As federal lawmakers consider whether to raise the minimum wage to $15, many state and local wage rates have been steadily rising in recent years, and some have reached or surpassed $15 an hour.

Compliance can be a challenge for employers operating in multiple jurisdictions, particularly during the COVID-19 pandemic.

"Employers have always had to deal with a patchwork of laws," said Dane Steffenson, an attorney with Littler in Atlanta. "This has exponentially increased with COVID-19 and remote work."

Local wage laws may apply to employees who are working from home, so employers need to know where their workers are located and what the laws are in those locations, Steffenson said.

Employers will likely need to update their employment posters, too. In response to the pandemic, the U.S. Department of Labor recently provided guidance on complying with its notice and posting requirements when employees are working remotely. Employers should check for additional requirements from other federal agencies, as well as state and local governments.

Here's what employers need to know about minimum-wage trends for 2021.

The Federal Rate

The federal minimum wage has been $7.25 since 2009, and some lawmakers want to raise the rate. But nationwide changes may be delayed.

Paulo McKeeby, an attorney with Reed Smith in Dallas, thinks a federal increase is not likely while uncertainty caused by the COVID-19 pandemic continues.

"If things get back to normal later in the year, I could definitely see the Biden administration looking at the issue as it becomes more politically viable," he said.

Supporters of a federal $15 minimum wage say the wage hike is necessary for workers to earn a living wage. Opponents say the increase will cost jobs and hurt small businesses. A recent study by the U.S. Congressional Budget Office found that raising the federal minimum wage to $15 would reduce poverty rates and cost jobs.

