High-Deductible Plans More Common, but So Are Choices

65% of big employers offer both high-deductible and traditional plans

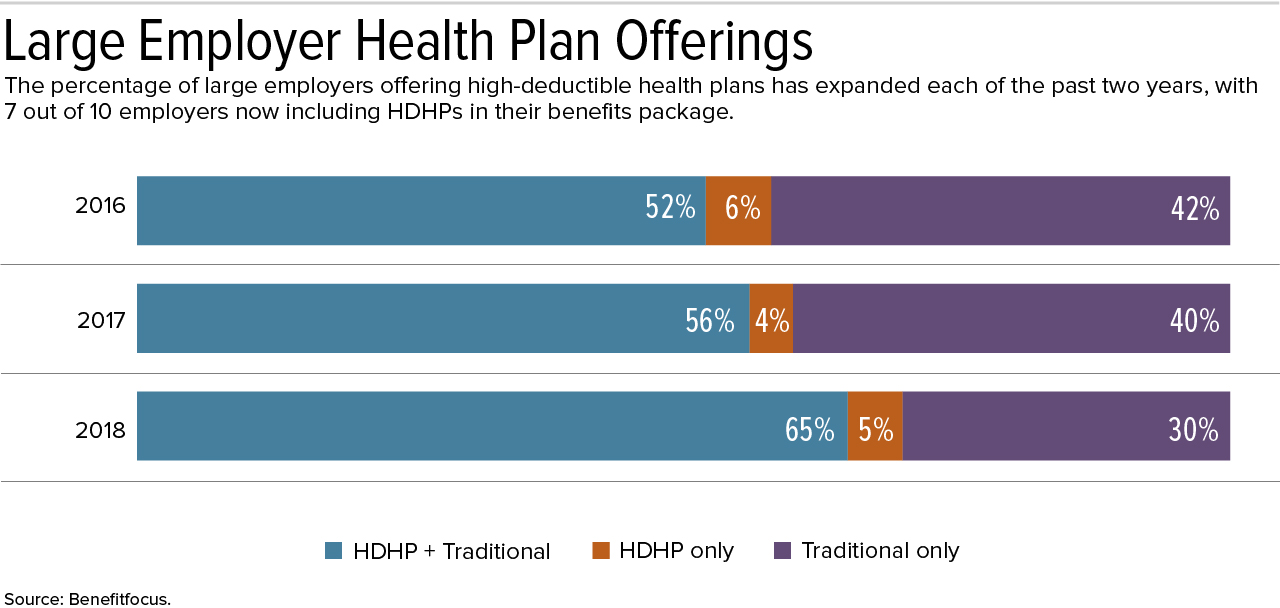

The share of big employers offering a high-deductible health plan (HDHP) has grown by more than 20 percent since 2016, new research shows. More employers are offering HDHPs alongside traditional health plans such as preferred provider organizations (PPOs), part of a trend of giving employees more choices.

Benefitfocus, a benefits technology and services firm, published its State of Employee Benefits 2018 report on Jan. 31. The report analyzes data from 540 large employers with more than 1.3 million benefit plan enrollees. Key findings are presented below.

Plan Offerings and Participation

For 2018, 70 percent of large employers offered at least one HDHP—either in addition to a traditional health plan (65 percent) or exclusively as a full replacement for traditional health coverage (5 percent).

"It's important to note that this growth has come primarily among employers offering both HDHPs and traditional health plans, as full-replacement offerings have essentially remained flat since 2016," said Jeff Oldham, senior vice president for global and institutional markets at Benefitfocus, based in Charleston, S.C. "This suggests that employers recognize the need to maintain a certain degree of choice in health plans," in that different types of health plans appeal to different employees based on their individual circumstances, such as age and income.

When employees at large organizations were given options, 35 percent selected an HDHP while 48 percent chose a PPO for 2018. The remainder opted for other types of traditional plans, when available, such as health maintenance organizations.

Employees who elected an HDHP earn on average a salary roughly $4,700, or 7 percent, higher than that of employees enrolled in a PPO, the analysts reported. "Higher earners appear to increasingly favor HDHPs, while lower-wage workers identify PPOs—and their lower out-of-pocket exposure—as better suited to their needs," Oldham said, and "that tendency is evident across age groups."

"The concept of HDHP full replacement was largely a response to the original threat of the Cadillac tax," blogged Logan Butler, a content specialist at Benefitfocus, and "the Cadillac tax poses much less of an immediate and serious threat to employers" now that it has been delayed until 2022 and, many believe, is unlikely ever to be implemented.

