Provide Security with Personalized Employee Benefits

Personalized benefits can contribute to employees' sense of security and well-being.

Many employers are currently managing five different generations in the workforce. From the oldest workers in the Silent Generation to the youngest in Generation Z, each group, and indeed each individual in each group, has unique priorities and needs when it comes to employee benefits.

General Mills had these diverse needs in mind when it revamped its paid-leave benefits in January 2019. Recognizing that employees need time off to deal with a range of life events, the company increased the amount of paid leave provided following the birth of a child (from six-to-eight weeks to 20 weeks), to caregivers (two weeks under a new program) and for bereavement (from one week to four weeks).

The company keeps an open dialogue with employees “at different life stages to better understand their personal pain points,” says Chris Brunson, General Mills’ vice president of total rewards in Minneapolis. The company took this holistic approach “to better support employees during some of the most important moments of their lives,” he says.

At the most basic level, employee benefits are designed to provide workers with a sense that their employer supports them both in and outside of the workplace. If something changes, whether for good or bad, those benefits are there to help employees cope. In the case of General Mills, the expanded leave program is broad enough to provide support for employees at every stage of life. And it’s an example of how personalized benefits can make a difference for workers and improve the employer/employee relationship.

Offering Greater Security

The best benefits plans offer employees a sense of security and well-being. “In general, employees are looking for greater security, but what that means varies by employee based on age, gender, salary and other factors,” says Jennifer DeMeo, a senior director with consultancy Willis Towers Watson in Washington, D.C.

