Using Voluntary Benefits to Support Workforce Strategy

Expanding voluntary options can keep benefits offerings competitive

Faced with a competitive talent market, employers are shifting voluntary and supplemental benefits into a more prominent, strategic role to attract and keep employees.

Whether offering traditional choices such as life insurance or newer options like financial wellness, meditation or concierge services, more employers view voluntary benefits—optional perks typically paid by employees but available at discounted group rates through their employers, or employer-paid noncore benefits—as an important piece of their employee engagement efforts.

"We see a marked increase in demand for voluntary benefits from our clients," said Mark Hebert, voluntary benefits practice leader at Willis Towers Watson. In a recent survey, 95 percent of Willis Towers Watson clients said voluntary benefits would play an important role in their total rewards strategy over the next three years, Hebert said. When the consultancy asked the same question in 2013, only 59 percent said voluntary benefits would be important.

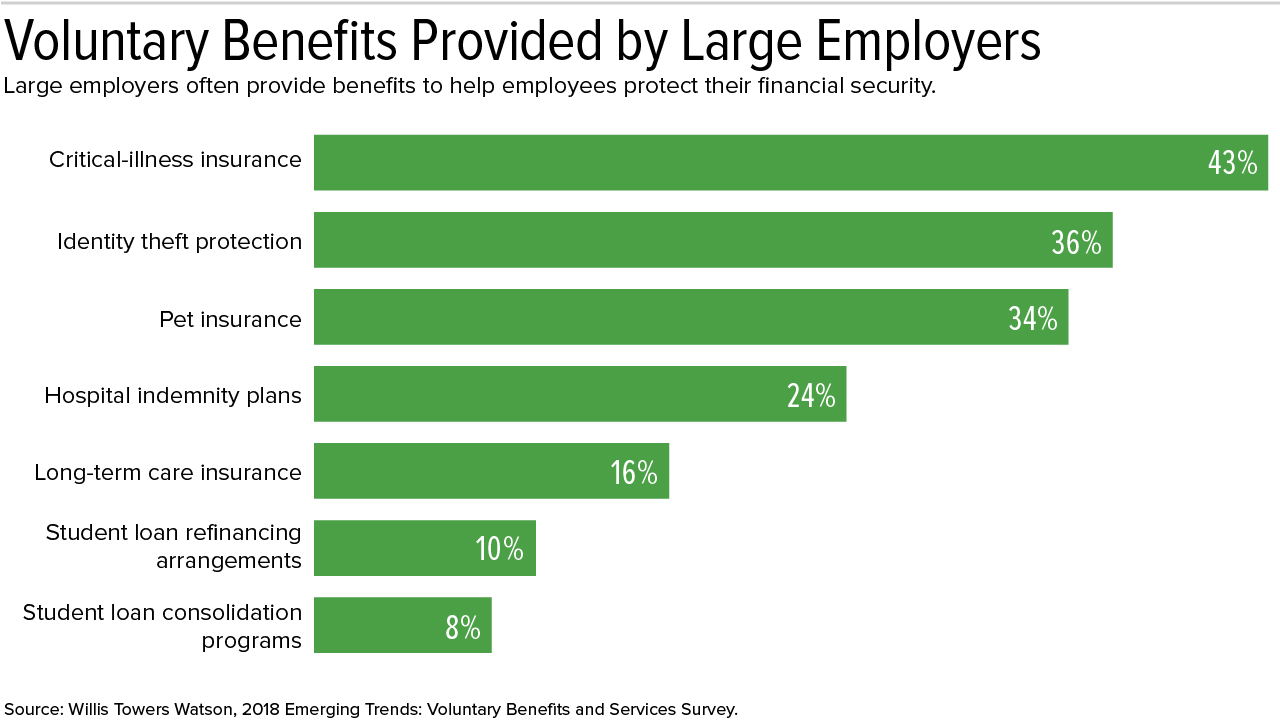

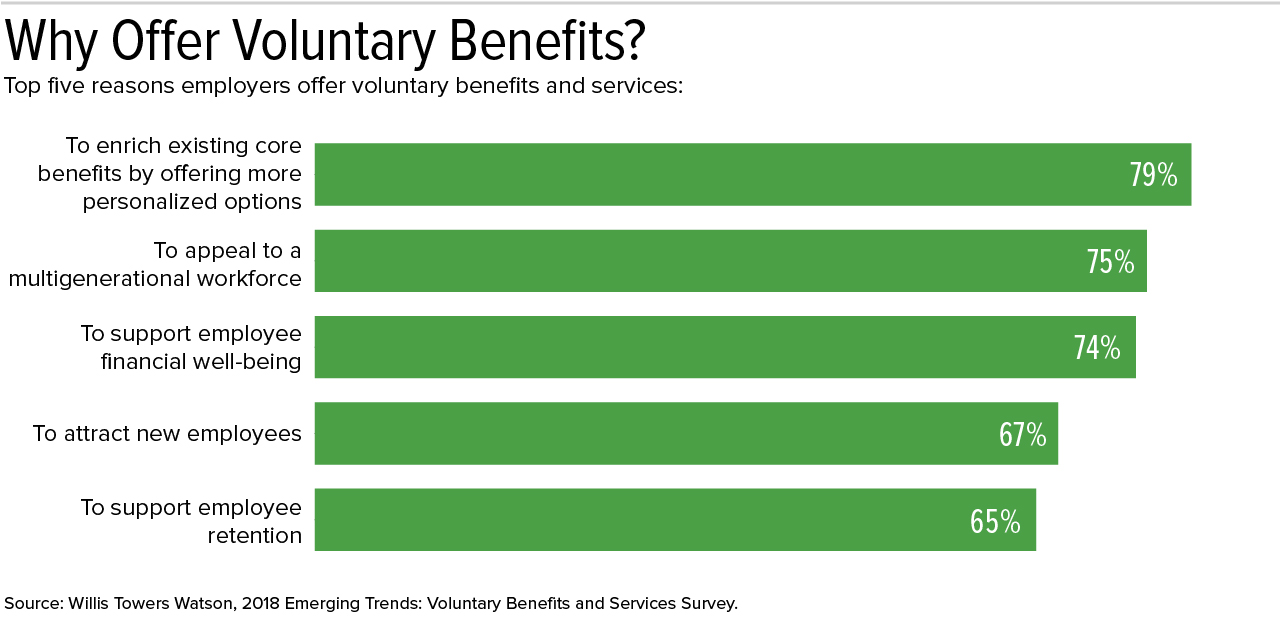

The firm's 2018 Emerging Trends: Voluntary Benefits and Services Survey results reflect responses from 336 large U.S. employers representing more than 4.3 million employees.

"While more-traditional voluntary benefits such as critical-illness, accident and legal insurance are most in demand, there's a significant interest in newer products like identity theft protection, student loan assistance programs, multi-life long-term-care insurance and even pet insurance," Hebert said.

The survey results showed a significant shift from 2016 responses in the reasons employers offer these options.

"The top reasons in 2016 centered on being defensive or reactive, primarily using voluntary benefits to replace something employees perceived as a takeaway, such as the elimination of a PPO [preferred provider organization]," Hebert explained.

