Number of 401(k) Funds Offered to Plan Participants Shrinks

More plan participants select a 'one fund' target-date option

A typical 401(k) plan offers fewer investment choices than a decade ago, while plan participants are now more likely to put all of their 401(k) account dollars into a single, diversified fund, tailored to their expected retirement date, new research from financial services firms shows.

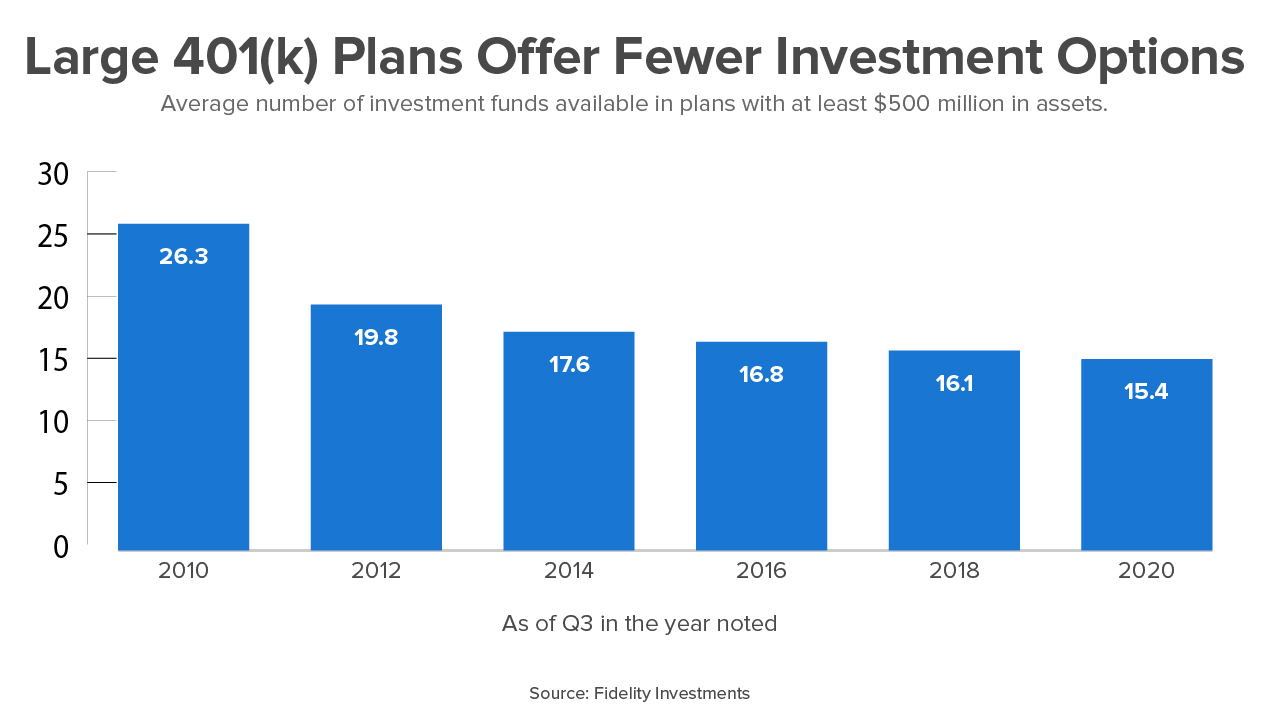

In its third-quarter 2020 retirement report, Fidelity Investments said that the largest corporate defined contribution plans it administers now offer fewer than 16 investment options in their lineup, down from 26 investment options in 2010. The analysis considers the plan's target-date fund series as a single fund (target-date funds are offered in a group, with each target-date fund tailored for a particular retirement year). Large plans are those with approximately $500 million or more in plan assets.

"An average of 26 funds in your lineup can be a lot of work for a fiduciary to oversee, ensuring each of those funds is still a prudent choice," said Chris Herman, head of investment strategists for workplace investing at Fidelity Investments. "It also creates a challenge for participants who have to select among all those funds to make their investment allocation. Fewer funds lessen the burden on fiduciaries and make it simpler for participants to choose where to invest."

