Soliciting Employee Feedback for 2022 Benefits Changes

Adjust benefits offerings to match what your employees value

There may still be time to make last-minute changes to benefits offerings before the fall open enrollment season begins, say benefits advisors. Soliciting employee feedback is a key way to reshape benefits packages to meet employees' changing needs, they note.

Momentive, a software firm with over 1,300 employees based in San Mateo, Calif., has been surveying its employees annually about how they use employee benefits, and then using this feedback to adjust its benefits offerings.

"We want to measure the effectiveness of our benefits program and get insight into how to improve the benefits we offer," said Cassius Conliffe, Momentive's vice president of total rewards. "But more broadly, we wanted to take a look at employee happiness," he said.

Along with surveying employees, the firm follows up with focus groups and an ongoing dialogue with its workers.

Using the firm's SurveyMonkey platform, Momentive asks employees to rank, using a five-point scale, benefits for physical and mental health and financial security. The firm also asks for suggestions about benefits it doesn't offer but employees would like.

New offerings that the company is now providing, based on employee surveying, include fertility benefits (see below), mental health services and acupuncture.

Employees are surveyed over the summer months, so that by August the HR team is able to use employee insights for the upcoming year's benefits planning cycle. Employees' perspectives are also used for long-term planning.

Momentive's employee surveys also revealed changing benefits needs as employees shifted to remote work during the COVID-19 pandemic, with more employees expected to continue working remotely on a full-time or partial basis going forward. Changes in benefits related to remote- and hybrid-working arrangements include offering employees a choice between subsidies to help pay for home office setup and maintenance or, alternatively, subsidies for commuting costs for those employees coming into the office.

Health Plan Design Changes

About eight years ago, Momentive—then under the corporate name SurveyMonkey, with about 100 employees—transitioned from a fully insured group health plan to a level-funded health plan (which combines elements of an insured and self-funded plan), according to Dan Maass, a principal at HR advisory firm OneDigital Health and Benefits, which has partnered with Momentive in this project. Then about five years ago, the firm adopted a self-funded plan.

"The move to a level-funded plan provided greater transparency for understanding what claim spending was, and to help employees in high-risk categories to manage their conditions," Maass said.

Moving away from a fully insured plan in stages helped the firm contain its health care spending and avoid large premium spikes, Maass noted.

The move has also helped Momentive to forecast future health care spending, by improving its ability to analyze claims spending in relation to workforce demographics.

Switching from a fully insured health plan allowed Momentive to be more responsive to employees. For instance, employee survey feedback showed that a subset of the workforce expressed a strong desire for infertility services, Conliffe said. "Self-funding allowed us to add infertility services to the medical plan," he explained, as "it's important for Momentive's culture to support employees and their families, including family forming services."

