Financial Wellness Perks Expand to Address Employee Needs

Opportunities abound to help employees better manage household finances

Growing awareness of how financial fitness initiatives can help employees has led to the growth of money-management benefits among employers, new research shows.

Compared to five years ago, the share of employers offering one-on-one retirement plan investment advice rose by 14 percentage points—from 41 percent to 55 percent, according to the Society for Human Resource Management's (SHRM's) 2018 Employee Benefits survey report, to be released in mid-June. The finding is based on responses from SHRM members polled in February.

Financial well-being offerings, however, go well beyond 401(k) advice to address, for example, budgeting and spending habits, short- and long-term savings goals, student-loan management and even home-purchasing advice.

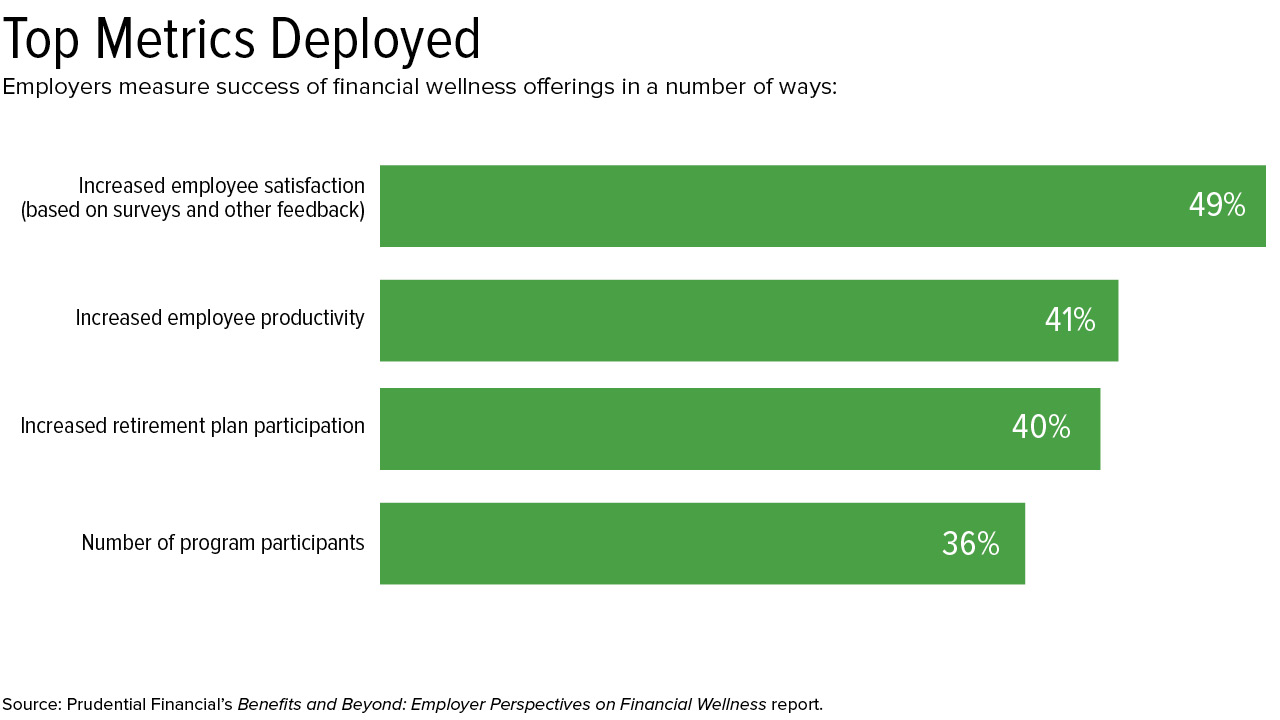

Benefits and Beyond: Employer Perspectives on Financial Wellness, a May survey report from Prudential Financial Inc., a retirement and financial benefits provider, found that:

- The percentage of employers offering financial wellness programs rose to 83 percent, up from 20 percent in 2015.

- Employers who offer financial wellness are more satisfied with their total benefits program (61 percent) than those who do not (44 percent).

