Phased Retirement Gets a Second Look

Employees want to ease into retirement. Why don't more employers let them?

Most Americans ages 61 to 66 who are still employed maintain a full-time work schedule. However, while about one-quarter of workers in this age group say they had planned to reduce their work hours as they transitioned to retirement, fewer than 15 percent subsequently reported that they were partially retired or were gradually retiring from their jobs, according to a new report from the U.S. Government Accountability Office (GAO).

The June report, Older Workers: Phased Retirement Programs, Although Uncommon, Provide Flexibility for Workers and Employers, looks at employer-based programs in which older employees can reduce their working hours, often with a knowledge-transfer component that passes along their expertise to younger colleagues.

"As the large Baby Boomer generation retires, the workforce will lose much of their knowledge and experience," stated the report by Charles A. Jeszeck, the GAO's director of Education, Workforce and Income Security Issues. Encouraging phased retirement is one way to mitigate this loss, he noted.

However, formal phased retirement programs present design and operational challenges for employers, including compliance with provisions and laws related to discrimination. Despite these challenges, most employers that the GAO interviewed that have phased retirement programs found them beneficial.

A Range of Approaches

Employers most likely to provide formal phased retirement programs had larger or technical and professional workforces, and tended to be in fields such as education, consulting and high-tech, the GAO found. The report summarizes the phased retirement programs at eight such (unnamed) companies, showing a range of approaches.

For instance, in one employer's program:

- Older employees work 80 percent of full-time hours and receive 80 percent of pay and 80 percent of their bonus money. Despite working fewer hours, workers keep their health benefits and their share of the cost is unchanged.

- The defined benefit pension formula is based on full salary for up to five years because workers appear full time on paper. The defined contribution plan contribution is based on a worker's full-time salary and reduced bonus.

- Employees are eligible to participate in the program if they are at least age 55 with 10 or more years of service, have achieved or exceeded performance expectations, and have permission from management.

- Workers can stay in the program for any length of time as long as they are meeting program standards and have their manager's approval.

- For each year the worker participates, he or she creates a proposal that includes a knowledge transfer plan with recommendations on how it will ensure business continuity.

At another employer's program:

- Participants must have reached age 60 and work at least 50 percent and no more than 80 percent of regular full-time hours.

- Participation in the program can last from six months to two years.

- The employer provides tools and guidelines to help phasing workers create a knowledge transfer plan.

- The employer provides a subsidy so that the health insurance rates for phased retirement participants are the same as if they were working full time.

- The defined contribution plan formula does not change with phased retirement, but the amount of pay on which the contribution is based changes in proportion to the worker's reduced salary.

[SHRM members-only toolkit: Managing Flexible Work Arrangements]

Informal Programs More Prevalent

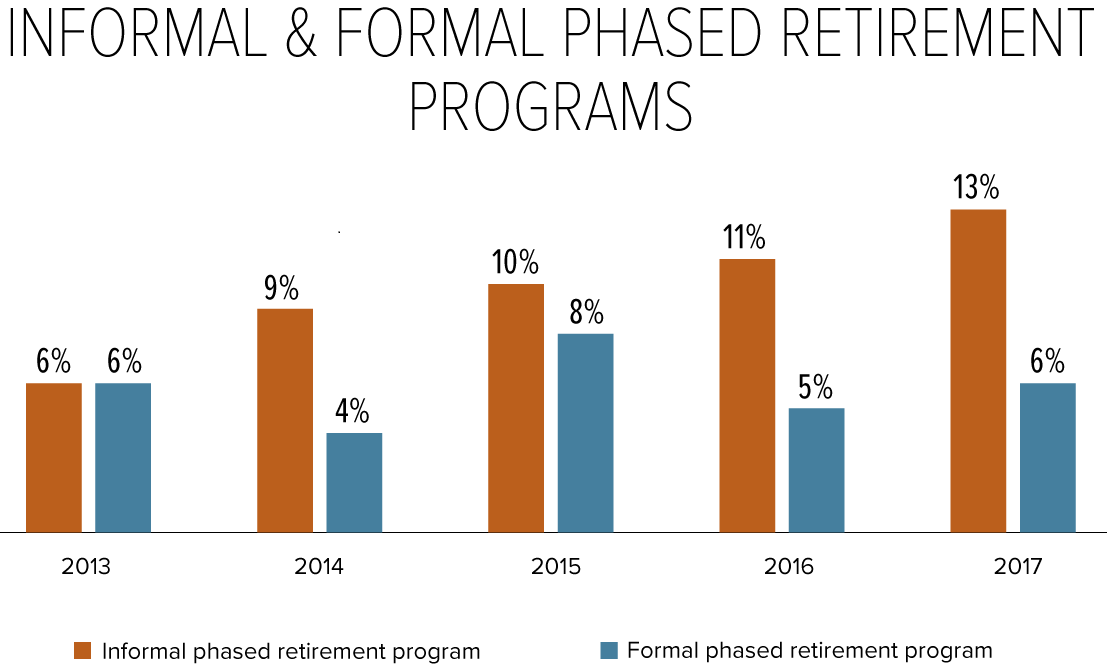

While formal phased retirement programs have not been widely adopted, more employers are offering informal or ad hoc programs, according to the Society for Human Resource Management's 2017 Employee Benefits survey report.

