandemic took employee compensation on a roller coaster ride in 2020. The year began with a tight labor market and rising wages followed suddenly by stay-at-home orders and massive job losses that upended the labor market. Companies had to adjust on the fly. Today, business leaders struggle to set 2021 pay levels absent certainty about when the economy will recover and how soon a vaccine for COVID-19 might become widely available. They are also considering the role of compensation in retaining top performers, who are more valuable than ever in this unstable environment.

Last spring, one-fourth of companies reduced pay (most of them temporarily) when the novel coronavirus shut down large swaths of the economy, according to research by Mercer. During those early months of 2020, as the pandemic was just beginning to be felt in the U.S. but not yet understood, companies weighed whether to stick with their compensation plans. Sixty-eight percent of them went ahead with merit pay increases and 79 percent paid out bonuses as planned, according to Mercer. Overall, the consultancy says, compensation rose about 3 percent in 2020—roughly the same as the increases seen in each of the past seven or eight years.

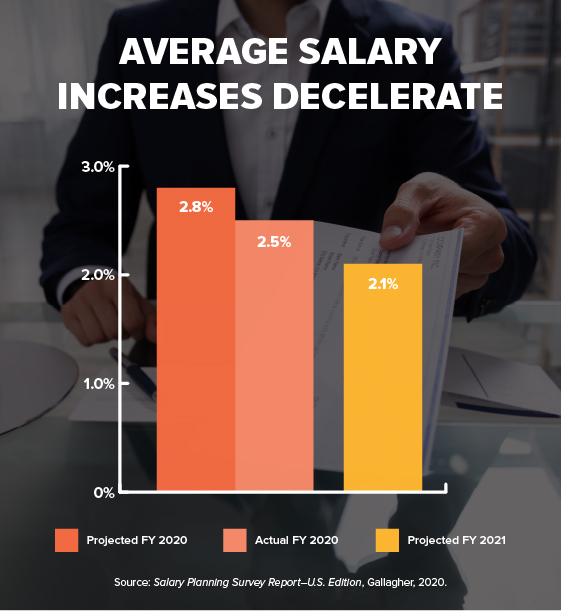

A survey report from Gallagher, however, found a lower average pay increase of 2.5 percent in 2020. And the benefits brokerage and advisory company projects a 2.1 percent increase for fiscal 2021.

But behind the averages, specific impacts varied.

Mixed Effects

In 2021, the impact of the COVID-19 pandemic on pay will continue to vary by industry and region—and even by job within companies.

Company leaders expect to increase compensation in 2021 by between 2.6 percent and 3 percent, according to Mercer’s research. But industries will be affected unevenly, just as they were in 2020. Online retailers enjoyed record sales as homebound consumers avoided stores and opted for delivery, for example, while other sectors were seriously hurt by the economic downturn. Between September 2019 and September 2020, the U.S. economy lost a net of 9.6 million jobs (not including agricultural jobs). A disproportionate 8.6 million of those were service jobs, with 3.6 million in leisure and hospitality, according to the Bureau of Labor Statistics (BLS).

Some workers in hard-hit businesses realized less growth in their hourly wages than national averages, according to the BLS’s Current Employment Statistics. Between September 2019 and September 2020, average hourly wages in the leisure and hospitality industry rose just 15 cents to $14.78. By contrast, average hourly earnings for nonfarm workers in production and nonsupervisory roles rose from $23.70 to $24.79.

Going forward, the effects of the pandemic are impacting decisions about overall compensation strategies. Incentive plans at some companies that have benefited from the unusual circumstances of 2020 paid out above target levels despite the battered overall economy, says Gregg Passin, senior partner, Executive Solutions, at Mercer. Other companies will take years to recover and must decide whether to change incentive plan awards downward to reflect the new economic reality.

Companies everywhere are weighing the uncertainties of the economy against the need to keep pay levels up to retain top performers. There’s no right answer for all companies regarding pay, according to Mary Ann Sardone, partner, U.S. Talent Solutions leader, at Mercer. “Our advice is you have to look at your situation,” she says.

Tom Gimbel, CEO of LaSalle Network, a national staffing and recruiting firm based in Chicago, recommends ranking employees on ability and future potential. He maintains that the top quarter need to get increases in base pay or variable compensation so that they don’t get snapped up by competitors.

“If you want to retain your best people, you have to do it with your top quartile,” Gimbel says.

Contributing Factors

Despite high rates of unemployment brought on by the pandemic, some companies with front-line workers raised hourly rates to attract new hires. Target increased its minimum wage to $15 an hour in July and gave front-line workers a $200 bonus. Walmart bumped up pay for 165,000 workers.

As the virus raged and killed hundreds of thousands of people in the U.S., many industries realized how critical their hourly workforces were for keeping the business—and the country’s economy—going.

While higher minimum wages and hazard pay were the answer for many companies, businesses in the health care industry were a notable exception, Sardone says. Leaders in that sector resisted hazard pay because nurses, doctors and other workers routinely faced job-related health threats before the pandemic.

“It’s a bit of a slippery slope when you add hazard pay to an already hazardous job,” Sardone notes.

But while the coronavirus is still a risk for the 50 million front-line essential workers in the U.S., most companies dropped hazard pay by early summer as a new normal took hold, according to the Brookings Institution.

At the same time, some lower-level workers have seen their wages stagnate because massive layoffs have resulted in a larger supply of labor, Gimbel says.

He doesn’t expect pay to collapse for managers and executives, though, as happened during the 2001 and 2009 economic downturns. That’s because the impact on compensation is not as widespread as in past recessions. Many job seekers are willing to hold out for more money instead of taking a reduction in pay because they believe that the economy will return to normal after a COVID-19 vaccine becomes widely available. “The accountant isn’t competing against the barista who got laid off,” Gimbel says.