A 2020 report by Vanguard Investments, also based on client data, showed that when counting a target-date series as a single-fund offering, the average number of investment options for 2019 was just over 17. The number of funds in a typical plan has shrunk by one fund each year, on average, since 2019, Vanguard reported.

Shift to Target-Date Funds

According to Fidelity, 45 percent of all assets in 401(k)-type plans it administers now are invested in target-date funds.

"With 98 percent of employers offering target-date funds and 92 percent using them as the default investment option, employee diversification has improved greatly over the last 10 years," Fidelity reported.

Similarly, at the end of 2019, 94 percent of plans that Vanguard administers offered target-date funds.

In an update to its report, Vanguard noted that six of every 10 dollars contributed were invested in target-date funds as of April 2020 in plans the firm administers.

Fidelity's data showed that among Millennials, 69 percent are invested exclusively in a target-date fund, due in part to being automatically enrolled in their 401(k) and defaulted into the option.

Additionally, 70 percent of Baby Boomers used a target-date fund within their 401(k), yet only 39 percent of Baby Boomers hold all of their savings exclusively in a target-date fund, which may expose them to greater market volatility risks (if they're over-invested in stock funds) or less growth over time (if they're over-invested in bond funds).

"As participants approach retirement and have greater certainty around their expected expenses and possibly additional sources of income, they may want greater flexibility in how their portfolio looks," Herman said, although it would be prudent to discuss their investment selections with a financial advisor, he noted.