The survey, conducted in late 2017, draws on responses from nearly 800 decision-makers for group insurance benefits at U.S. businesses with at least 100 full-time employees.

"Employers and employees report higher satisfaction with their benefit plans when financial wellness programs are offered," said Vishal Jain, financial wellness officer for Prudential's workplace solutions group. "Employees increasingly look to their employers to help them achieve financial security, and employers are seeking data and insights on how to respond and influence better outcomes."

(Click on graphics to view in a separate window.)

Stress over Financial Goals

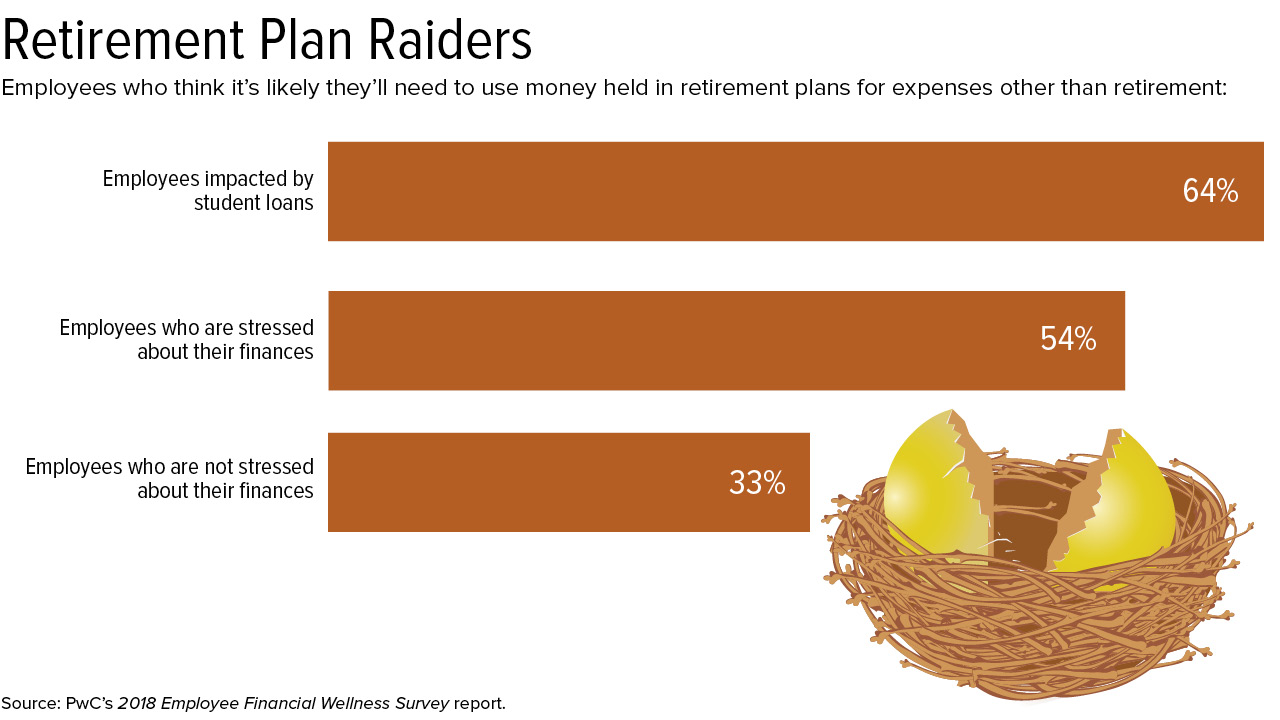

Retirement plans continue to serve as a safety valve for immediate needs such as home or car repairs, according to PwC's 2018 Employee Financial Wellness survey report.

The survey, conducted in February, with responses from 1,600 full-time employed adults throughout the U.S., found that:

- Less than half of employees are confident they'll be able to retire when they want, and nearly two-thirds either say their retirement plans and Social Security won't be sufficient to support them in retirement, or they aren't sure.

- 42 percent say before they retire it's likely they'll need to use money held in retirement plans for other expenses, and that number is much higher among employees who are stressed about their finances or impacted by student loans.