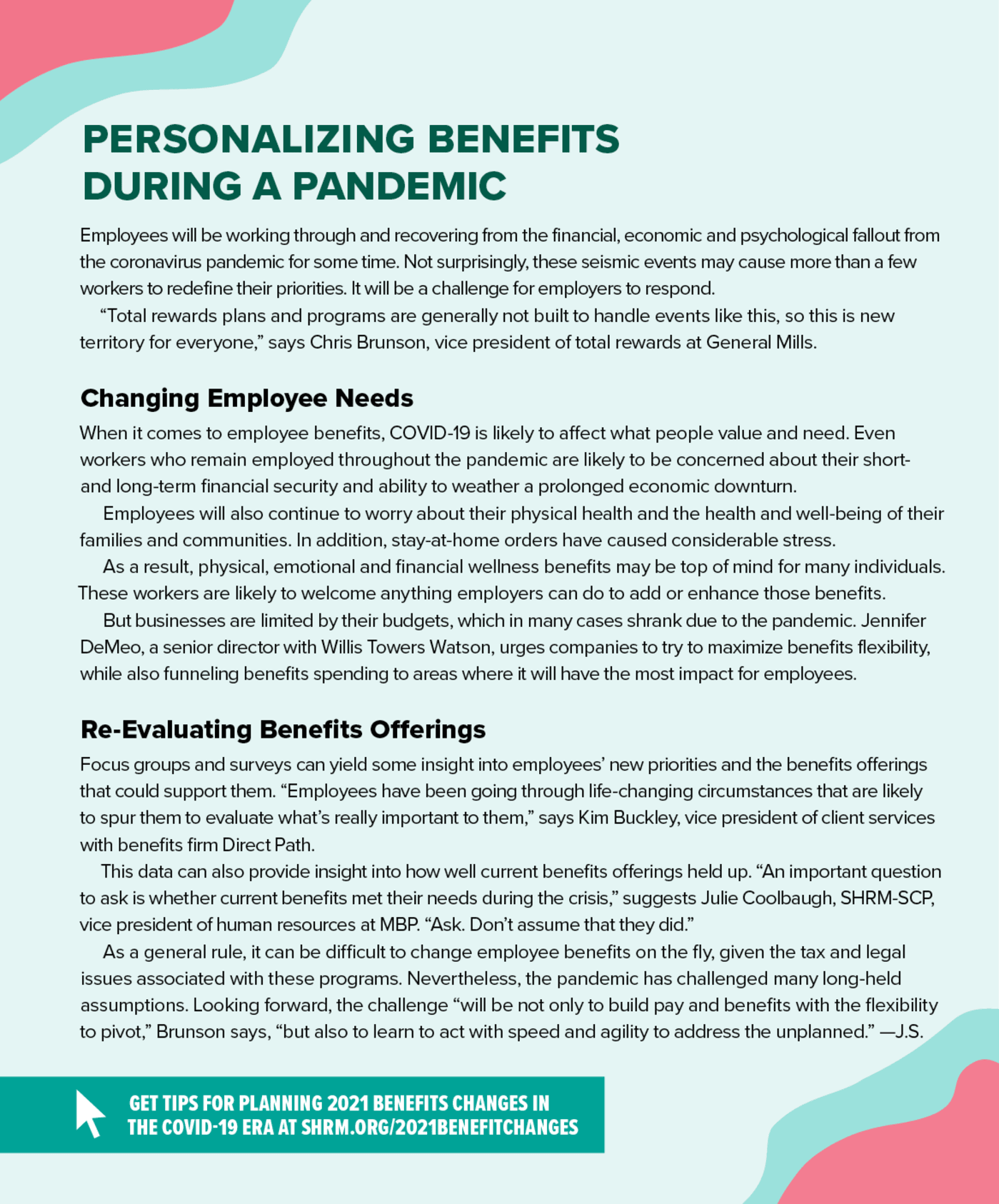

The need for security is particularly relevant as employers and their workers face unprecedented economic disruption and uncertainty as a result of the coronavirus pandemic. In this environment, a robust benefits offering with enough choices to empower employees to shape one aspect of their lives when so much seems to be out of their control is attractive.

