HSA Enrollment Rises but Misunderstanding Still Common

Small companies more generous with HSA funding than large employers

Employers continue to seek health care cost savings through consumer-driven health plans with health savings accounts (HSAs) and, to a lesser extent, health reimbursement arrangements (HRAs), a new analysis shows.

The May 2017 report, How Health Savings Accounts Measure Up, analyzes responses from the 2016 United Benefit Advisors (UBA) Health Plan Survey, conducted last year with 11,524 U.S. employers that sponsor group health plans. Among the findings:

- 35.1 percent of employer health plans offered an HSA, an HRA or both, a 3.2 percent increase from 2015.

- HSAs were offered in 24.6 percent of employer-sponsored plans, up 21.8 percent from five years ago.

- HRAs were offered by 10.5 percent of employer-sponsored plans, a rate that has remained flat over the last five years.

- 17 percent of group health plan participants were enrolled in an HSA, up nearly 26 percent from 2015 and by nearly 140 percent from five years ago.

- Just under 11 percent of group plan participants were enrolled in an HRA, up 23 percent from five years ago.

"Since more than half of all employers only offer one health plan to employees, there is evidence that HSA enrollment growth may, in some cases, be a function of reduced plan offerings," said Mary Drueke-Collins, vice president of employee benefits at Swartzbaugh-Farber & Associates, a UBA partner benefits advisory firm in Omaha, Neb.

Employer Contributions

As for employer contributions to HSAs and HRAs, the survey results showed that:

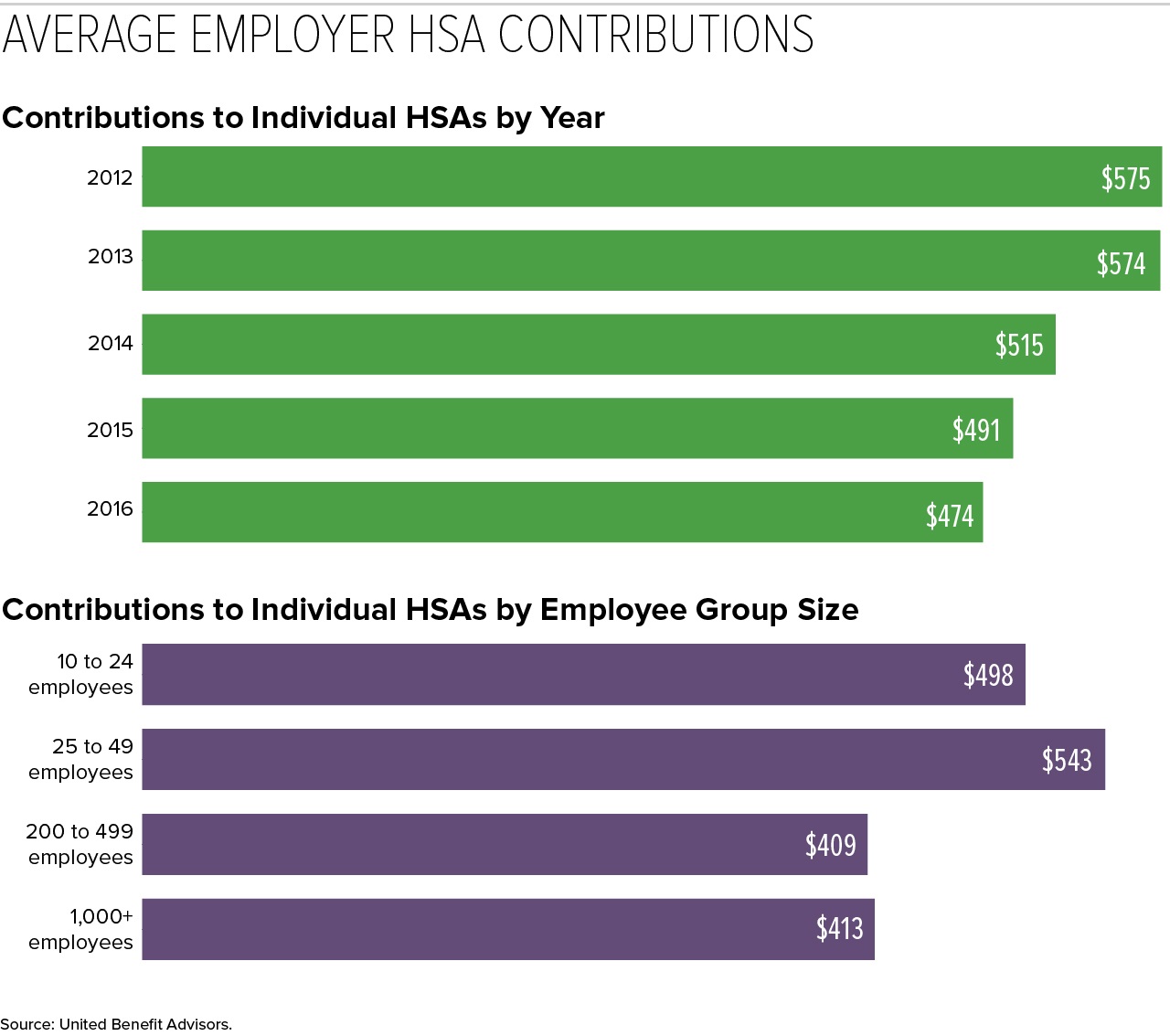

- The average employer contribution to individual-coverage HSAs was $474 (down 3.5 percent from 2015 and 17.6 percent from five years ago).

