Framing the ESG Conversation

Here's a structured framework—focused on values—to de-escalate emotion from the discussion within your organization around environmental, social and governance issues.

Over the past few years, companies have taken a more vocal stand on ESG topics—whether a commitment to net zero emissions, social justice, investments in minority-owned businesses, targeted recruiting or quotas for hiring diverse candidates. The inclusion of ESG goals in the design of executive compensation has also been gaining traction among shareholders.

"In fact, ESG is now the topic most often covered during shareholder engagements that include company directors," according to a PwC report.

Yet other shareholders, states and individuals have expressed skepticism about corporate stances and have publicly pressed companies on their actions to address climate change, social issues and other ESG areas. For these stakeholders, stated ESG objectives potentially come at the expense of shareholder return.

Those of us who have responsibility for recommending, or even deciding, the company's position and actions must weigh these opposing views in our planning. Specifically, as we design executive compensation, how—if at all—should ESG be considered and to what degree? (See "How to Incorporate ESG Into Your Compensation Plans" below.)

Some elements of ESG are crucial to company growth and many already have been included in executive compensation short-term plans, although not necessarily highlighted as ESG. A focus on diversity and belonging, leadership and talent development and employee engagement are critical to attracting talent. Governance elements like company policies and standards, disclosure and compliance issues have been required of public companies for years, although not necessarily spelled out in exec compensation designs. These issues are certainly heavily considered when selecting key executives, particularly for the C-suite.

If those goals will indeed be part of the ESG Rubik's cube we most solve, three questions arise:

- How do we help the organization clarify what priorities it is setting and rewarding?

- How do we help ground those priorities to our culture, strategy and values?

- At what weighting of total exec comp can "ESG-type" goals make a difference without taking leaders' eyes off financial performance?

Clarifying ESG Priorities: Start by Avoiding the Labels

For companies that have taken a strong, positive stance on environmental, social and governance issues, their view is often that government is incapable of affecting change without their help. Many stakeholders—including many shareholders—believe that companies should have an obligation to affect sustainability, address poverty, speak out again social injustice, be responsible for their communities and be held accountable for their contributions (or lack thereof).

However, pushback is on the rise. According to the August 2022 McKinsey Quarterly, "ESG is something 'good for the brand' but not foundational to company strategy. It is additive and occasional." McKinsey also notes that plenty of critics refer to ESG efforts as "greenwashing," "purpose washing," or "woke washing." Others say ESG is severely discounting the importance of shareholder return. And another subset argues that corporations can have little impact on climate change and sustainability without a commitment from all countries to do the same, and therefore, we're wasting time that should be focused on driving financial performance.

I would argue that ESG is generating these polarizing reactions because ESG is being referred to as one thing. But if we evaluate what ESG entails, it's more likely that many of the elements can be agreed upon even by those who hold positions at the extreme ends of the current dialogue. It is the simplistic conversation of talking about ESG as a single, blended topic that drives our polarization.

It is my belief that this acronym will shortly disappear and not be replaced by another stand-alone label. Yet the principles behind ESG will certainly survive and will surface individually. Some elements will be more controversial and more difficult for corporate involvement than others. Others will be discussed as an extension of culture and talent, and ultimately tying directly to company advantage and profitability.

Regardless, we as CPOs, HR executives and heads of total rewards do have to evaluate how ESG and its elements will play in our company strategy, our culture and our compensation design.

A Structured Framework for the Debate, Focused on Values

My own views are molded by many elements—my experience as an HR and total rewards executive, conversations with colleagues, my family upbringing, my political views, the media, among others. When considering the right framework for your own organization and stakeholders, it's important to factor this subjective backdrop into your thinking. This can personalize the conversation in ways that other business or financial decisions are less susceptible to.

Perhaps we become defensive of our ESG positions because the media cycle and our current civics climate have trained our brains to immediately challenge opposing positions before truly understanding them in greater detail. Can a good framework help us get to a discussion state where we recognize an underlying truth—perhaps we're not that different?

We need a framework to de-escalate emotion from the conversations and instead focus our questions on whether and how ESG goals should be part of our company strategy, and specifically executive compensation. We will need to make decisions that affect divergent shareholders, public perception, culture, current executives and their compensation—and decisions that also shape our ability to attract and engage new and existing talent.

To attract and keep talent and create an environment where employees continue to be engaged is critical. Employees want a trusting and supportive environment. They want to be recognized and be recognized frequently. And they want to be compensated fairly. All of this means that our conversations about integrating ESG and compensation strategy should start at an unexpected place—neither ESG, nor exec comp. Start with values instead.

