Take Steps to Measure—and Enhance—Financial Wellness Success

Hardships of 2020 improved engagement with financial well-being initiatives

Employers can improve the value of workplace financial wellness initiatives by tracking metrics such as employee morale and financial stress, along with measures such as retention and absenteeism, personal financial advisors recommend.

"2021 will be a particularly pivotal year, as financial well-being benefits offerings have matured and many organizations are eager to understand how [these programs are] supporting both workers and the company, while making the best use of limited resources," said Jacqueline Barrett, business lead for SoFi at Work, which provides workplace financial wellness services.

"A well-structured financial wellness program will provide education, tools and resources to address the causes of financial stress within a workforce," the Retirement Advisor Council, an organization of retirement plan advisors, investment managers and defined contribution plan service providers, concluded in a January research report. Employee financial stress can worsen absenteeism and reduce productivity while taking a toll on employees' health, which can drive up insurance costs, the council reported.

Financial Wellness Basics

Financial wellness programs typically seek to improve employees "financial literacy" by addressing challenges such as creating and maintaining a household budget and taking steps to reduce long-term debt. Other frequently addressed topics include savings for milestone events such as buying a home or funding a college education.

Programs use a range of methods, including webinars, online articles, interactive tutorials and in-person meetings (pre- and post-pandemic), or virtual lunch 'n learn sessions.

"In most cases, employees are asked to provide feedback throughout their financial journey, as they interact with tools and content to learn, participate in training sessions, and meet with certified financial planners," Barrett said.

"To help employees stay engaged in their own financial wellness, many employers integrate elements of financial literacy into their employee payroll program," said Dom Morea, senior vice president and head of prepaid at Fiserv, a financial services technology firm. "This can include a simple financial tip of the day or an interactive component that incentivizes the employee to take action. Doing so can be a simple way to help employees start setting aside funds, build savings and reduce financial stress."

[Need an electronic solution for payroll delivery? Check out SHRM PaySolution enabled by Money Network® from Fiserv.]