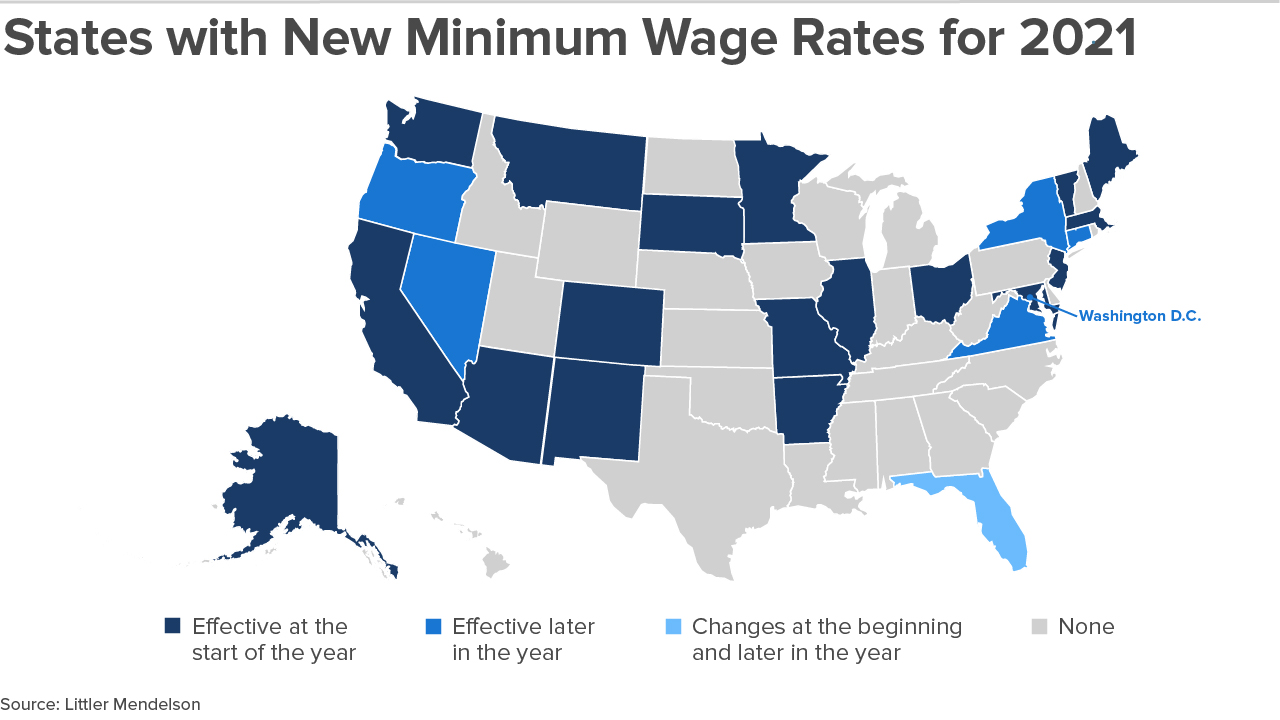

State Changes for 2021

Twenty-nine states and Washington, D.C., have higher minimum-wage rates than federal law.

On Jan. 1, new wage rates took effect in about 18 states. Michigan employers had anticipated a wage hike at the start of the year, but the scheduled increase was halted because the state's unemployment rate exceeded 8.5 percent in 2020.

Not all wage rates take effect on the first of the year. New York's rates changed on Dec. 31, 2020, and a new rate for fast-food workers in the state will take effect on July 1.

Employers in Connecticut, Nevada, Oregon, Virginia and Washington, D.C., will also have to comply with minimum-wage hikes later in the year.

Florida employers should note that the state's minimum wage was raised on Jan. 1 and will increase again on Sept. 30. In 2020, Florida voters approved gradual increases to the minimum wage each year until it reaches $15 in 2026.

"Every state seems to be doing things differently," noted Robert Boonin, an attorney with Dykema in Detroit. Some states, like Florida, are gradually raising their minimum wage until it reaches a certain amount and will tie additional increases to the consumer price index, employment cost index or other indicators.

"Some states, like Michigan, have a safety net if the economy is doing poorly," Boonin observed. Scheduled increases can be paused if unemployment is high.

State minimum-wage rates also may vary by geographic location or employer size.

Five states—Alabama, Louisiana, Mississippi, South Carolina and Tennessee—don't have a minimum wage, and two states—Georgia and Wyoming—have a lower minimum-wage rate than the federal standard. In those states, the federal rate of $7.25 applies to jobs that are covered by federal wage laws.

Additionally, while the Fair Labor Standards Act (FLSA) allows certain employers to pay less than the standard minimum wage to workers who customarily receive tips, such as servers and bartenders, some states set higher minimum wages for tipped workers or ban subminimum wages altogether.

Employers must review more than just federal and state wage rates, since counties and cities may have their own laws. For example, many localities in California raised their minimum wages on Jan. 1, and more jurisdictions have scheduled wage hikes for July.

"The most important thing for employers is to identify all the locations where they routinely provide services," noted Guillermo Tello, an attorney with Clark Hill in Los Angeles. The wage requirements in some jurisdictions, for example, will be triggered when employees spend at least two hours working within the location's boundaries.

Exempt Salary Levels

"As minimum wages increase, employers will have to take a look at their salaries for exempt workers," Steffenson explained. Employers may need to bump salaries for certain exempt employees or reclassify them to nonexempt and pay overtime premiums.

In 2020, the FLSA salary threshold for white-collar exemptions from overtime pay was raised to $684 a week ($35,568 annualized), and some states have higher salary cutoffs.

"Some of the state exempt salary requirements are tied to minimum-wage thresholds, which creates additional complexity," McKeeby said.

In California, for example, the weekly salary threshold for the executive, administrative and professional exemptions is calculated by doubling the state minimum wage and multiplying by 40 hours. The exempt salary thresholds in Alaska and Maine are also tied to the state minimum wage.

Other states—including Colorado, New York and Washington—have exempt salary rules that are separate from the minimum wage and will change for 2021. Pennsylvania's exempt salary threshold for executive, administrative and professional employees also will surpass the federal level in October this year.

"Employers should remember that exempt status is not just about salary rules," noted Stephanie Rawitt, an attorney with Clark Hill in Philadelphia. Exempt employees must be paid a salary of at least the threshold amount and meet certain duties tests.

Not all state duties mirror the federal test, she said, so employers should make sure they review the nuances under state law.

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.