The Business Case for Employee Student Loan Repayment Programs

Student loan relief plans are becoming a valuable recruiting tool, and there are other reasons for companies to get more aggressive about aiding staffers with debt woes.

The stats are in, and when it comes to U.S. student loan debt, they're not pretty.

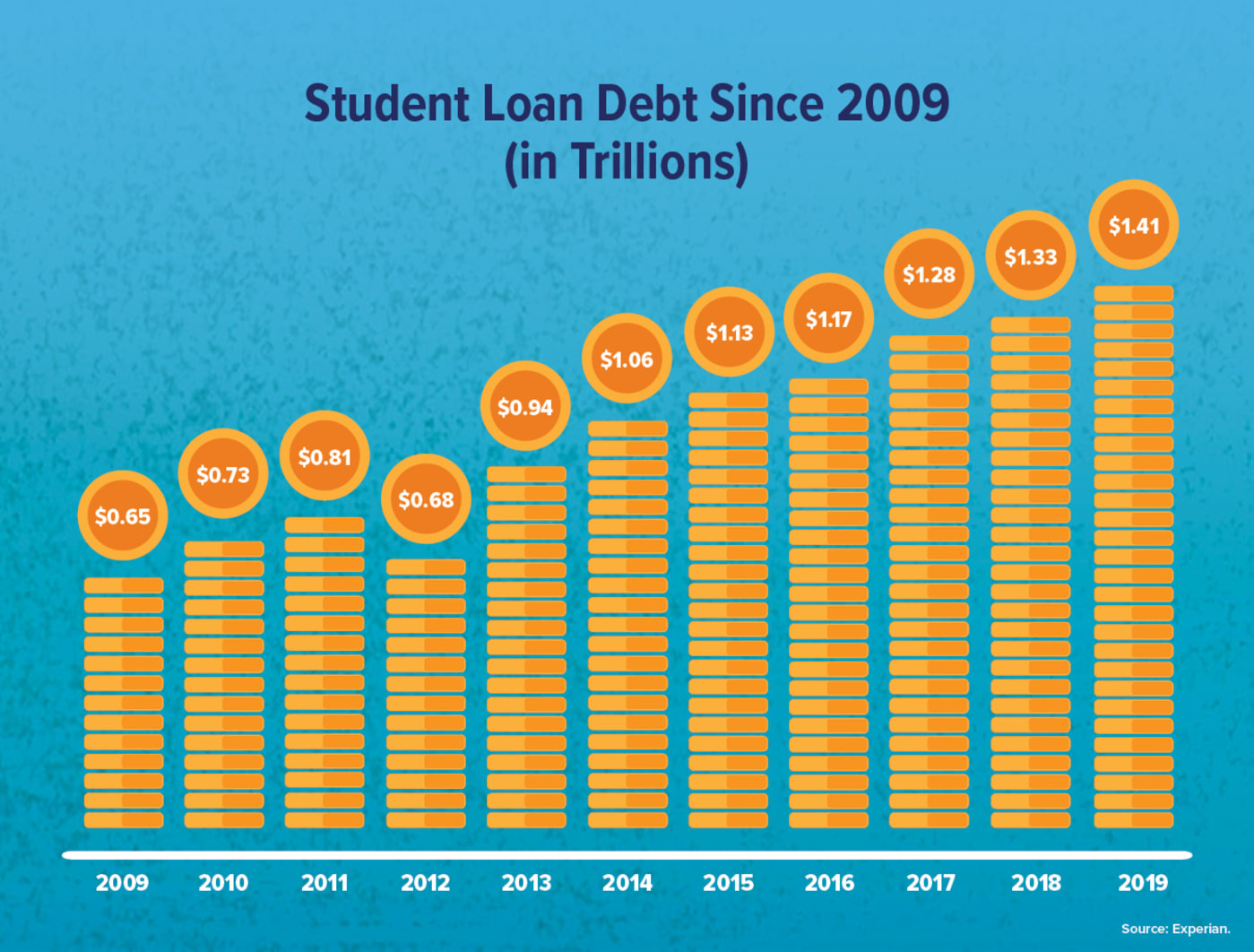

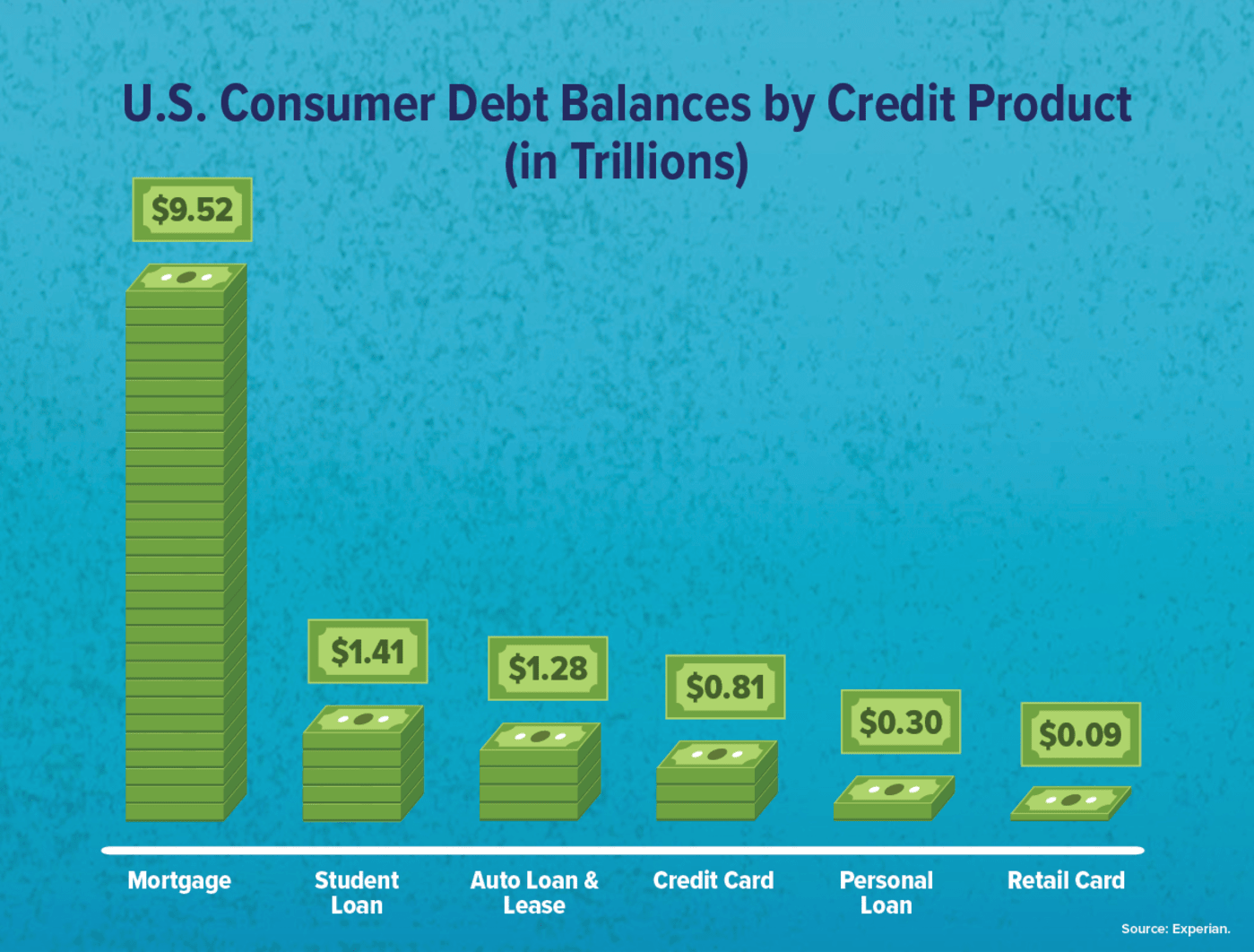

This year, 45 million Americans owe student loans worth more than $1.4 trillion, a figure that has risen 116 percent in the last decade, according to 2019 data from consumer credit reporting company Experian.

