Severance Tied to Tenure and Position as Formal Policies Decline

Redeploying talent in lieu of layoffs could help organizations to stay competitive

While almost all U.S. businesses (97 percent) say they offer some form of severance to workers, only 55 percent had formal, written severance policies last year, a decline from 2011, when 65 percent had formal severance policies.

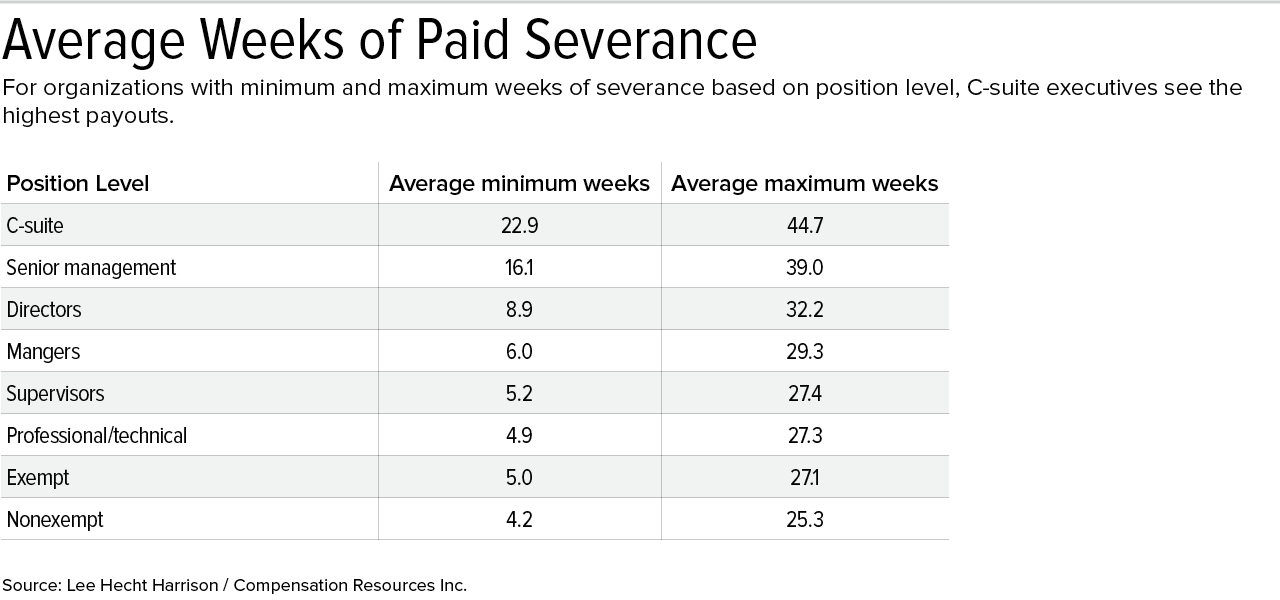

In their written policies, 52 percent of businesses set minimum and maximum severance amounts, down from 70 percent in 2011.

"We're definitely seeing more companies moving away from formal, written policies in favor of more flexible terms" for severance, said Greg Simpson, Denver-based senior vice president and career transition practice leader at Lee Hecht Harrison, a talent development firm. "That having been said, severance and separation benefits remain among the best ways for a company to protect its brand."