Tracking Metrics

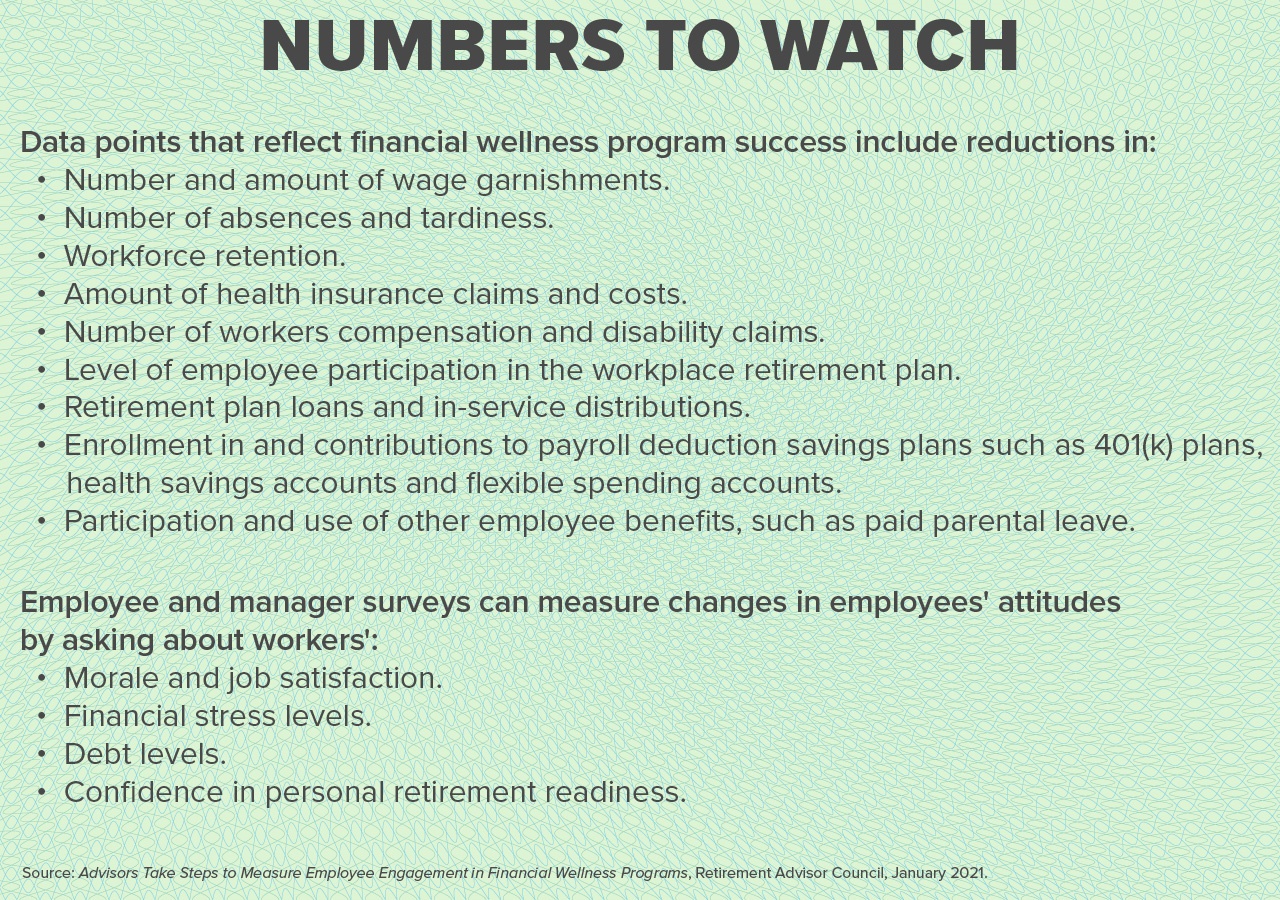

To assess the success of a financial wellness program, metrics tailored to program goals should be established, the Retirement Advisor Council recommends. Performance against those metrics should be measured periodically.

Employee surveys and internal information gathered before a program's launch can establish a baseline for measuring improvements in employees' financial well-being, according to the council's report. In addition, baseline metrics of employee engagement can help employers determine which program features are most widely used by various employee demographics.

According to Barrett, "qualitative" metrics, which are useful for evaluating employees' perspectives on a program's usefulness, can be gathered through text responses to survey questions, anecdotal employee feedback captured via focus groups, and exit interviews. "Quantitative" or number-based metrics include program participation, employee retention (or turnover), and contributions to retirement plans, automatic savings programs and health savings accounts.

"Different employees need different things at different points in their life, and even seemingly homogeneous populations, upon analysis, are in need of different types and levels of support," she said.

Engagement Is Key

"Employee engagement isn't just part of the success of financial well-being program success, it's at the heart of it," Barrett said. Interactive technology, such as online dashboards that allow employees to track progress toward their goals, can help "to bring employee input into the design process" for future financial wellness offerings, "using data from measurement tools to inform future rollouts."

Employers should not merely monitor their financial wellness programs, however, but can drive up participation by "pushing the offering out to the people as opposed to letting them know it is there," said Retirement Advisor Council member Mark Ratay, senior vice president and corporate retirement director at investment services firm Morgan Stanley. Another tip: Have corporate leaders champion the program to raise engagement levels.

Financial advisors said that on average, 19 percent of their clients with financial wellness programs use a rewards or points program to stimulate participant engagement, the council reported.