[SHRM members-only toolkit: Managing Health Care Costs]

Premiums and Out-of-Pocket Costs

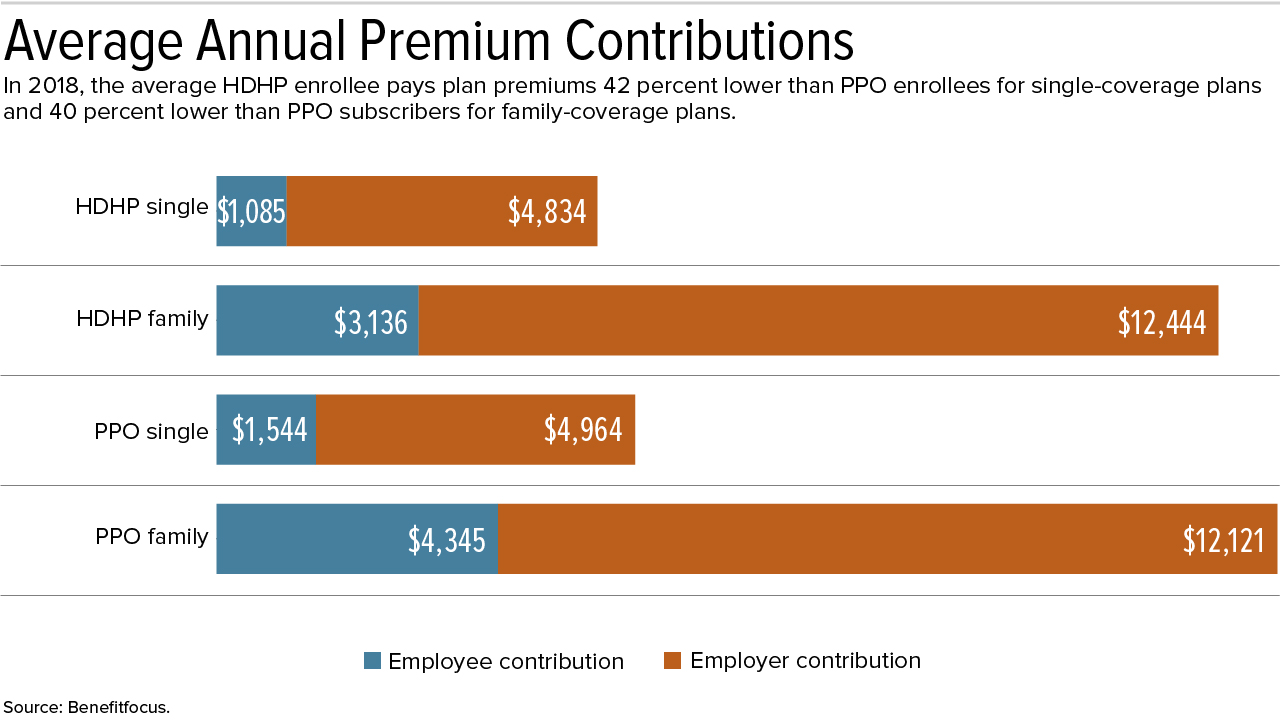

In 2018, the average HDHP enrollee is paying a 42 percent lower monthly premium than PPO enrollees for single-coverage plans and a 40 percent lower premium than PPO enrollees for family-coverage plans, the report notes.

When employer contributions are considered, HDHP enrollees are responsible for no more than 20 percent of the total annual premium, while PPO enrollees will pay up to 27 percent of their plan costs this year.