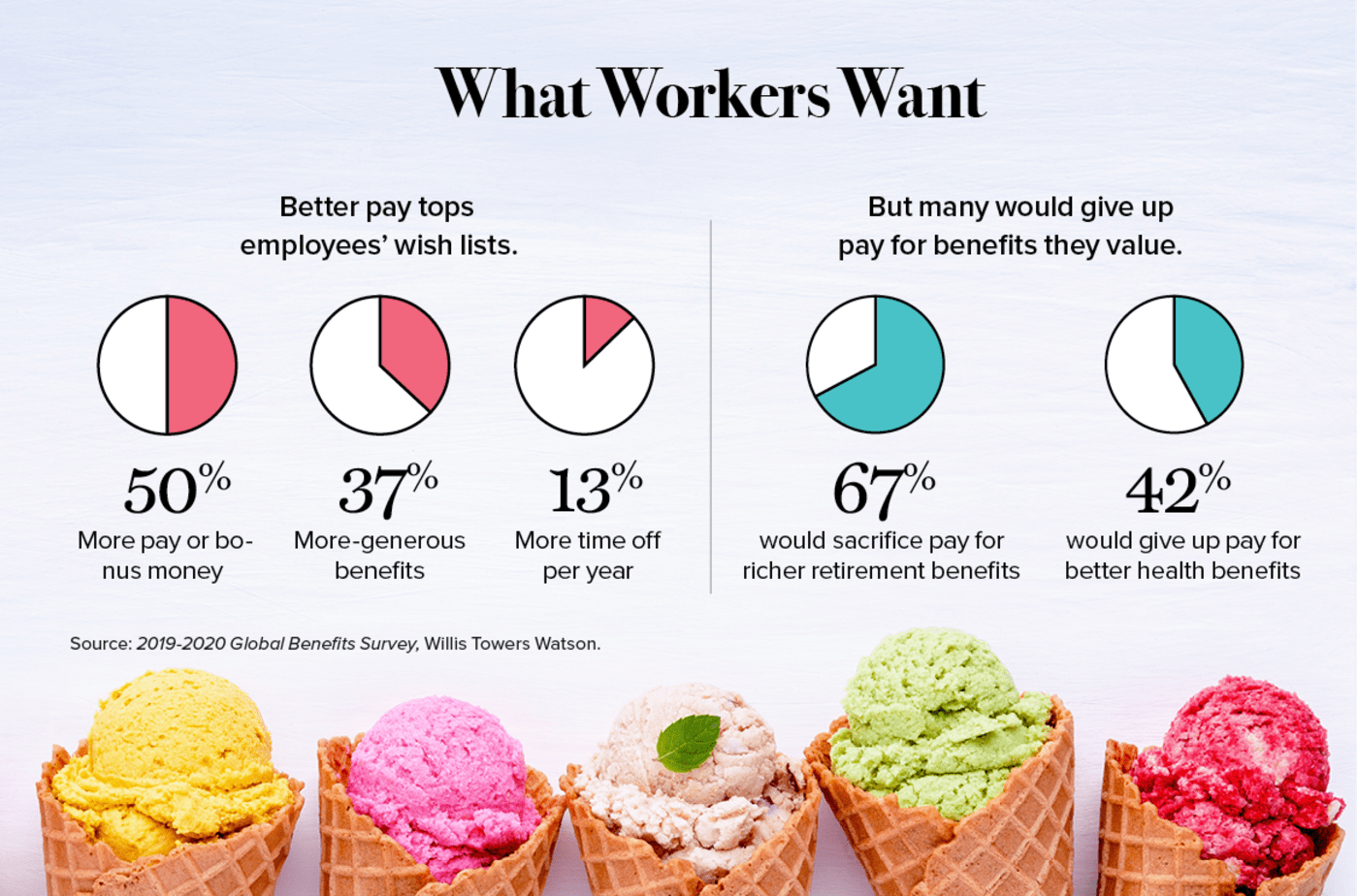

There’s no question that employees place great importance on benefits. Two-thirds are willing to pay more each month for more-comprehensive retirement benefits, and 42 percent would sacrifice additional pay each month for richer health benefits, according to a recent Willis Towers Watson survey of more than 40,000 workers at medium and large organizations in 27 countries, including 8,000 employees in the U.S.

Julie Coolbaugh, SHRM-SCP, had an “aha” moment about the potential for personalizing benefits when younger employees began asking for employer-sponsored pet insurance. Initially, “we laughed at the idea of adding pet insurance to our benefits,” says Coolbaugh, vice president of human resources at MBP, a 300-employee construction management consulting company based in Fairfax, Va. “However, it turned out that younger employees really want it” and it has real meaning for them. Many of these younger employees view their pets as their children and want to have the means to take care of them, Coolbaugh says. It’s another way to increase security in their lives.