Many in 'Survival Mode' for 2021

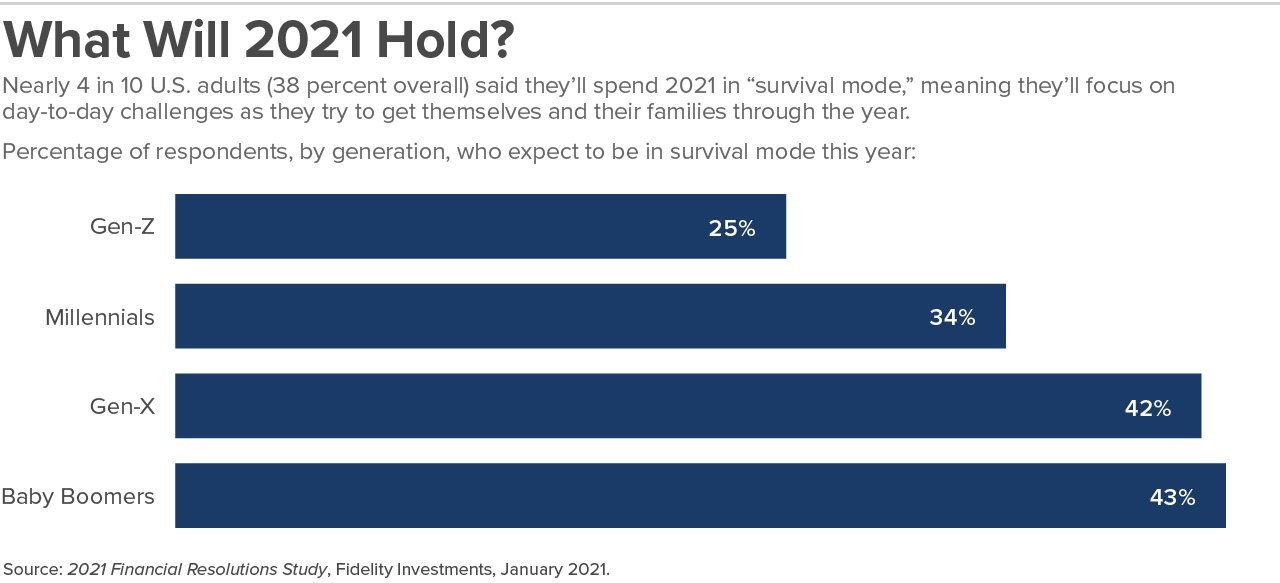

Separate research indicates why ensuring the success of financial wellness programs is so important. According to 3,011 U.S. adults surveyed in October, more than two-thirds experienced financial setbacks in 2020, often from the loss of a job or household income due to the COVID-19 pandemic, and nearly one-third said they were in a worse financial situation compared to the previous year.

The findings are from Fidelity Investments 2021 Financial Resolutions Study. When faced with financial setbacks in 2020, the most common solutions were to cut back on expenses, use emergency savings, or to take on debt using credit cards or personal loans.

Looking ahead, nearly 4 in 10 (38 percent) respondents said they'll spend 2021 in "survival mode," meaning they'll focus on the day-to-day to try to get themselves and their families through the next year.

Keeping Financial Resolutions

A key to keeping financial resolutions is setting clear and specific financial goals—such as budgeting expenses and creating or replenishing a "rainy-day" fund for unanticipated expenses—and seeing progress toward achieving those goals, according to Fidelity.

"The financial impact of the pandemic has highlighted the importance of having an emergency fund to help employees avoid tapping their retirement savings to cover financial emergencies," said Jeanne Thompson, Fidelity's senior vice president for workplace consulting.

Providing Support

"Last year, the COVID-19 pandemic taught many individuals that they need to be ready for the unexpected, which … could deplete their emergency and retirement savings," said Rob Grubka, president of Voya Financial's employee benefits business.

Added Andrew Frend, Voya's senior vice president of product and strategy, employee benefits, "With COVID-19 shining a spotlight on the need for greater financial security, the challenge for employers moving forward will be connecting health and wealth benefits as their employees continue to have an increasing need for budgeting, planning and guidance resources."

Employers can help by partnering with their benefits providers, he said, to provide robust education programs, year-round communication campaigns and digital tools to help their employees understand and make the best use of their workplace benefits.

Related SHRM Articles:

Employers Feel More Responsible for Employees' Financial Wellness, SHRM Online, October 2020

Emergency Savings Accounts Funded by Payroll Deductions Boost Financial Wellness, SHRM Online, September 2020

How Income-Advance Loans Help Financially Stressed Employees, SHRM Online, February 2020

Helping Employees Save for the Unexpected Pays Off, SHRM Online, August 2019

6 Ways to Measure the Success of Financial Wellness Efforts, SHRM Online, January 2019

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.