Among other financial and emotional calamities, younger adults in the U.S. are often saddled with years of substantial monthly payments, with potentially huge ramifications. For instance, paying back these loans often means postponing saving for retirement, delaying marriages, and putting off buying a home and establishing community roots.

For managers and human resources professionals, overwhelming student loan debt could also lead to younger staffers being distracted and unfocused at work and steer them toward moonlighting jobs that further sap their physical and emotional energy.

With more student loan borrowers speaking up about their plight in the workforce, some companies have become more aggressive about offering student loan repayment help.

Take Raytheon, which recently rolled out a new program to help employees save for retirement while repaying their student loans.

Eligible employees at the Waltham, Mass.-based company who aren't able to make student loan repayments and also contribute to their 401(k) can get a company matching contribution (three or four percent, depending on years of service) if their student loan repayments reach the percentage of the company match that meets the firm's eligibility criteria.

The program, called the Raytheon Savings and Investment Plan, will see accruals start growing in 2020, with company contributions deposited in employees' 401(k) accounts in the first quarter of 2021, company officials say.

"We're always searching for innovative ways to offer competitive pay and benefits to current and prospective employees," says Mike Bull, vice president of Total Rewards at Raytheon.

That said, caveats abound with student loan repayment plans, and cost is at the top of the list.

"These plans can improve employee financial wellness, increase productivity and retention, and attract better employees," says Fred Amrein, founder of PayForED, a college loan services company. "But on the downside, student loan repayment plans are expensive per employee and only help a limited number of employees."

Loan repayment plans are fairly expensive in comparison to other benefits, as well. "It's unclear if they pay off since the retention and productivity benefits are not proven yet," Amrein adds.

Appealing to Millennials

Younger professionals are beginning to take notice of employer-based student loan relief programs, with some staffers wondering why their own companies aren't getting on board.

"I graduated from law school with over $200,000 in student loans, and I'm not alone," says Erika Kullberg, a former corporate attorney with Morrison & Foerster in Tokyo who now runs her own YouTube channel teaching finance to Millennials.

Kullberg says it's "not uncommon" to see young attorneys in her former industry with more than $200,000 in student loan debt.

She believes that if companies want to attract young talent, they need to step up their game on helping employees pay off their student loans.

"If my law firm had a student loan repayment assistance program, that would be an easy way to differentiate the law firm from other law firms and attract top students across the country," she says. "A student loan repayment assistance program would really help to instill loyalty—it would also show employees that the company actually understands their pain points."

Kullberg says that she would "much rather have" a student loan repayment assistance program in place at her company than any other perks or benefits, even if those benefits amounted to thousands of dollars in value. "Right now, student loan repayment assistance is much more meaningful," she says.

There's no doubt that demand for student loan repayment assistance programs is strong with younger career professionals. Data from Student Loan Hero shows that 54 percent of younger employees prefer a student loan payment assistance program over a 401(k) plan (45 percent of all employees feel the same way).

Yet according to SHRM's 2018 Employee Benefits Survey, only 4 percent of companies actually offer a student loan repayment aid program.

The Pros and Cons

According to a 2018 study by Willis Towers Watson, a global advisory company, employers contributing to student loan repayment are projected to grow from 4 percent in 2018 to 32 percent by 2021. Meanwhile, employers offering student loan consolidation is estimated to jump from 8 percent to 34 percent over the same timeframe.

Business experts say companies that offer student loan repayment help are finding such relief plans to be a valuable recruiting tool, and that they should be even more aggressive about aiding employees with student loan debt woes.