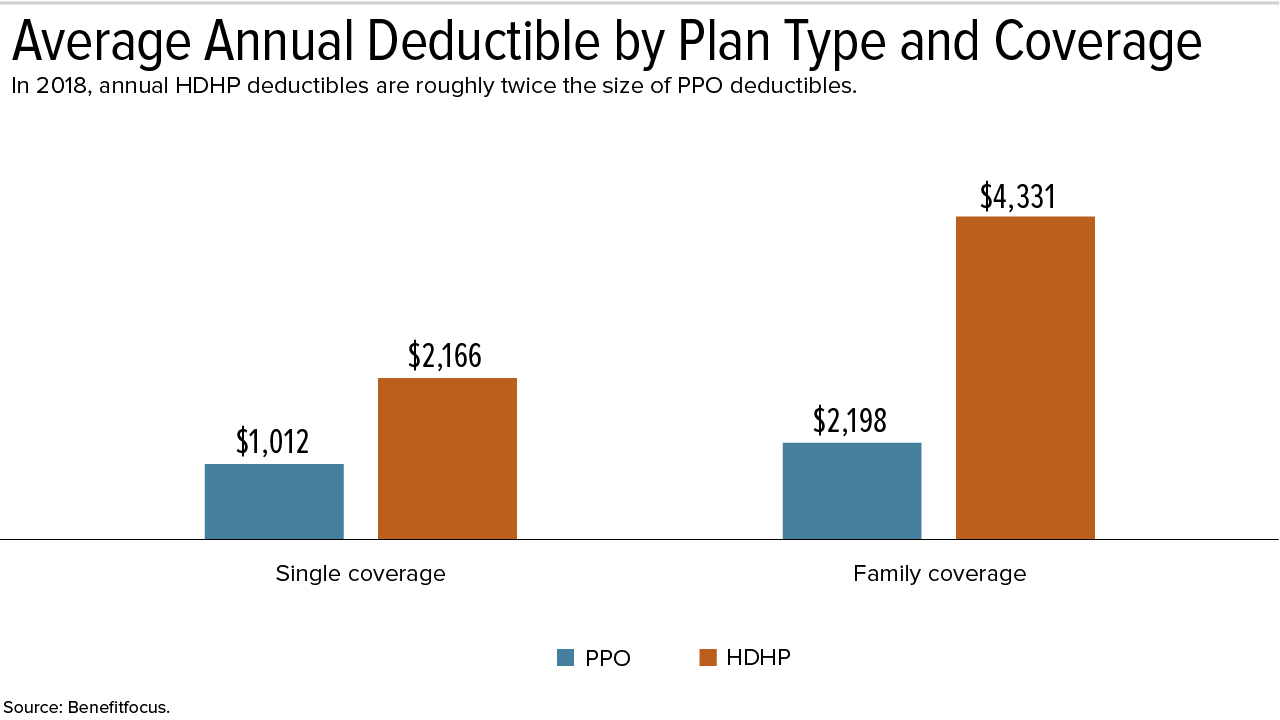

Deductibles are actually down from last year across both plan types, however. PPO enrollees, especially, will enjoy relief in this area, with a 9 percent decrease for family-coverage plans and a 7 percent decrease for single-coverage plans.

"Employers are continuing to tweak health plan design in an effort to strike the right balance of cost-sharing with employees," Oldham explained.