Employers in the latest survey, he said, reported offering voluntary benefits to achieve three major goals:

- To provide meaningful choice to their employees. "Increasing meaningful choice leads to greater benefits satisfaction, thus higher overall employee engagement," Hebert said.

- To meet the needs of their diverse workforce. Whether looking at generational, cultural or economic diversity, "it's nearly impossible to meet the varied needs of each employee with a one-size-fits-all benefits plan," Hebert added.

- To ensure employees' financial well-being. A well-designed voluntary benefits plan can help protect employees' financial stability, "making them happier and more productive at work," Hebert said.

Other benefits experts have noted similar trends.

"Over the last five years, there has been a significant shift, as employers are now seeing the advantages of having these programs offered with open enrollment," said Kelly Bonanno, area executive vice president and Northeast region practice leader for voluntary benefits at Arthur J. Gallagher & Co., an employee benefits brokerage firm.

In the past, employers offered voluntary benefits coverage off-cycle from the typical fall open enrollment period, she explained.

The shift in benefits strategy can be attributed, in part, to employers becoming focused on "providing holistic coverage that supports their overall benefits strategy" by aligning voluntary benefits with the core offerings, Bonanno said.

Having access to voluntary benefits that provide supplemental hospital and critical-illness coverage, for example, can help employees feel more comfortable electing lower-premium plans with higher deductibles, she noted, although supplemental health coverage may cause an employee to become ineligible to contribute to a health savings account—a factor workers should keep in mind when selecting benefits.