"These programs can be a great incentive for employees that have student loan debt," says Robert Farrington, founder of TheCollegeInvestor.com, an online personal finance and investing platform for Millennials. "Student loans are a burden, and if the employer can take some of that burden off their shoulders, it can significantly improve recruitment and retention."

For employers, the "pros" in offering student loan help are abundant, Farrington says.

"Employees appreciate income, bonuses and incentives in the first place," he says. "Given that student loans are a burden for 45 million Americans—mostly Americans in the workforce—student loan relief programs are an especially solid benefit that can be useful and impactful for companies."

Gaining happier, more productive employees is perhaps the biggest motivator for companies mulling over a student loan repayment assistance program.

"At this point, the benefit of paying student loan debt offers more of an intangible benefit for the company," says Matt Ruttenberg, business development officer for Life Inc. Retirement Services, a 401(k) services firm that's starting to work with companies on student loan aid plans. "It's well known that financially secure employees come to work happier, engaged and motivated. That benefit naturally flows downhill and creates a more profitable environment."

As student loan debt is a heavy burden that weighs on the psyche of people, mental health benefits come into play as well. "Many people already know how long it will take to pay off by using simple online calculators," Ruttenberg says. "But when having an employer who's willing to take on that burden with you and bring that payoff date closer, it brings a much higher level of appreciation toward the employer."

On the downside, such plans may not be helpful for older workers or those without debt.

"The system isn't quite set up to benefit all sides of this new age offering," Ruttenberg adds. "For now, the benefit is more of an intangible solution than a financial one for the employer."

Higher cost issues may also force companies to choose between one employee benefit and another.

"Saving for retirement is also extremely important, and by diverting matching contributions, companies could be harming their employees' ability to save for the long term," Farrington says. "Additionally, the tax benefits aren't as strong for workers compared to a 401(k) or IRA plan."

With the cost of repaying employee student loan debt amounting to potentially millions of dollars or more, depending on the size of the company, small businesses must carefully consider the pros and cons of such programs.

"Student loan repayment programs take funds from the employer without providing an obvious payoff, and many employers are hesitant to implement them," says Deni Sharp, a student loans expert at the financial comparison site Finder.com who has worked for Arizona State University and Grand Central University advising students on financial issues.

A Benefits Expert's Take on Student

Loan Payment Assistance Plans

Lydia Jilek, director of voluntary benefits at Willis Towers Watson, offers a unique glimpse into how employers can ensure the financial health of their employees through student loan repayment assistance.

Here are the key issues she sees for companies considering the implementation of a student loan assistance plan:

Don't try to keep up with the Joneses. Employers hear the buzz about brands offering student loan benefits and think they need to follow suit. But don't do this just because it's the next hot thing, Jilek says.

"Are you hearing from your employees that this is a real need?" she asks. "Assess first if it's critical to your employees and prospects. Companies in tech, financial services and health care have more adoption, as well as employers with headquarters off the beaten path who are using loan repayment as a way to sweeten the pot and attract new talent to remote locations."

Know that the student loan struggle is a family affair. While it may seem as if today's young grads are the only ones impacted by student loans, often the burden impacts older employees, too. "Loan repayment perks can help the 'Sandwich Generation' of Boomer parents caught between caring for their aging parents and taking on the loans of their children as well," Jilek says.

Creative student loan benefits may soon go mainstream. "Today, innovative companies like Abbott are making it possible for employees to pay off their loans on time—without neglecting their financial future," Jilek says. "For every student loan payment the employee makes, the employer contributes a match into a 401(k) toward their retirement savings. The U.S. Treasury will rule as early as this summer on whether all employers can do this moving forward." —B.O.

Implementation Considerations

Like any corporate employee initiative, a little knowledge goes a long way. Launch your student loan assistance program with these action tips:

Get your employees involved. Begin with some preliminary information-gathering so you know exactly where you stand.