Participants Select Fewer Funds

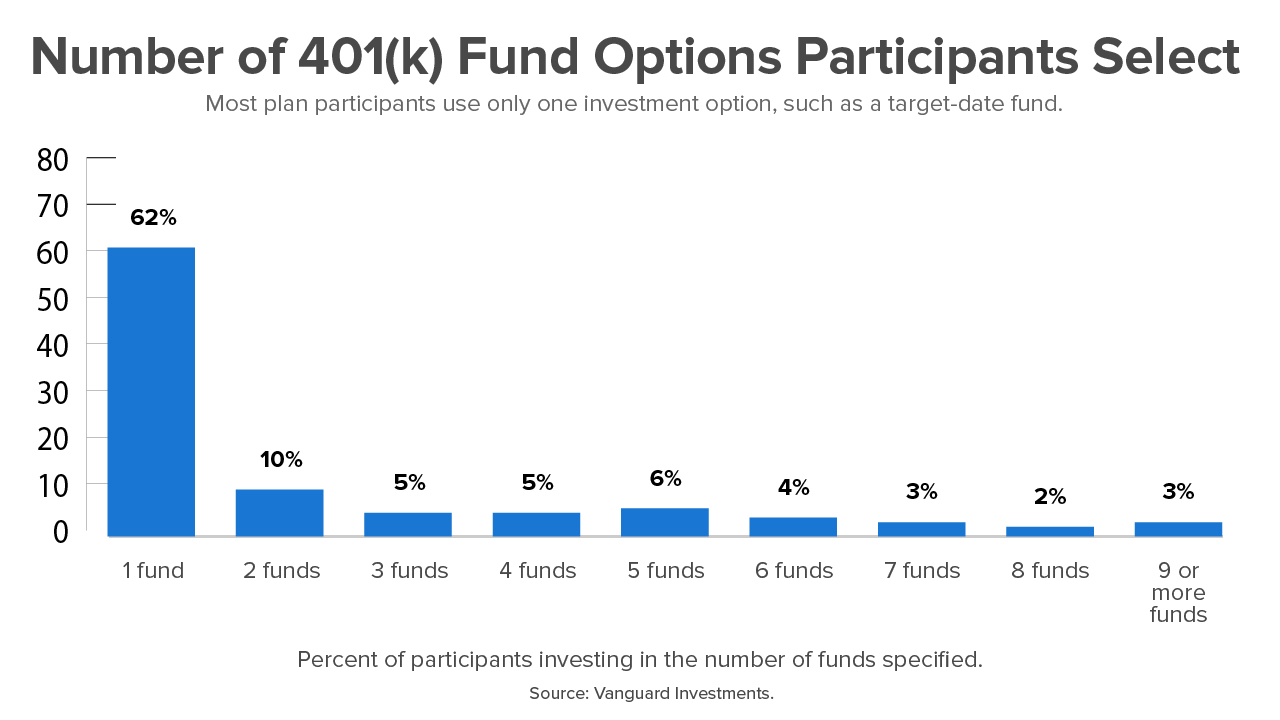

Vanguard found that despite the menu of investment choices, 62 percent of participants used only one fund. On average, participants used 2.4 options in 2019, fewer than the 3.3 options used, on average, in 2010.

One reason for this change is the growing number of single target-date fund investors. In 2019, 62 percent of participants held a single-fund option in their account and 88 percent of these participants were invested in a single target-date fund.

Use of Brokerage Windows

Along with the increased availability of target-date funds in plan lineups, another reason 401(k) plans are offering fewer funds is greater use of self-directed brokerage windows, Herman said. Brokerage windows let participants select investments beyond those designated by the plan and are "a simpler way to give participants broader choice if they were seeking it, rather than adding more funds in your lineup," he explained. "As the number of investment options in a typical plan has come down over the past 10 years, we've seen the number of plans adopting self-directed brokerage going up," Herman said.

Among large plans with more than 50,000 participants that Fidelity administers, "close to 58 percent offer self-directed brokerage, whereas 10 years ago 35 percent did so," Herman noted.

Smaller plans are less likely to offer a brokerage option, however.

Index Funds and Tiers

Tiering is an effective way to present plan investment choices to participants, according to Vanguard's report. Typically, tiers are presented as possible all-in-one investment strategies, with separate tiers for:

- Target-date funds.

- Stock and bond index funds that reflect market benchmarks.

- Actively managed stock and bond funds.

Sixty-four percent of Vanguard-administered plans offered a core of index or "passively managed" funds last year, up from 54 percent in 2015.

According to Vanguard, an index core, at a minimum, consists of four options covering U.S. equities, non-U.S. equities, U.S. taxable bonds and cash. "A passive core of these four options offers participants broad diversification, varying levels of risk exposure and very low investment costs," the firm stated.

Some plans offer target-date funds that are themselves solely invested in index funds, rather than actively managed funds, which can reduce fund management fees for the target-date series funds.

Sixty-three percent of Vanguard plans offered both an index core and passive target-date funds last year. In 2010, 32 percent of plans offered both an index core and passive target-date funds.

[SHRM members-only toolkit: Designing and Administering Defined Contribution Retirement Plans]

Keeping It Simple

"Plan administrators might want to put themselves in the shoes of their typical 401(k) participant and conclude that fewer investment options would be better," blogged Andrew S. Williams, a partner at law firm Golan Christie Taglia in Chicago.

He noted that recent participant lawsuits include allegations that employers' plans were complicating investment decisions "because the plans offer too many investment choices."

He added, "regardless of how many investment options are provided in your 401(k) plan, make sure that its investment array includes low-cost index funds [which can] provide a good defense if plan fiduciaries are ever second-guessed by a plaintiff's lawyer."

Attorneys at law firm Nixon Peabody recently advised that "fiduciaries should remain diligent in monitoring their plan's investment fund lineup, reviewing record-keeping fees and documenting their processes when making decisions involving the plan."

Related SHRM Articles:

For 2021, 401(k) Contribution Limit Unchanged for Employees, Up for Employers, SHRM Online, October 2020

Viewpoint: Employers Need to Reinvent Retirement-Savings Match, SHRM Online, October 2020

Viewpoint: How to Minimize the Risk of Retirement Plan Litigation, SHRM Online, September 2020

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.