And, unlike in previous downturns, the federal government in 2020 decided to temporarily expand unemployment benefits and protect against evictions and home foreclosures. “You don’t see people willing to take jobs below their skills and pay grade,” Gimbel says.

Regional differences have also impacted compensation decisions. Dan Ryan, CEO of executive search firm Ryan Partners in Nashville, Tenn., has seen virtually no downward pressure on salaries in the Southeast, where his clients include architectural, engineering and construction firms.

“Depending on geography, in parts of the country where development is still on track, the pace of construction and design is still very busy,” Ryan says. “From a supply and demand standpoint, there is still inadequate supply [of labor].” When stay-at-home orders were imposed in the spring, many construction companies cut pay by 10 percent to 15 percent, Ryan says, but most have since restored rates to pre-pandemic levels.

Leaders at some companies are trying to determine what areas of the business need beefing up and what type of talent they need. With the economic upheaval leaving less money to go around for salary increases, companies must choose wisely where to dole out increases. The move to remote work, for instance, put a spotlight on the importance of IT workers who can enhance a company’s digital infrastructure. And marketing talent is valuable as companies adapt to new digital platforms.

“What COVID has shown is the need for digital transformation of … business and what parts of the business will enable that,” Sardone says. “Companies may take a much more surgical approach this year to distributing salary increases.”

Flexible Work Arrangements

Flexible work was a top priority for many employees prior to the pandemic. Then the public health crisis gave businesses a sudden chance to experiment with flexible work on a large scale when they were forced to send their employees home to work remotely. Even when it’s safe for everyone to be back in the office together, flexible work options and hours will become common. Before the pandemic, just 1 in 30 companies planned to let half or more of their employees work remotely, according to Mercer. Now, one-third of companies plan to allow that.

As employees shifted to remote work, some companies provided compensation for home office furniture or equipment. Google and Twitter, for instance, kicked in $1,000 stipends for remote employees.

Not all jobs can be done remotely. But it’s important to note that working in sweatpants from a home office isn’t the only type of flexible work arrangement available. Some jobs can provide flexible hours or allow split shifts or job sharing.

Gimbel sees a coming rift between blue-collar and white-collar workers if only the latter get flexibility. Workers who aren’t allowed to take advantage of flexible work arrangements are going to want more compensation to make up for it. Their message, Gimbel says, will be “Pay us more … or have everyone get their butts into the office. [If] I’m in Chicago in the cold and the marketing person is in Naples, Florida, is that fair?”

Location Matters

As companies realize that remote work can work, some are rethinking how they recruit and compensate people. If a job can be done outside the office, should it be benchmarked to the local talent market? Should it be pegged to the regional or national market? Why pay a Silicon Valley salary to an employee sitting in his home office in Montana?

When you say you don’t care where your workers work, it calls into question how you set pay, Sardone says.

Some companies are cutting the salaries of workers who switch to remote work permanently if they move to a lower-cost area.

In fact, the move to remote work could save companies money if they reclassify employees based on their remote status, Ryan says. He has already seen workers use the flexibility of remote work to move from high-tax states like Illinois and California to suburban and rural areas where they have more space, such as Texas and Florida. The ability to work remotely is high on many candidates’ priority lists when weighing jobs, even if it means less pay, because they can live in a lower-cost area. “It’s a trade-off people are willing to make,” Ryan says.

But companies may be better off reducing pay for future hires who live in less expensive areas instead of ruffling the feathers of current staff who work remotely, Sardone warns.

Businesses also need to be careful about how they handle executive compensation, especially if rank-and-file workers have taken a hit on pay. “Making executives whole or close to whole is a difficult story to tell” if other workers are suffering financially, Passin says.

Leaders need to think about how employees, regulators and customers will view cushy executive incentive payouts in the middle of hardship, Passin says. He is seeing a range of strategies among his clients. Some companies planned to limit executive incentive payouts at the end of 2020. But with the uncertain economy, executives could have a tough time meeting target goals in 2021, leaving them without incentives two years in a row.

That’s not what you want to tell an executive who you’re keen to retain, Passin says.

There’s no right or wrong answer on executive compensation, Gimbel says. He took no salary from February through September 2020 so he could pay his employees. And he understands that it’s important to workers to be able to choose where they perform their jobs.

“I’m seeing companies say more than before, ‘What is our culture? What do our employees mean to us?’ ”

Tamara Lytle is a freelance writer in the Washington, D.C., area.

Explore Further

SHRM provides advice and resources to help business leaders make strategic decisions about employee pay.

Fewer Workers Will Get Pay Raises in 2021

The economic effects of the COVID-19 pandemic have forced nearly half of organizations to re-evaluate their salary increase plans for 2021. Many employers expect to reduce salary increases or suspend them altogether.

One-Third of U.S. Employers Trim Projected Pay Raises for 2021

One in 3 U.S. companies responding to a recent survey are lowering their projected salary increases for 2021 amid concerns over weaker financial results and budgetary restraints in the wake of the pandemic.

Salary Increase Budgets Decline for First Time in 12 Years

Hoping for an economic rebound before year-end, employers largely kept their salary increase budgets for 2020 intact, although the budgets were reduced a bit, new research shows.

Developing a Post-Pandemic Pay Strategy

Making decisions about employee pay is among the biggest challenges facing organizations in the wake of the pandemic. Company leaders have an opportunity to reset ties between work and rewards.

SHRM Compensation Data Center

Are your salaries on par with the competition’s? Find out with this resource. Search more than 15,000 job titles across 225 industries, and customize each report by industry, geographic location and company size.