Personalizing with Choice

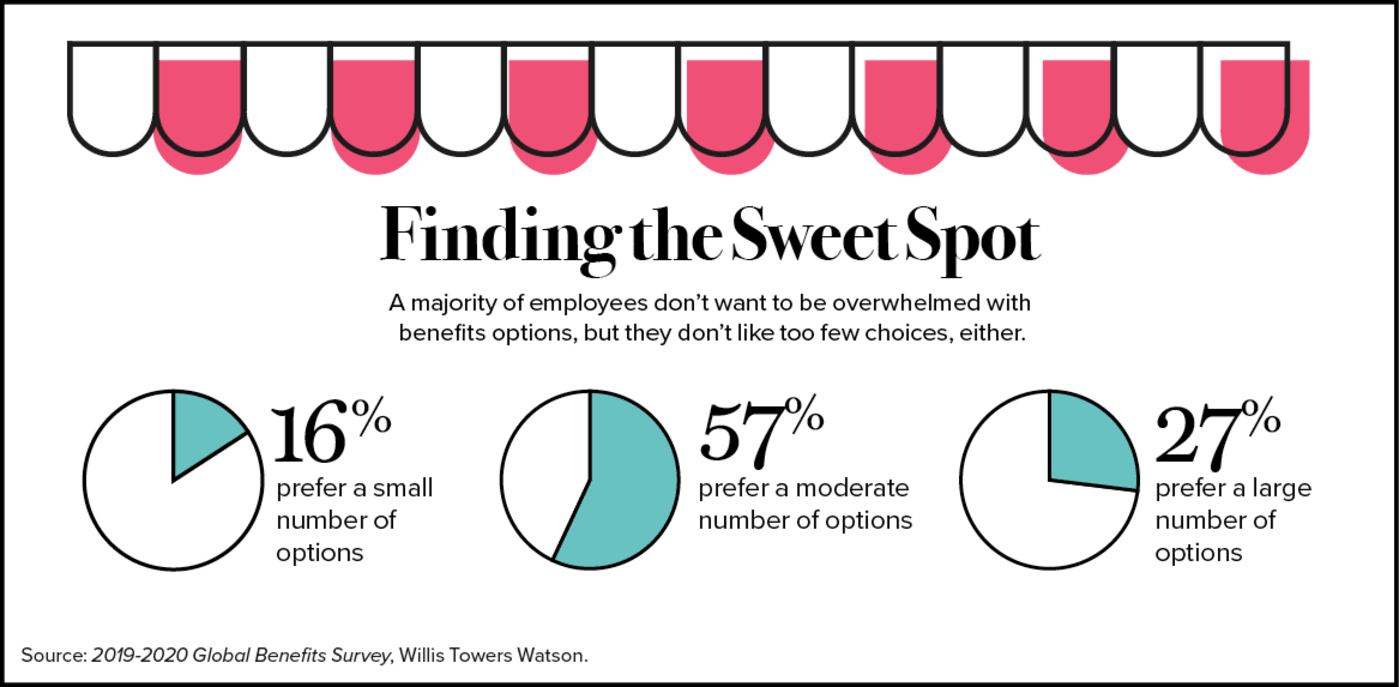

To make personalized benefits more meaningful, benefits choices must be tied closely to the needs of various segments of the workforce and should be diverse enough to satisfy those needs. “Employers need to find the balance between providing meaningful choice and overwhelming employees with too many options,” DeMeo says.

At the same time, organizations should consider the cost of potential benefits to stay within budget. This is the time to weigh the trade-offs necessary between the value of a benefit to employees and its cost.

Should a benefit with strong appeal to a relatively small but critical group of employees be prioritized over another benefit with broader appeal at the same cost? Is it possible to assemble an array of benefits wide enough to meet all employee needs?

For example, older and higher-paid employees tend to value retirement and health care benefits. To satisfy this group, employers can offer higher 401(k) plan matching contributions and different buy-in levels for richer health care benefits. Meanwhile, younger workers who are building careers and managing more-precarious finances may want programs designed to help them improve their financial well-being, aid in their professional development and meet niche needs through targeted perquisites, such as free meals or discounts for personal services.

Companies can also create personalized benefits based on health conditions and health care utilization. For example, an organization with a large number of employees with diabetes can establish an opt-in diabetes management program that helps to reduce health care costs for both the company and workers. “Employers can also develop targeted programs to support employees with chronic conditions through stress and weight management,” says Kate Brown, leader of Mercer’s Center for Health Innovation in Houston.

At the same time, personalized employee benefits are not just about discrete programs. The whole is often greater than the sum of its parts. Well-designed benefits offerings have the potential to provide a support structure through life stages, allowing employees to pick and choose different benefits as their lives change over time.

That’s what Liberty Mutual Insurance does. Its diverse menu of benefits is built around specific life experiences and goals—including paying student loan debt, starting a family, managing overall physical and mental health, and dealing with legal issues.

Many of these programs overlap, and they can serve as the building blocks to greater security and peace of mind. For example, the company’s student loan refinancing program allows workers who are new graduates or parents of new graduates to refinance federal, private and previously consolidated student loans with no fees or penalties. Employees receive a $400 cash bonus when the refinance process is complete. The program can be the first step toward a more secure financial future and augmented by long-term saving and investing for retirement and other needs.

Similarly, a worker planning to start a family can leverage the company’s fertility or adoption and surrogacy benefits, while also relying on its legal benefits to draw up a will, complete an adoption, name a guardian or handle a home purchase. A worker relying on support from the company’s employee assistance program to manage personal issues can tap into available physical and mental health management benefits to explore meditation and support services.

The success of this approach to personalized benefits lies in comprehensive and continuous communication so employees always know what’s available. “Getting benefits to the right people at their time of need is the biggest challenge,” says Sari Kalin, Liberty Mutual’s manager of well-being programs and benefits. To protect employee privacy, the company relies on outside vendors to identify appropriate benefits that may help support an employee based on his or her specific situation and to provide customized outreach.

Minding the Details

To get an idea of the benefits that various employee groups are likely to value, there’s no substitute for direct confirmation from individual workers. LatentView Analytics, an artificial intelligence company based in Princeton, N.J., relies on employee surveys to capture information about the kinds of personalized benefits that interest employees individually or as a group.