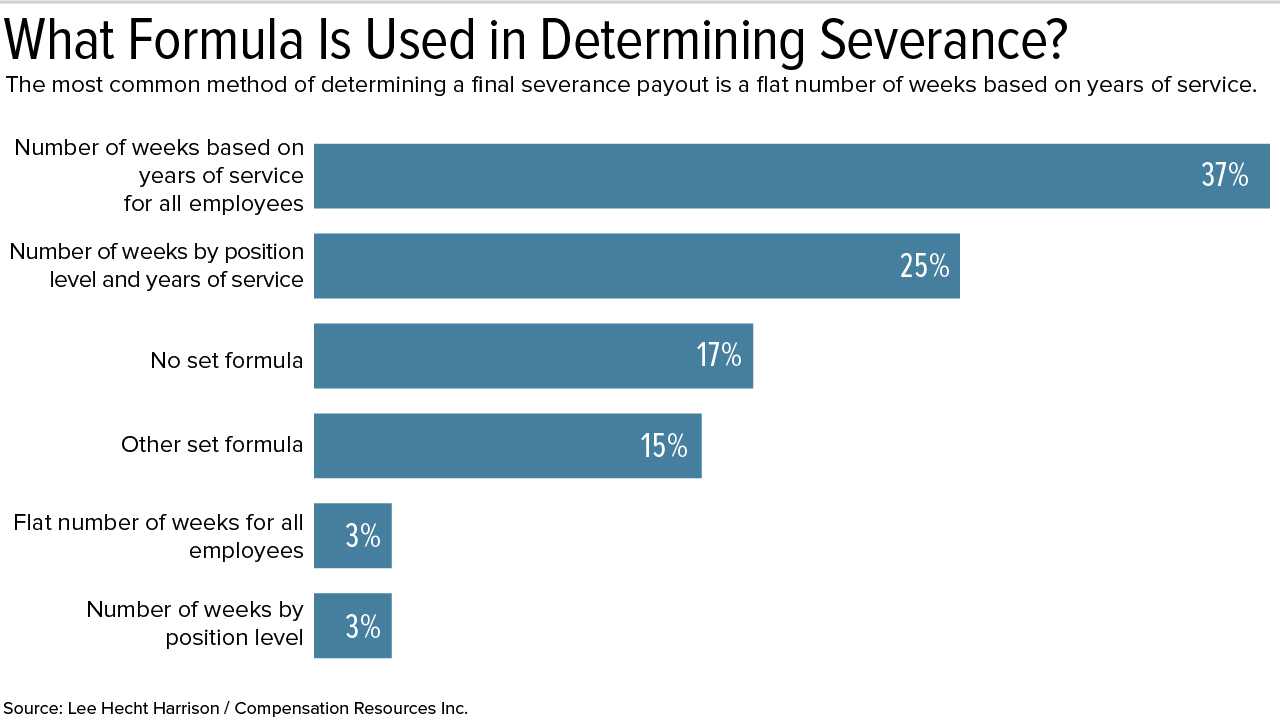

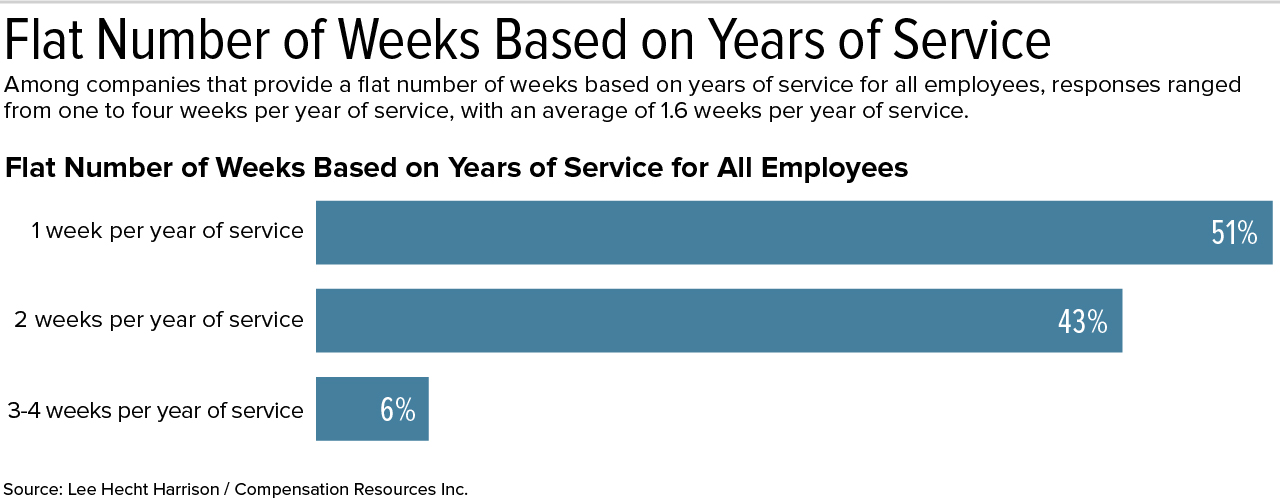

Lee Hecht Harrison and Compensation Resources Inc., a pay consultancy, last year surveyed 350 senior HR leaders at U.S. companies. The findings were detailed in the firms' 2017-2018 Severance & Separation Benefits Benchmark Study, released in February. Among the practice trends reported:

- While 88 percent of companies pay severance when termination is due to a reduction in force or corporate restructuring, only 13 percent do so when the termination is for cause and only 6 percent provide severance on retirement.

- In exchange for severance, employees at 92 percent of companies are required to sign a written release that ends any legal liability between the employer and the employee, a figure virtually unchanged from 2011 (93 percent).

- The number of companies with a process to appeal severance packages, however, is rising. Nearly one-quarter (24 percent) of companies had such a process in place last year, up from 15 percent in 2011.

- 58 percent of employers pay severance in a lump sum while 35 percent use their normal payroll cycle. An additional 7 percent offer recipients severance on a normal payroll cycle but stop when they find new employment.

Formal Policies vs. Flexible Terms

While almost all U.S. businesses (97 percent) say they offer some form of severance to workers, only 55 percent had formal, written severance policies last year, a decline from 2011, when 65 percent had formal severance policies.

In their written policies, 52 percent of businesses set minimum and maximum severance amounts, down from 70 percent in 2011.

"We're definitely seeing more companies moving away from formal, written policies in favor of more flexible terms" for severance, said Greg Simpson, Denver-based senior vice president and career transition practice leader at Lee Hecht Harrison, a talent development firm. "That having been said, severance and separation benefits remain among the best ways for a company to protect its brand."

