Employers Feel More Responsible for Employees' Financial Wellness

COVID-19 has heightened employees' financial stress; employers are responding

More employers feel responsible for helping improve employees' financial wellness as workers experience more stress due to the COVID-19 pandemic, new research shows.

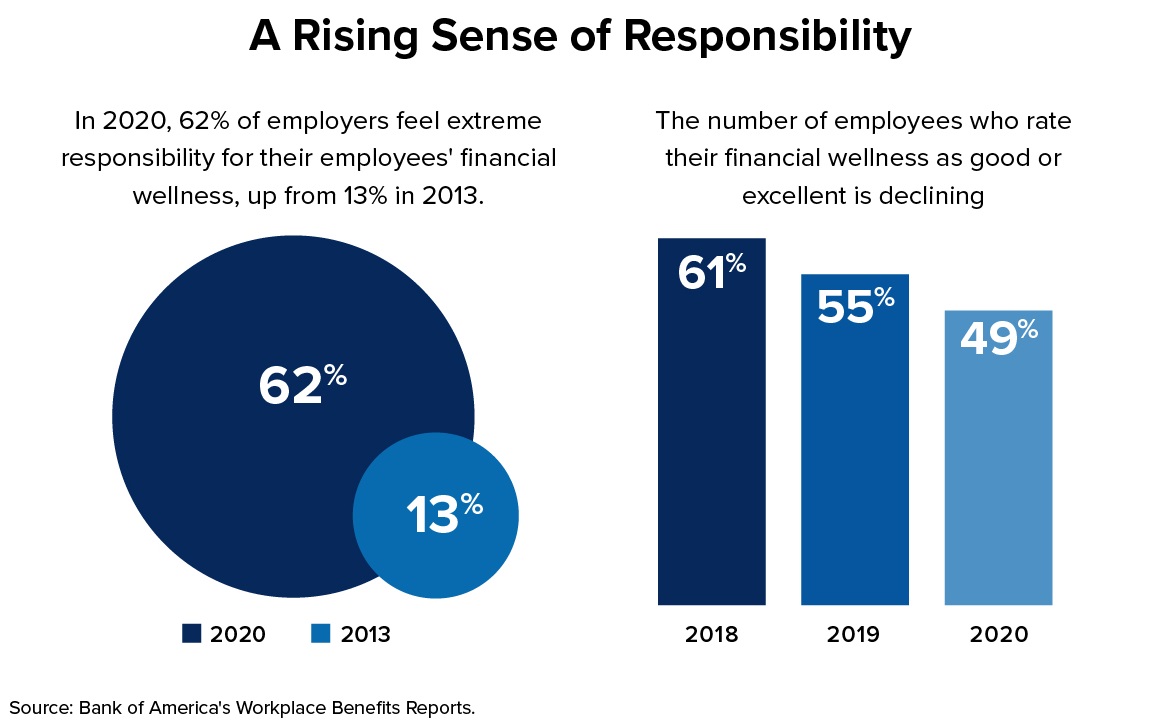

Sixty-two percent of employers feel "extremely" responsible for their employees' financial wellness, up significantly from 13 percent in 2013, Bank of America's 2020 Workplace Benefits Report noted. The findings are based on a March survey of 808 employers that sponsor 401(k) plans, compared with the results of previous annual surveys by Bank of America.

The range of topics being addressed by workplace financial wellness programs also has increased since 2013, the survey found. Employers are now more likely to address broad aspects of employees' financial lives, often by offering advice, counseling or training on:

- Saving for retirement (offered by 81 percent of employers in 2020, up from 70 percent in 2013).

- Planning for health care costs, including the use of health savings accounts (71 percent of employers, up from 38 percent).

- Budgeting (63 percent of employers, up from 14 percent).

- Saving for college costs (55 percent of employers, up from 13 percent).

- Debt management. (54 percent of employers, up from 15 percent).

"Over the last decade, we've seen a significant increase in the range of financial wellness programs, which have become an integral part of employer benefits offerings," said Lorna Sabbia, head of retirement and personal wealth solutions for Bank of America. "While this growth is essential and encouraging, the pandemic has brought the topic of holistic well-being into sharper focus."