Source: Society for Human Resource Management's 2017 Employee Benefits survey report.

One reason employers are more likely to offer informal programs is that they prefer to limit phased retirement opportunities to high-performers and those with in-demand skills and believe that an ad hoc approach makes that easier, suggested Jack Towarnicky, who has held HR and benefits leadership positions at four Fortune 500 companies, during a May 9 presentation at WorldatWork's Total Rewards conference in Washington, D.C.

An informal approach, however, "could pose legal issues regarding nondiscrimination based on who is offered the right to shift to part time, but this hasn't been tested" in the courts, said Towarnicky, who noted he was speaking for himself and not on behalf of any organization.

Employees' desire for phased retirement opportunities is growing, and eventually that will drive more employers to offer formal programs that they can use to attract and retain talent, Towarnicky said.

"Increasingly now and in the future, the lines between employment and retirement are going to become almost imperceptible," and HR will be challenged with finding ways to respond, Towarnicky noted, or older employees will depart with their knowledge and find organizations that will allow them to work fewer hours.

"If you're thinking that people are going to call it quits at 65, it's just not going to happen," Towarnicky remarked. "A lot of employers still have this full-stop concept. People end up having to leave the organization."

However, companies such as financial services firm S&T Bancorp are making concerted efforts to hire part-time retirees, he pointed out.

He also referenced Northern Arizona University's phased retirement program as an interesting model.

Working Longer and Its Consequences A July report from Deloitte, Navigating the Future of Work, found that "The prospect of older generations working for longer periods as their physical capability to remain employed improves could affect the pace at which younger talent and ideas renew organizations—and potentially intensify the intergenerational competition for jobs. It could also lead to a substantial increase in seniors participating in the 'gig economy,' out of post-retirement desire or necessity." |

Benefit Decisions

When putting phased retirement opportunities in place, employers must decide whether to maintain full health care and retirement plan benefits for those who are phasing into retirement—which is the approach most likely to keep older employees onboard.

Alternatively, they can classify program participants as part-time employees not entitled to group benefits, or provide a different benefit approach such as subsidies for program participants to purchase health care on the individual market or through public exchanges.

Organizations with defined benefit pension plans can permit near-retirees to reduce their hours worked and use partial distributions from their pension plans to make up for their reduced wages (IRS rules allow in-service distributions from defined benefit plans under certain circumstances.) Also, the salary component of the pension formula should be designed—or amended if necessary—so that, for instance, it is based on a plan participants' three consecutive highest-earning years, rather than their final three years of employment.

If choosing not to offer full benefits for phased retirees, organizations should keep close watch on these employees' hours to ensure their part-time status is maintained, Towarnicky said.

A Phased Retirement Disconnect Employers recognize that their employees envision transitioning to retirement in a variety of ways, according to Transamerica Center for Retirement Studies 17th Annual Retirement Survey report, published in August. The survey, conducted from Nov. 20 to Dec. 20, 2016, among a nationally representative sample of 1,802 employers, revealed that:

Despite employers' recognition that many of their employees envision a flexible or phased transition into retirement, few have programs in place to support them:

Yet most employers (71 percent) nevertheless consider themselves to be "aging-friendly" by offering opportunities, work arrangements, and training and tools need for employees of all ages to be successful.

Employers also are missing an opportunity to ensure smoother transitions when their employees do retire, the findings indicate: only 27 percent encourage employees to participate in succession planning, training and mentoring. |

Related SHRM Articles:

Taking Phased Retirement Options to the Next Level, SHRM Online Benefits, February 2017

Use Voluntary Benefits to Attract and Keep Part-Time Workers, SHRM Online Benefits, July 2017

Early Retirement Health Care Quandary Keeps Workers on the Job, SHRM Online Benefits, July 2017

Was this article useful? SHRM offers thousands of tools, templates and other exclusive member benefits, including compliance updates, sample policies, HR expert advice, education discounts, a growing online member community and much more. Join/Renew Now and let SHRM help you work smarter.

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.