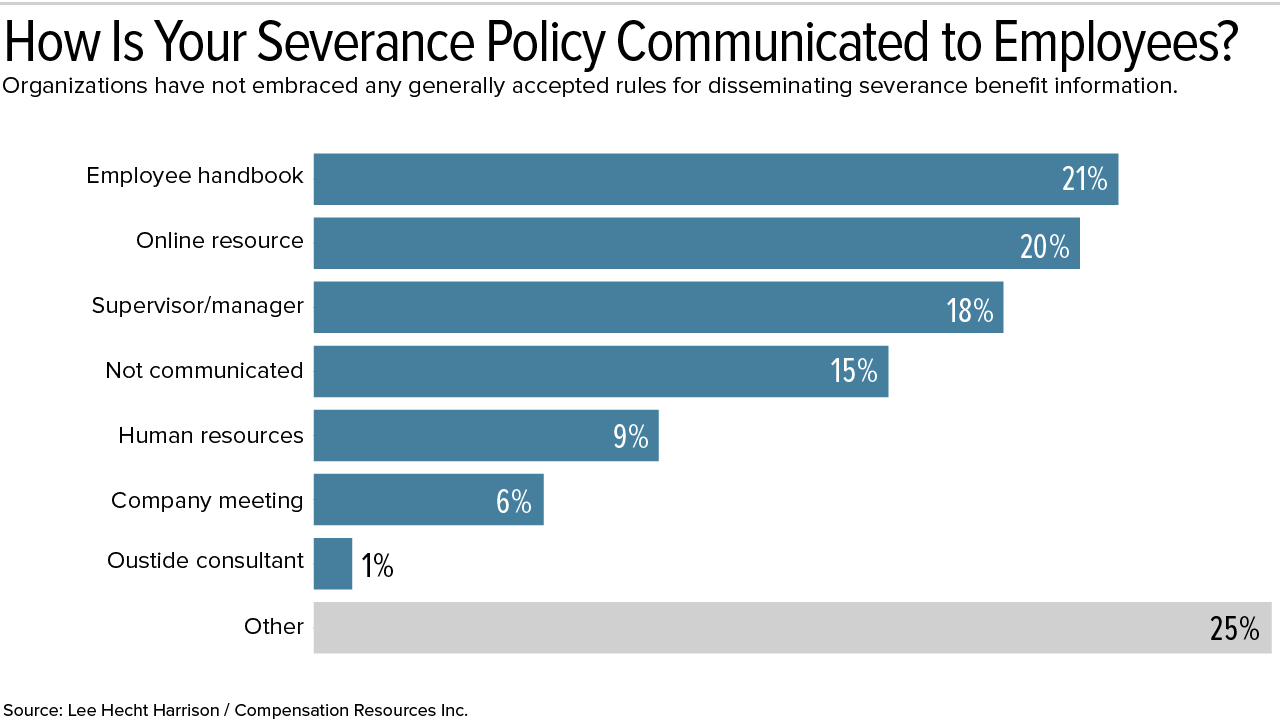

(Click on graphics to view in a separate window.)