HSA Participation and Contributions

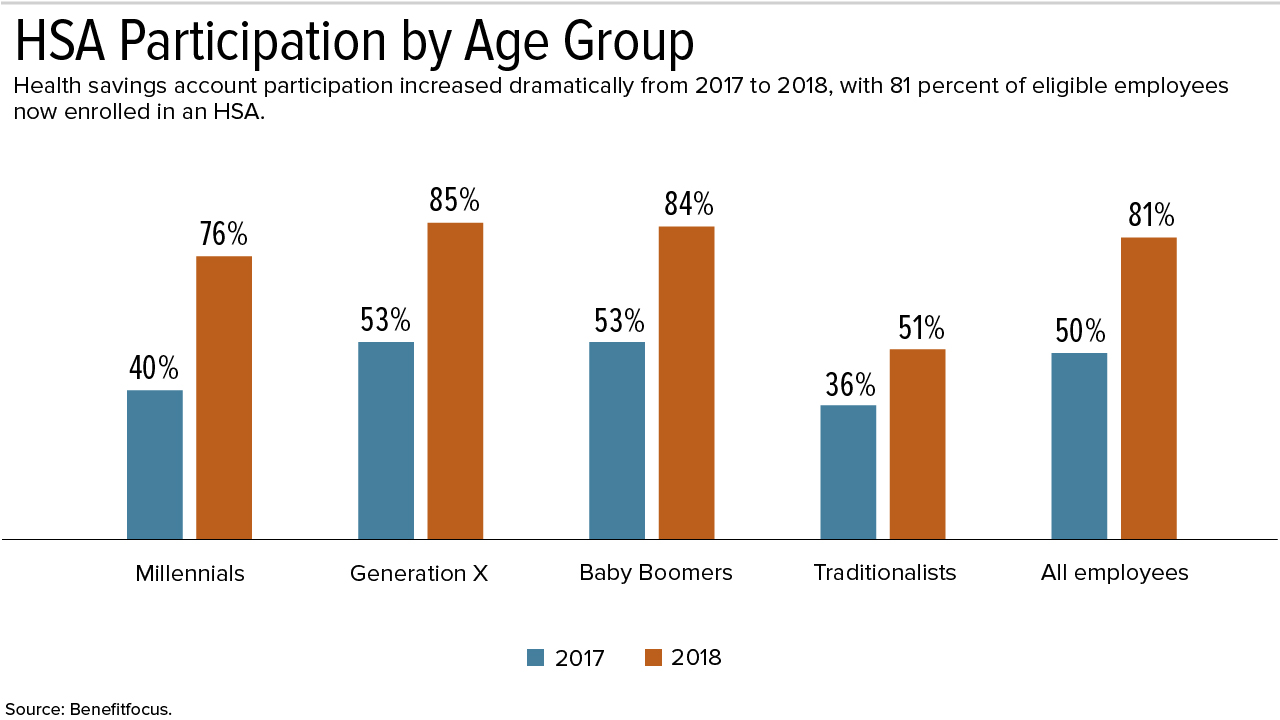

Participation in health savings accounts (HSAs) among eligible HDHP enrollees jumped from roughly 50 percent in 2017 to 81 percent in 2018—with increases observed across every age group. Millennials were especially eager to adopt HSAs, nearly doubling their enrollment rate from last year.

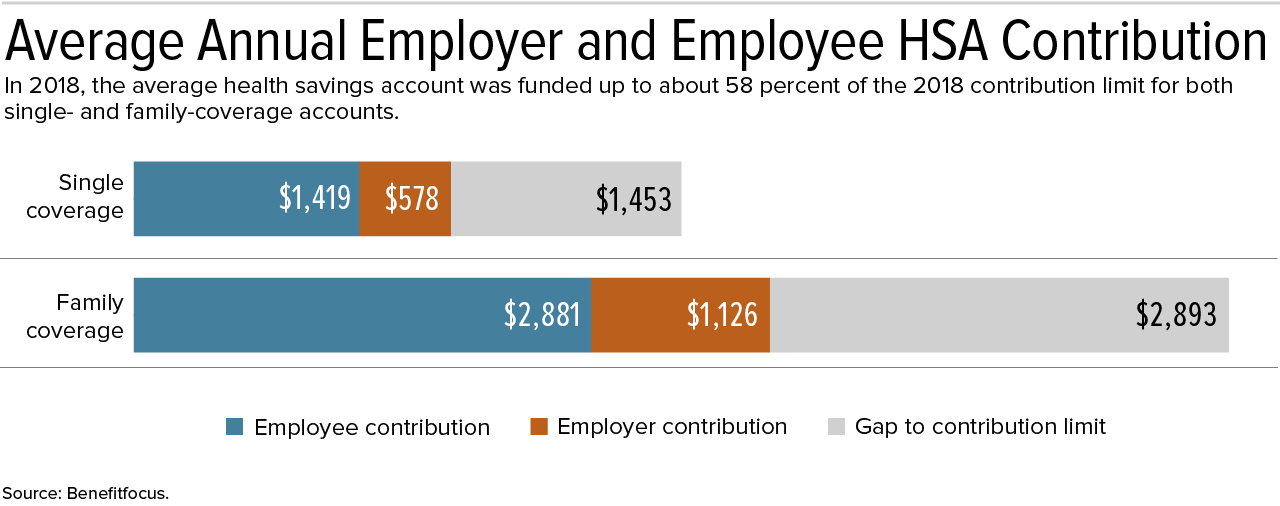

"When it comes to HSA contributions, there remains room for growth," Oldham said. Combining employee and employer contributions, the average single- and family-coverage HSA received a little more than half of the allowable amount for 2018.

Employee contributions, however, are up year over year for 2018—4 percent for single coverage and 3 percent for family coverage.

Pairing HDHPs with HSAs—especially when the HSAs are seeded with employer contributions—provides an incentive to skip unnecessary services since employees keep unspent funds, while rendering necessary health services affordable to employees who may lack other savings.

Rising Costs Bring Financial Hardships Only 30 percent of U.S. workers say they are confident they can afford health care without financial hardship, according to a January report by the nonprofit Employee Benefit Research Institute (EBRI) in Washington, D.C. "Workers' dissatisfaction with health insurance is focused primarily on cost," said Paul Fronstin, director of EBRI's health education and research program. "Just 22 percent are extremely or very satisfied with the cost of their health insurance plan, and only 18 percent are satisfied with the costs of health care services not covered by insurance." Among workers who reported health care cost increases last year, 26 percent said they are contributing less to retirement plans and 43 percent have decreased their contributions to other savings. EBRI and research firm Greenwald & Associates conducted the survey in June 2017, receiving responses from 1,518 workers throughout the U.S. |

Related SHRM Articles:

Employers Adjust Health Benefits as Costs Near $15,000 per Employee, SHRM Online Benefits, August 2018

Employees Are More Likely to Stay If They Like Their Health Plan, SHRM Online Benefits, February 2018

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.