Employers Underestimate Importance of Benefits

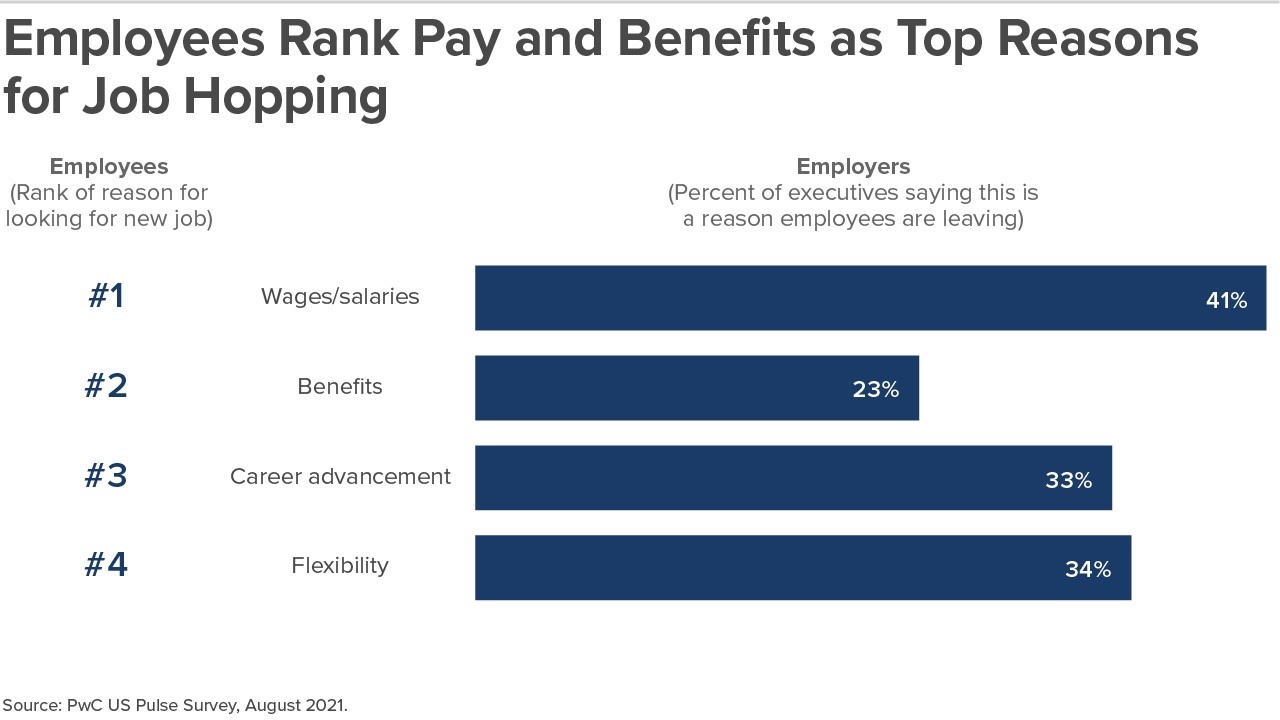

For the most part, executives have a good grasp on why their employees may be looking elsewhere for jobs. But when it comes to offering incentives that employees want most, employers are falling short in two key areas: benefits and compensation, according to new research by consultancy PwC.

Employees and employers both say compensation is the top reason why workers look for a new job, but employers underestimate the value of benefits in retaining employees, according to the PwC US Pulse Survey: Next in Work. The August survey received responses from 651 full-time and part-time employees throughout the U.S. looking for a new job, and from 661 business executives who report higher-than-normal turnover at their companies.

Gauging Employees' Priorities It's important to understand the priorities for your employees and consider those conversations when making any benefits decisions—especially as the cost of offering employee benefits remains a concern for small businesses," said Amy Friedrich, president of U.S. insurance solutions at Principal Financial Group. "The ability for small businesses to have ongoing, open communication with their employees is a distinct advantage over larger employers, where it's much more difficult to understand implications for a larger, more distributed workforce," added Friedrich, who advised the following actions:

"The benefits landscape has shifted throughout the pandemic, and offerings like mental health, paid family leave and caregiving, and financial wellness have risen in importance when it comes to recruiting and retaining top talent," Friedrich said. "Our latest research shows that 60 percent of businesses have seen an increase in questions related to mental health and well-being offerings, with more than half of respondents saying their employees are asking for more of these resources." Often, employees "won't mention specific benefits like disability or life insurance but instead will express concerns like paying the mortgage if they can't work for a while," she noted. When employers hear these cues, it could be a signal to enhance financial wellness benefits. |

No Going Back

"Feedback from our workforce echoes what HR professionals are hearing across the board," said Sherry Olson, vice president of human resources at WEX Inc., a benefits technology solutions provider.

"It is no surprise that pay remains at the top of the importance list," she noted. "We also see greater importance being placed on flexible work schedules, opportunities to continue working remotely, support for career and skill development through tuition reimbursement and self-paced learning programs, and a variety of optional lifestyle spending accounts."

Olson added: "The importance of the benefits we offer in our employees' day-to-day lives has never been higher. Evolving your offerings to meet changing employee needs and work environments is critical. Based on all my recent conversations with fellow HR professionals, I don't see us going back to the old, pre-pandemic model of benefits design and education."

Related SHRM Articles:

Managing Open Enrollment for a Hybrid Workforce, SHRM Online, August 2021

Virtual Communications: Expert Tips for Open Enrollment, SHRM Online, August 2021

[Visit SHRM's resource page on Open Enrollment.]

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.