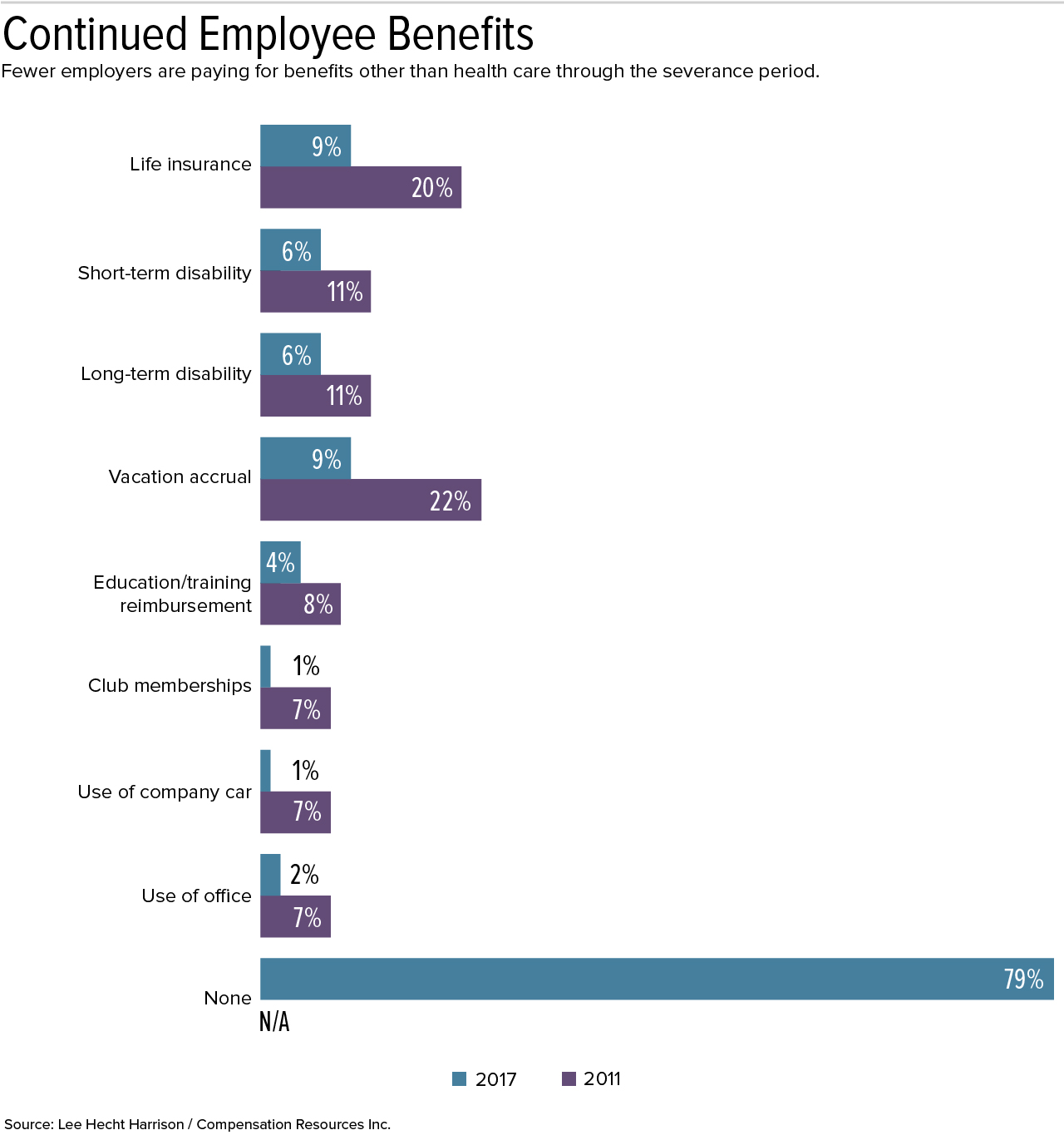

Benefits During Severance

Companies were nearly evenly split on whether to continue medical coverage for terminated employees, with a slight majority (52 percent) opting to extend those benefits if the employees were enrolled prior to the termination date.

Among companies that continued medical coverage:

- Nearly half extended medical coverage for the duration of the severance period.

- Nearly one-quarter do it through the end of the month in which the termination became effective.

- Nearly two-thirds expect employees to continue making their shared contributions.

"Many severance packages include an offer to make COBRA payments for a period of time or simply continue existing health benefits for a period of time and defer the start of the COBRA period," noted Robert Ottinger, an employment attorney and principal of The Ottinger Firm P.C. in New York City.

It's common for employees to ask employers to help make these payments if the company has not offered to either extend health benefits or make COBRA payments, Ottinger commented. Employers should be prepared to negotiate this issue or explain why they won't.

If employees were provided stock options, "typically, a departing employee will have 90 days to exercise vested stock options before they expire, but make sure this is clearly stated in your severance package," Ottinger advised.

[SHRM members-only toolkit: Designing and Administering Severance Pay Plans]

Outplacement Help

In 2017, about two-thirds of companies offered outplacement services to all levels of employees as part of the severance package, consistent with findings in the 2011 survey.

Half of the respondents offered outplacement aid to all C-suite executives, senior managers and directors, and nearly half provided outplacement help to other exempt employees. Forty percent offered these services to nonexempt employees.

Missed Opportunity to Redeploy Talent

The redeployment of talent—placing people in new roles within the organization as opposed to simply laying them off—is an underused strategy, the survey showed. Only 19 percent of organizations had in place some form of redeployment program, down from 26 percent in 2011.

“Redeploying talent leverages an organization’s internal talent management systems to match employees with open internal positions,” Simpson said. “This can help retain valued talent while eliminating risk from high turnover and, ultimately, reduce severance costs.” Nearly two-thirds of companies said they have not compared the cost of terminating employees to the cost of redeploying them.

A Voluntary Severance Plan Misfire A 2017 federal district court ruling in Delaware, Girardot v. The Chemours Co., had its roots in a corporate spin-off, followed by a voluntary severance plan (VSP), followed by a reduction in force (RIF), wrote Mark Poerio, an attorney at Wagner Law Group in Boston who specializes in executive compensation, employee benefits, and fiduciary matters. "Litigation came from VSP participants who alleged that "they would not have elected to participate in the VSP had they been informed of the possibility that the [RIF plan] would be implemented with greater benefits," Poerio explained. "The Girardot case highlighted the need for VSP communications to eligible employees through FAQs, or other vehicles, that explain how the VSP will operate, as well as how it will differ from a possible future RIF. Imprecision or ambiguity can open the door for claims by employees who feel in hindsight that that they were misled or under-informed about their choices," Poerio pointed out. "Employers should also take VSP precautions with supervisory employees," Poerio noted. "Well-intentioned advice could inadvertently convert a VSP into an involuntary program." This may result, he said, "if particular employees are forewarned that they would be smart to take the voluntary severance because they are at risk of being terminated in any event if a RIF occurs. That kind of advice could open the door for claims that the VSP is a ruse for involuntarily terminating protected classes of employees (such as older ones)." |

Was this article useful? SHRM offers thousands of tools, templates and other exclusive member benefits, including compliance updates, sample policies, HR expert advice, education discounts, a growing online member community and much more. Join/Renew Now and let SHRM help you work smarter.

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.