As a result of lower wages and other economic uncertainties, she added, "employees are facing greater stress and demands on their time, straining their overall sense of wellness. More needs to be done to ensure employees feel supported at work—financially, physically, emotionally and mentally."

Good business reasons have also driven the expansion of these programs, the report said. More than 8 in 10 employers believe employee financial wellness programs and tools help to create more productive, loyal, satisfied and engaged employees.

Gender Inequities

Bank of America also polled 996 full-time employees who participate in 401(k) plans and found that just 41 percent of women rate their financial wellness as good or excellent, compared with 58 percent of men. Among the differences, women were:

- More likely to feel a lack of control over their debt (67 percent versus 49 percent of men).

- Nearly twice as likely to cite a lack of cash after monthly expenses as a primary challenge to achieving financial goals (47 percent versus 27 percent of men).

"Women have inherently different financial journeys than men, creating a clear need for employers to target financial wellness solutions by both age and gender," said Kevin Crain, head of workplace solutions integration for Bank of America.

A Benefits Shift

Employers are adapting their financial wellness solutions to their employees' evolving needs—and their own new budgeting constraints—according to the nonprofit Employee Benefit Research Institute (EBRI). In June and July, EBRI surveyed 250 benefits decision-makers at U.S. companies with at least 500 employees.

The responses showed how the financial wellness mix has shifted. Since 2018, debt counseling and incentives around savings and financial action increased in popularity among surveyed employers. During the same period, however, firms became less likely to offer tuition reimbursement, discount programs or bank-at-work partnerships, either because of the expense or a perception that these benefits weren't valued by employees.

Some 27 percent of respondents provided emergency fund or employee hardship assistance this year, little changed from 2018. Emergency assistance is most likely to consist of allowing active employees to make withdrawals from retirement funds, facilitating paid-time-off donations or leave-sharing among co-workers, and providing employee relief funds for those facing severe hardships.

The survey also showed that:

- Worker satisfaction, employee retention and stress reduction were the top reasons for offering financial wellness initiatives.

- Costs—both to the employer and employee—were the top challenges in offering financial wellness benefits, followed by concerns about complexity for employees using the programs, data and privacy fears, and a perceived lack of interest among employees.

Assessing Needs

The most common steps taken to understand employees' financial wellness needs, EBRI found, were examining employee retirement plan contributions and withdrawals, surveying employees, and analyzing aggregate health data.

"In total, 88 percent [of employers] have taken at least one step to understand their employees' financial wellness needs," said Craig Copeland, senior research associate at EBRI. "Three-quarters of firms have examined some type of existing employee data, and 56 percent have used qualitative methods," such as conducting interviews or holding focus groups with their employees.

Open Enrollment Opportunities

Employees are approaching open enrollment with a newfound determination to prepare for what's ahead, and their personal finances are top of mind, according to benefits provider MetLife.

Based on a July survey of 1,000 full-time employees in the U.S.:

- 69 percent of respondents said improving their financial health was one of their most important goals this year, with 45 percent feeling insecure about some aspect of their finances—including feeling behind compared to their peers and lacking experience with personal finance.

- 27 percent of workers are more interested in life insurance this year, and 22 percent are more interested in using pretax dollars to pay for care through health savings accounts or flexible spending accounts, and in having access to financial planning and education tools.

"In this tough environment, it's important that employers demonstrate an understanding of employee stress, anxiety and insecurities," said Meredith Ryan-Reid, senior vice president and head of financial wellness and engagement at MetLife. "Workers understand that benefits play a vital role in achieving financial security and will use this year's enrollment to be more deliberate in how they use these offerings moving forward."

Related SHRM Articles:

Emergency Savings Accounts Funded by Payroll Deductions Boost Financial Wellness, SHRM Online, September 2020

How Income-Advance Loans Help Financially Stressed Employees, SHRM Online, February 2020

Helping Employees Save for the Unexpected Pays Off, SHRM Online, August 2019

6 Ways to Measure the Success of Financial Wellness Efforts, SHRM Online, January 2019

Related SHRM Resources:

Open Enrollment Guide & Resources

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.