- The average employer contributions to family-coverage HSAs was $801 (down 9.2 percent from last year and 13.7 percent from five years ago).

- The average employer contribution for HRAs was $1,810 for a single employee and $3,545 for a family, both up approximately 2 percent from 2015.

(Click on charts to view in a separate window.)

"Initially, HSA plans were an attractive way for employers to reduce rising premium costs by offering a high-deductible plan while funding an HSA account that an employee could use to pay for qualified medical expenses," said Elizabeth Kay, compliance and retention analyst at AEIS Advisors, a UBA partner firm in San Mateo, Calif. "Employers could essentially self-fund most of the upfront costs to the employee for the medical plan, so in many cases employers were able to offer a richer medical plan by combining the medical plan with HSA contributions, while still saving money over their current traditional health plan costs."

What insurance carriers didn't realize, she noted, was that HSA funding would lead to greater use of health services under the plan. "These low-premium health plans were essentially 'blown up' with heavy utilization, raising costs," she pointed out. "As a result, we'll see employer contributions to HSA accounts continue to decline as employers try to mitigate these costs."

Those with self-only coverage at companies with 200 to 499 employees received the lowest HSA contributions ($409), while singles at some of the smallest companies (25 to 49 employees) received the most generous contributions ($543), on average.

Last year, some of the smallest companies (10 to 24 employees) had the highest HSA enrollment (16.3 percent). However, rapid enrollment increases among large employers in recent years now places the largest companies (1,000-plus employees) as HSA enrollment leaders, with 19.1 percent enrolled.

[SHRM members-only HR Q&A: Are employer contributions to an employee's health savings account (HSA) considered taxable income to the employee?]

Contrary Findings Show Employer HSA Contributions Are Rising Results released in May from the Employee Benefit Research Institute (EBRI)/Greenwald & Associates Consumer Engagement in Health Care Survey provide a different perspective. The survey, conducted last August with responses from 3,295 adults with private health insurance coverage, focused on consumer-driven health plans (CDHPs)—health plans associated with a health savings account or health reimbursement arrangement. Among the findings: "It's more common for employers to contribute to HSA than in the past, and the dollar amount is also increasing." Specifically, the survey showed that:

Another finding to note: 25 percent of respondents were enrolled in an HSA-eligible health plan but had not opened an HSA, and so were missing out on the opportunity to use pretax dollars to pay for qualified health services. CDHP's Promote Cost-Conscious Behaviors Adults in a CDHP were more likely than those in a traditional plan to exhibit a number of cost-conscious behaviors, the EBRI/Greeenwald & Associates survey showed. For example, they were more likely to say that they had:

CDHP and those in a high-deductible health plan (HDHP) without an HSA or HRA were more likely than traditional-plan enrollees to report that they tried to find cost information before getting care: Nearly one-half of HDHP enrollees, and 43 percent of CDHP enrollees said they had searched for the cost information, compared with 32 percent among traditional-plan enrollees. |

Satisfaction High, Misconceptions Remain

Of those in an HSA-eligible health plan, 80 percent are satisfied with their high-deductible health plan (HDHP) and 77 percent say that HSAs help them to manage their health care costs, Fidelity Investments, an HSA services provider, recently reported, based on responses from 1,309 HSA enrollees polled last December.

"Continued education by employers and HSA providers helps drive satisfaction and illustrate the benefits of HDHPs and HSAs, but misconceptions remain," said Eric Dowley, senior vice president of HSA product management at Fidelity.

Unlike contributions to health flexible spending accounts (FSA), of which at most $500 can be carried over year-to-year depending on the plan design, all unspent contributions to HSAs roll-over from year-to-year. "Yet when asked, 39 percent of people believed they lost unspent HSA contributions at year end," Dowley noted.

Regional Difference with HSAs and High-Deductible Plans BenefitsFocus, a provider of benefits management tech, analyzed employee benefit election data from over 500 employers on the firm's platform and found that behaviors across the country vary widely by region. Among its findings: Employers in the West are moving away from traditional plans as employees invest in HSAs.

The Midwest had the highest HDHP offerings and participation rate and higher adoption of voluntary benefits.

Employees in the Northeast see higher premiums but lower deductibles.

Employees in the South face the highest out-of-pocket costs for all plans.

|

Related SHRM Articles

IRS Sets 2018 HSA Contribution Limits, SHRM Online Benefits, May 2017

Rising Health Benefit Costs Still Outpace Overall Inflation, SHRM Online Benefits, May 2017

Health Benefits Take Bigger Bite Out of Paychecks, SHRM Online Benefits, September 2016

Benefits Education Aids Shift to Health Care Consumerism, SHRM Online Benefits, March 2016

CDHP Cost-Savings Maintained over Time, Researchers Find, SHRM Online Benefits, March 2015

Was this article useful? SHRM offers thousands of tools, templates and other exclusive member benefits, including compliance updates, sample policies, HR expert advice, education discounts, a growing online member community and much more. Join/Renew Now and let SHRM help you work smarter.

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.