In the competitive labor market, more employees are changing jobs to improve their pay and benefits, Bonanno said. Expanding and changing the use of voluntary options—such as coverage for critical illness, legal services, identity theft protection and commuter benefits—can keep benefits offerings competitive as the labor market continues to tighten, she pointed out.

A Strategic Imperative "There are five generations in the workplace, compared to only three or four a decade ago. With this widening age range comes an increase in the variety of employees' needs, and as a result more demand for personalization," said Chris Bruce, co-founder and managing director of Thomsons Online Benefits. "Depending on employee preference, geography or generational differences, it becomes vital for employers to offer a range of voluntary benefits to their workforce." Findings from his firm's latest Global Employee Benefits Watch, which surveys 497 benefits professionals last year, found that global benefits professionals are grappling with an expanded role as business leaders increasingly call on them to shape and support talent strategy. Four in five (82 percent) global benefits professionals cited attracting and retaining talent as their top benefits objective, a significant increase from the prior year's figure of 65 percent. "Business leaders are waking up to the potential of benefits as a key enabler of people and business strategy," Bruce noted. "Delivering personalized benefits that accommodate an individual's interests and life goals is instrumental to ensuring they remain at the organization and have the support they need to work at their best." |

Benefits Platforms on the Rise

Technology lets employers offer core and voluntary benefits on a single online platform, noted Rhonda Marcucci, practice leader for HR and benefits technology at Gallagher. Tools accessible through enrollment platforms can educate employees on how to choose benefits appropriate to their needs, sometimes with videos, she noted.

"Decision-support tools and technology help employees to feel confident in their benefit elections," Hebert said.

These tools ask questions to gauge risk tolerance and guide employees to make the best choice. For some workers, though, human benefits coaches may make the most sense. "Whatever the model," Hebert added, "decision support and correct product placement are critical to achieving meaningful choice."

[SHRM members-only toolkit: Designing and Managing Flexible Benefits (Cafeteria) Plans]

Perks Preferred to Higher Pay

Mat Vogels, co-founder and CEO of newly launched Denver-based employee perks cloud platform Zestful, surveyed nearly 3,000 people working mostly in technology and asked if they'd prefer a $130,000 salary or a $100,000 salary plus subscriptions to Netflix, HBO, Spotify and Headspace; a meal delivery service; a gym membership; a $100-a-month "experiences" allowance; and a $20 monthly contribution to a charity.

Although the respondents didn't know it, the perks added up to about $6,000 a year—only one-fifth of the additional salary they could choose instead. Nonetheless, 80 percent chose the lower salary with all the perks, Vogels reported.

"I was completely blown away by the results," he said in a blog post announcing the service, which landed $1.1 million in venture capital.

The startup CEO contacted some participants for more information and found that most considered salary something they spend on "boring things" like rent, bills and groceries. On the other hand, they found the idea of not paying for things they love and use to be very appealing.

"There's definitely some psychology at work here, because an employee would certainly be better off taking the higher salary and could buy these exact same perks five times over," Vogels wrote.

Meanwhile, nearly 70 percent of workers responding to a Zenefits survey considered supplemental benefits and perks at least as important as employer-based health insurance and retirement benefits, the employee benefits platform reported last year, based on responses from employees at more than 600 small businesses. And more than 70 percent somewhat or strongly agreed that fringe perks would be a major consideration in evaluating future job opportunities.

Employee wellness platform Wellable, in its 2019 wellness trends survey of more than 90 health insurance brokers and wellness professionals, found that nearly 70 percent of organizations plan to boost their investments in employee financial wellness programs this year, while 35 percent of employers plan to boost spending on health and well-being programs overall.

Among other programs, most employers planned to keep or boost spending on offerings related to sleep management, stress management, telemedicine, mental health, mindfulness, free healthy food and weight management.

"The tightening labor market is allowing employees to be more selective about where they choose to work, which is resulting in an employer arms race to expand benefits while balancing costs," Wellable reported.

Dinah Wisenberg Brin is a freelance reporter and writer based in Philadelphia. Stephen Miller, CEBS, contributed to this article.

Related SHRM Articles:

Voluntary Benefits Now Essential, Not Fringe, SHRM Online, April 2018

Open Enrollment: Voluntary Benefits Emphasize Choice, SHRM Online, September 2017

Use Voluntary Benefits to Attract and Keep Part-Time Workers, SHRM Online, August 2017

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.