Common Pay Stub Errors California Employers Should Avoid

Many mistakes are technical, but they can be costly for businesses

This is the first in a three-part series of articles about California wage statement laws. This installment addresses the items that must be listed on a pay stub and the frequent mistakes employers make. Read the second part here and the third part here.

California HR professionals know the importance of promptly and accurately paying employees for all hours worked and that failing to do so can lead to expensive class-action lawsuits. It's essential to also note that employers that don't list certain information on pay statements can find themselves in hot water.

Complying with California's wage statement provisions is a lot more complicated than people probably think, said Christopher Ahearn, an attorney with Fisher Phillips in Irvine. At first glance, the rules may seem nit-picky, but there are legitimate policy reasons behind a lot of them, he added.

The purpose is to provide transparency to workers regarding wage calculations and to give employees enough information to verify that they are being properly paid, according to the state Division of Labor Standards Enforcement.

"The most common mistakes tend to be technical … usually failing to include one of the various items of information that must be included on each itemized statement," said John Kuenstler, an attorney with Barnes & Thornburg in Los Angeles.

Failure to comply can lead to significant per-pay-period penalties. Even the slightest mistake or omission could create thousands of dollars in liability, Kuenstler noted.

That's why employers may want to consider having an attorney review their statements for compliance. Most experienced wage and hour attorneys in California can look at these issues and help employers fix them with a minimal investment of time, Ahearn said. "It's worth the effort for the potential cost savings and to avoid associated headaches."

What Must Be Listed?

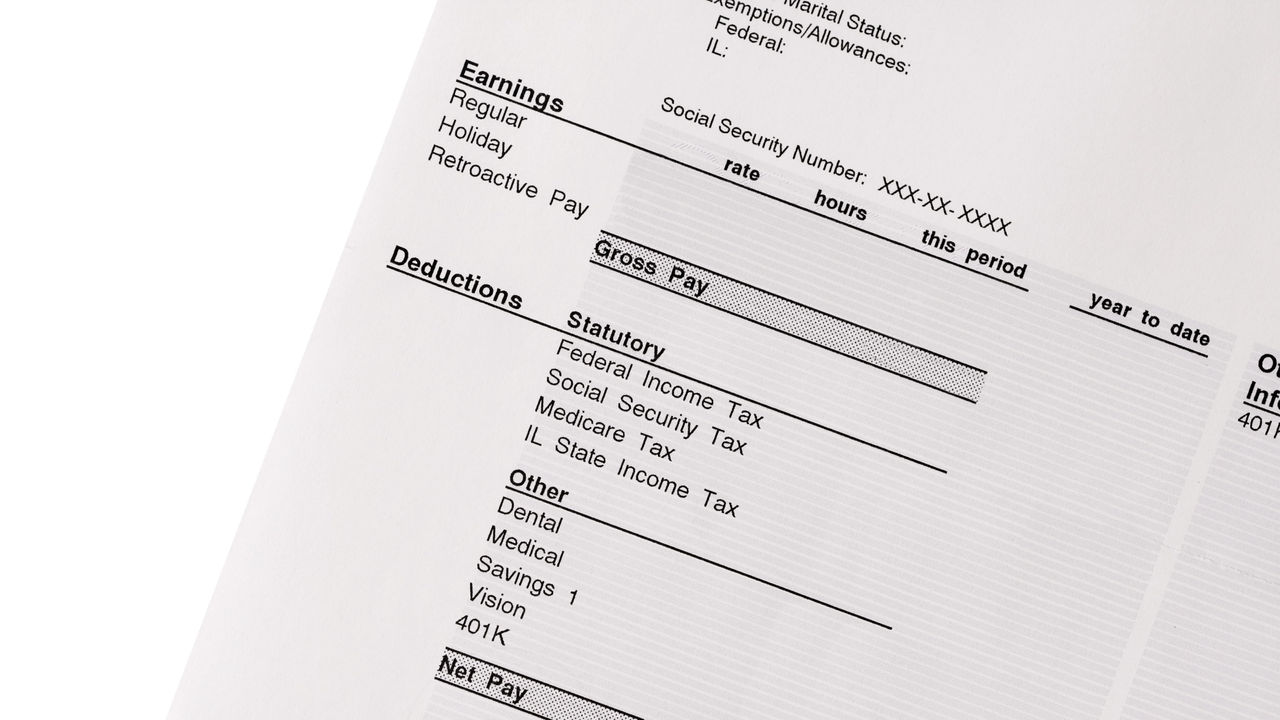

California Labor Code Section 226(a) outlines nine specific items that must be included on a pay statement:

- Gross wages earned.

- The total hours worked by the employee (unless the employee is exempt from overtime).

- The number of piece-rate units earned, if applicable.

- All deductions made from wages.

- Net wages earned.

- The pay period beginning and end dates.

- The employee's name and only the last four digits of his or her Social Security number (or an employee identification number other than a Social Security number).

- The name and address of the legal entity that is the employer.

- All applicable hourly rates in effect during the pay period and the corresponding number of hours the employee worked at each hourly rate.

There is also an element that employers will find in the Healthy Workplace Healthy Family Act, said Bruce Sarchet, an attorney with Littler in Sacramento.

The act entitles most California employees to accrue one hour of paid sick leave for every 30 hours worked, but employers can limit use to 24 hours or three days of accrued leave each year. Employers must show on a pay stub—or a document issued the same day as a paycheck—how many days of sick leave an employee has available.

Common Mistakes

"One of the biggest mistakes we see is that employers who operate in many states have a one-size-fits-all approach to pay stubs," Kuenstler said. "Remember that California has many requirements that are often not required in other states."

[SHRM members-only toolkit: Complying with California Wage Payment and Hours of Work Laws]

Employers shouldn't assume that just because they use a third-party payroll service provider that their wage statements are compliant with California law, Ahearn said. Ultimately, compliance is the employer's responsibility, so it is important for employers to be proactive when they work with vendors to make sure the format and content of their statements satisfy state law, he added.

Other frequent pay stub mistakes include:

- Neglecting to list the total hours worked in the pay period.

- Leaving off the start or end date of the pay period.

- Not having the employer's complete legal name listed (or listing something other than the employer's legal name, such as the name under which it does business).

- Failing to include the employer's address on the pay stub.

- Not keeping a copy of the pay stub.

- Listing overtime compensation, commissions or bonuses in a confusing way that may not fit into the standard payroll template.

- Not having a place on the wage statement for items like double time and any premiums that an employee was paid for a missed meal or rest period.

Sarchet said employers should make sure that all necessary information is on the wage statement—not just the paycheck. If the employee tears off the check and deposits it in the bank, he or she may no longer have the information.

Employers should routinely audit pay stubs—with help from either HR staff or outside counsel—to make sure they are compliant, Kuenstler said. "An audit should be done every few years, as what is required often changes."

This was the first in a three-part series of articles on California wage statement laws. The next installment will explore the rules for electronic pay stubs.

Was this article useful? SHRM offers thousands of tools, templates and other exclusive member benefits, including compliance updates, sample policies, HR expert advice, education discounts, a growing online member community and much more. Join/Renew Now and let SHRM help you work smarter.

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.