"Retirement plan funds have become a safety valve for many who don't have money set aside for an emergency or unexpected expense," said Kent Allison, leader of PwC's employee financial education and wellness practice. "While some employers are looking to address this growing concern through plan design changes that further restrict loans and withdrawals [from 401(k) and similar plans], they may only exacerbate the situation if employees then seek less favorable ways to meet their needs," such as taking out a high-interest loan, he explained.

"It will take an increased focus on promoting healthier employee financial behaviors to solve the issue," Allison noted.

"Employees typically seek financial help reactively—when they have an important decision to make or are in financial crisis," Allison said. "The more employers can encourage their employees to use [offered financial education and advice] services on an ongoing basis, the more positive the outcome for employees as they become increasingly proactive in addressing their financial needs."

Embedding Financial Fitness

Tweaks in HR processes can nudge employees toward greater financial health, according to a new report from the nonprofit Neighborhood Trust Financial Partners, which helps workers achieve financial health, and Trusted Advisor, a financial counseling service.

The report, Re-Imagining the Workplace as a Hub for Financial Wellness, proposes making financial fitness programs more effective by, for example, providing referrals to a financial counselor—whether that service is in-person, phone-based or virtual—when employees seek payroll or 401(k) loans or pre-retirement 401(k) withdrawals.

"The more the referral process is embedded within standard HR operating procedures, the higher the chances that employees will learn about the service and take advantage of it when it means the most to them," commented Justine Zinkin, CEO of Neighborhood Trust.

Another example would be advising employees to split their direct-deposit pay between a checking account and a savings account "so that they're more likely to build up their savings than if they have to manually move money into savings on their own," Zinkin said.

"Employers have an immense opportunity to help their employees' paychecks go further and build a financially healthy workplace given the central role the workplace plays in their employees' financial lives. The end result is a more productive and loyal workforce," she noted.

[SHRM members-only: Managing Employee Assistance Programs]

A Culture, Not a Product

Chris Whitlow, founder and CEO of Edukate, a financial wellness vendor, noted in a recent podcast that benefit managers should:

- Understand and address the kinds of financial issues common among employees generally and those more likely to challenge specific groups within the workforce based on income, education, age and other factors. Design programs that target resources where they are most needed.

- Ask employees how they would prefer to receive information about program offerings, such as by e-mail, smartphone messages or print, and then tailor communications based on those preferences.

- Ensure that managers relay to employees the program's importance to the organization.

"Financial wellness is not a product but a culture that the organization adopts" to improve employees' well-being, Whitlow said.

"Employees are struggling to navigate a convoluted financial landscape," said Anna Phalen, vice president of customer insights at Jellyvision, a benefits-communication software firm. "Many people are making bad decisions or no decisions" when it comes to savings, she noted. "By giving employees education, guidance and resources to help them make smart financial decisions for their future, employers will have a competitive edge when it comes to recruiting and retaining talent, reducing employee financial stress and helping aging populations retire comfortably."

Funding New Programs "Paying for financial wellness offerings is often the biggest bottleneck employers face when trying to introduce a new program," said Edukate's Whitlow. "Your current health insurance or wellness program provider may have a budget set aside for third-party wellness initiatives," he noted. Because financial fitness programs seek to reduce employee stress, "they may be a relevant expense under an existing wellness budget." Alternatively, "your organization may have a budget in place for continuing education," Whitlow said. "If you work at a large organization with a chief learning officer, ask about funding financial wellness education as a continuing learning opportunity, targeting departments where the need is greatest or the organization as a whole." |

Related SHRM Articles:

How Improving Financial Health Boosts Productivity, SHRM Online Benefits, December 2017

Take a Team Approach to Financial Wellness, SHRM Online Benefits, October 2017

‘Rainy Day’ Savings Accounts Prevent 401(k) Raids but Face Regulatory Hurdles, SHRM Online Benefits, November 2017 Tips for Launching a Student Loan Repayment Benefit, SHRM Online Benefits, September 2017

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.