"To get started properly, take a poll of your employees," says Ruttenberg. "Get to know them on more of a personal level to see if they're taking on the burden of student loan debt, or if the majority is more concerned about saving for retirement or even health care. If you're not quite ready to take on all three of these, then start with your employees' suggestions and needs. Then work on implementing the rest when you're ready."

Take a piecemeal approach. You'll also want to start small and work your way up as you get a better grip on the issue of student loan debt in your workplace.

"Unlike tuition assistance programs, student loan repayment plans do not equate to a more qualified employee," says Sharp.

However, since student loans are one of the biggest burdens for today's employees, companies often want to consider some type of loan assistance program.

"Some companies are offering assistance programs as simple as contributing $100 a month towards the employee's principal loan amount," Sharp says. "That's a relatively small amount when you consider that employees have expressed willingness to lose vacation days in exchange for loan assistance. Being able to help employees, stand out to recruits and even cut other expenses allows loan repayment assistance programs to be cost-efficient overall."

Dare to be different. It's OK to get creative with your student loan assistance plan, as that's exactly what many other companies are doing.

"Different companies have implemented loan repayment programs in different ways," Sharp says. "Some employers offer benefits such as agreeing to contribute to retirement accounts as long as the student is contributing a certain amount to their student loans. Other companies are offering direct loan payment options, while others are partnering with refinancing companies to help offer lower group interest rates [at little to no cost to the company]."

Pitching In on Student Loan Payouts

Companies that launch student loan repayment plans usually limit their per-employee payouts to around $100 per month.

That's what PWC did when it rolled out its Student Loan Paydown program in 2016, offering younger employees with college debt $1,200 per year for six years. The company says the program has been a boost to its talent recruitment efforts.

Other companies go even higher. For example, Aetna offers full-time employees up to $2,000 annually in student loan repayment assistance, and caps that assistance at $10,000. Part-time employees get help, too, with loan repayment assistance of up to $1,000 annually, with a $5,000 cap limit.

Fidelity Investments is in the same ballpark. It offers employees struggling with student loan debt $2,000 annually, with a $10,000 cap.

Chegg, an education technology firm, bases its student loan repayment plan disbursements on seniority—only in reverse. For instance, entry-level employees qualify for up to $5,000 a year in loan repayment assistance, while senior staffers qualify for up to $3,000.

Clearly, companies want to help their younger staffers burdened with student loan debt to pay down their loans. There's also little doubt that company decision-makers view student loan repayment assistance plans as a significant recruiting tool, with companies such as Fidelity and Aetna being more aggressive about payouts with an eye on gaining top talent in return. —B.O.

Use it to recruit. Don't hesitate to use your loan assistance plan as an employee marketing tool once it's up and running.

"Employee benefits are vital when recruiting high-quality employees," Ruttenberg says. "If you end up offering a loan repayment benefit, lead with it. If the demographics of your ideal employee have student loan debt, then offering something different than your competition will give you the upper hand."

Additionally, getting every employee on board, whether they're a student loan borrower or not, is crucial to a plan's success.

Factor in all of your employees. Not every employee has a student loan debt problem, so there should be a carrot—and no stick—for them, too.

"Companies will need to consider how their loan repayment aid program will be received by employees who don't have student loans," Sharp adds. "Consider if there are ways to offer those employees additional benefits so that there's no animosity."

Be careful with third-party benefits providers. "Many of the third-party providers don't really offer 'student loan assistance,' but rather steer borrowers to student loan refinancing," Farrington says. "For example, we've seen programs like 'guaranteed rates' for employees. These programs can be harmful for borrower employees because student loan refinancing is usually only the best approach for a small percentage of student loan borrowers. Most need assistance navigating the complex options of federal student loan repayment, and simply need dollars put towards their student loans."

In Farrington's opinion, the best repayment programs "are simply a monthly deposit directly towards a student's loan account."

Brian O'Connell is a Bucks County, Pa.-based freelance business writer.

Illustration by Daniel Baxter.