“This data can be anonymized, tabulated and analyzed for use in strategic planning around what new benefits the company could consider implementing, as well as ways those benefits packages could be customized, even down to the individual employee,” says Pramad Jandhyala, the company’s co-founder and director, who has responsibility for the human resources function.

“We make it a point to go out to our 11 offices and listen to what employees are saying,” MBP’s Coolbaugh says. “Knowing their stress points and challenges allows us to get to know them and their needs. It’s also important to ask employees what they want from their benefits that they aren’t currently getting.”

Of course, finding out what benefits people want and value is not always so straightforward and doesn’t always show up in data analyses. Employees themselves don’t always know exactly what they need. And even if they do, they may not be sure there’s a benefit that would fulfill that need.

There are other considerations as well. With 80 percent of its workforce in the early stages of their careers, LatentView Analytics looks for ways to personalize benefits within that demographic. But as a global business with 650 employees based in the U.S., Europe and India, the company must create a different level of personalization based on cultural differences and expectations. For example, it allows employees based in India to purchase health insurance for their parents, which is a highly valued benefit for younger workers in that country.

Local laws and requirements also play a part. “Being a global company with employees who live and work across various geographies”—each with their own unique labor laws—“there are definitely challenges in customizing and personalizing benefits for our team members,” Jandhyala says.

Local laws and requirements also play a part. “Being a global company with employees who live and work across various geographies”—each with their own unique labor laws—“there are definitely challenges in customizing and personalizing benefits for our team members,” Jandhyala says.

The company offers two weeks of paid paternity leave, but it also has to comply with various country-level requirements that can be complex to administer. “In Europe, for example, maternity and paternity benefits are different across each country, so keeping up with compliance and managing how we offer benefits above and beyond mandatory benefits across geographies can be a challenge,” Jandhyala says.

Defining Benefits Broadly

The personalization of benefits may force employers to rethink their definition of a benefit. “True flexibility requires a broader definition of benefits,” DeMeo says. Many programs that can be an important part of a personalized approach are not necessarily costly but are often very highly valued. “This can include anything that an employee views as a benefit, such as workplace snacks, gifts, birthday celebrations,” she says. “This all impacts how employees view their employer.”

A broader definition of benefits is particularly useful to smaller companies that often have to be more creative because of budget constraints. As a small employer with 14 employees, Shapiro Negotiations Institute (SNI), a sales training and consulting firm in Baltimore, starts personalizing benefits during the hiring process. “Whenever we hire people, we always ask them what’s important to them, not just about the job but in life in general,” says Andres Lares, the firm’s managing partner. “We believe this conversation helps us understand what makes them tick, which is critical for creating a personalized program for them to succeed.”

Nontraditional benefits can also be an important way to reinforce workplace values. When one SNI employee self-quarantined with a potential COVID-19 infection and others worked from home during the pandemic, the company replaced some of the free snacks, coffee and meals it provides at work through home deliveries. “We wanted to create some sense of normalcy,” Lares says.

Keeping Things Fresh

The best approaches to providing personalized benefits will always be works in progress that change over time. “Employers should be prepared to curate offerings based on employee needs and wants,” says Kim Buckley, vice president of client services with benefits firm Direct Path in Burlington, Mass. Are the benefits being used? Are employees getting value from the programs? “It’s important to act based on actual needs, not just perceived needs,” she says.

Coolbaugh urges employers to work with brokers and other benefits partners throughout the year, not just when it’s time to renew plans and during open enrollment. “This is the time to consider what’s going on in the market and benchmark what you offer against peers in the industry and by company size,” she says. Benefits need to remain competitive and reflect employee needs at different life stages. For example, when MBP prepares for college recruiting, it needs to make sure its benefits remain relevant to its youngest hires.

Coolbaugh says this approach contributes to the company’s consistently high employee retention rate. “When we make this investment, the return comes back to us in different ways,” she says. If the company makes a $20,000 investment in new benefits and retention increases by 1 percentage point, that investment is much easier to justify. “We can’t give everyone everything they want, but we want them to say, ‘They listened to me and responded to my needs.’ ”

Joanne Sammer is a New Jersey-based business and financial writer.