Here's a possible framework:

1. Identify Key Values That All Can Agree On

Avoid the broad categories of environmental, social and governance. Get specific instead. Focus on foundational values that most of your key people can agree on. Some examples:

- People of every race, color, sex, religion, socio-economic status should be valued.

- Exceptional leadership promotes strong employee engagement, enabling company growth.

- Understanding shareholder sentiment is essential to continued shareholder investment.

- We can and should make a difference in our community and the world (whether through employee/employer matching donations, community volunteering, etc.).

- Regardless of other country (or company) actions, we each individually (and/or collectively as a company) have a responsibility to do what we can to care for each other and our world.

2. Gauge Shareholder Sentiment

Avoid the generic acronym ESG and evaluate the specifics of their requirements and views.

- For public companies, consider what the top 10 investors are sharing about their current and future requirements for continued investment. If they support ESG metrics, what are they? Are they simply for PR or are they purposeful toward making a positive difference and can they be measured? To what degree is the sentiment of shareholder groups similar or opposing? What is the sentiment of the board of directors?

- For private companies, consider what is known about the views of the founders and owners.

- In either case (public or private), is there a strong sentiment in the communities we operate about our role in areas that might fall under "ESG"? How do those sentiments align or contrast with those of our key shareholders and board?

3. Consider What Your Candidates and Employees Want from Your Company

Remember, they will have differing views on ESG-related matters and the degree to which they want their employer involved. Serving only one voice will cause other voices to feel dismissed, losing their commitment to you and their passion for your company.

Though we're serving a range of views, many are potentially grounded in the same key values that we identified in step 1. Identifying those values can build common ground within the broader talent pool. Understand how you want to engage with the range of views to avoid the perception that one or two groups have an outsized voice while others are being ignored.

4. Identify Your Desired Company Culture

What is the current culture in your organization and what is your aspirational culture? Based on the agreed-upon key values identified above, are there particular areas of focus you need to achieve the aspirational culture?

5. Balance the Financial Picture

How do you balance the need to drive total shareholder return and yet invest both in terms of resources and strategic bets? How will you define what "good" financial performance looks like overall, so that you can measure the impact of ESG stances against that baseline?

6. Set Priorities

How do you identify the most critical actions consistent with your agreed-upon values, shareholder sentiment, the voices of needed talent, the aspirational company culture and key financial performance measures?

Employees want to feel that they belong. No one wants to feel excluded, pushed aside or invisible. There are elements of ESG that are absolutely focused in this space. A sense of belonging may come from taking actions that:

- Create a diverse workforce in an inclusionary way;

- Focus on improving employee engagement through exceptional leadership and recognition/rewards;

- Provide encouragement and a means for employees to give financially or contribute their time to their community.

Starting with what unites us can make for much more productive conversations about how we approach problem-solving from that common base.

How to Incorporate ESG Into Your Compensation Plans

According to Russell Investments, some companies—more heavily S&P 500 than the Russell 3000—have started to include specific ESG goals in the design of either short or long-term incentive plans. In fact, elements of ESG have been included in many short-term incentive plans for years, without referring to the more "soft" nonfinancial goals as specifically a part of ESG. These goals have focused on quality leadership, employee engagement, customer satisfaction, turnover and diversity, to name a few.

Identifying the right metrics, though, can be challenging and potentially difficult to measure. And if success is measured against other companies, the difficulty increases as metrics are not necessarily quantified in a consistent and easy manner. But when metrics are defined and measured, and they focus leaders to support a positive culture and employee experience, then including those measures in short-term incentive compensation is appropriate and needed.

Simply focusing on financial goals (revenue, profitability, EBITDA, as examples) avoids the importance of people. The key is to set the goals well and ensure they align to the company's values agreed upon in step 1 of the framework (see above).

Let's take one complex example: carbon footprints. Before leaping into an approach to carbon emissions, it's worth asking, "Is there any validity for our company to do what it can to make a positive difference within our own ecosystem?" If the answer is "yes," then ask the next question: "What is your company's ability to reduce emissions, reduce waste, drive towards sustainable products, etc. at a reasonable cost?" Remember that investors still want a good financial return, and the company must continue to be profitable to survive and grow. As long as there is alignment around what "good" looks like, the process of creating longer-term executive compensation plans becomes more feasible.

Pay for Performance and Shareholder Support

According to a 2021 "ESG + Incentives" report by exec-comp consulting firm Semler Brossy, "The most common approaches to incorporating ESG metrics in incentive plans are to use them as part of a scorecard of nonfinancial or strategic objectives or as part of an individual performance assessment that is used to adjust incentive plan performance."

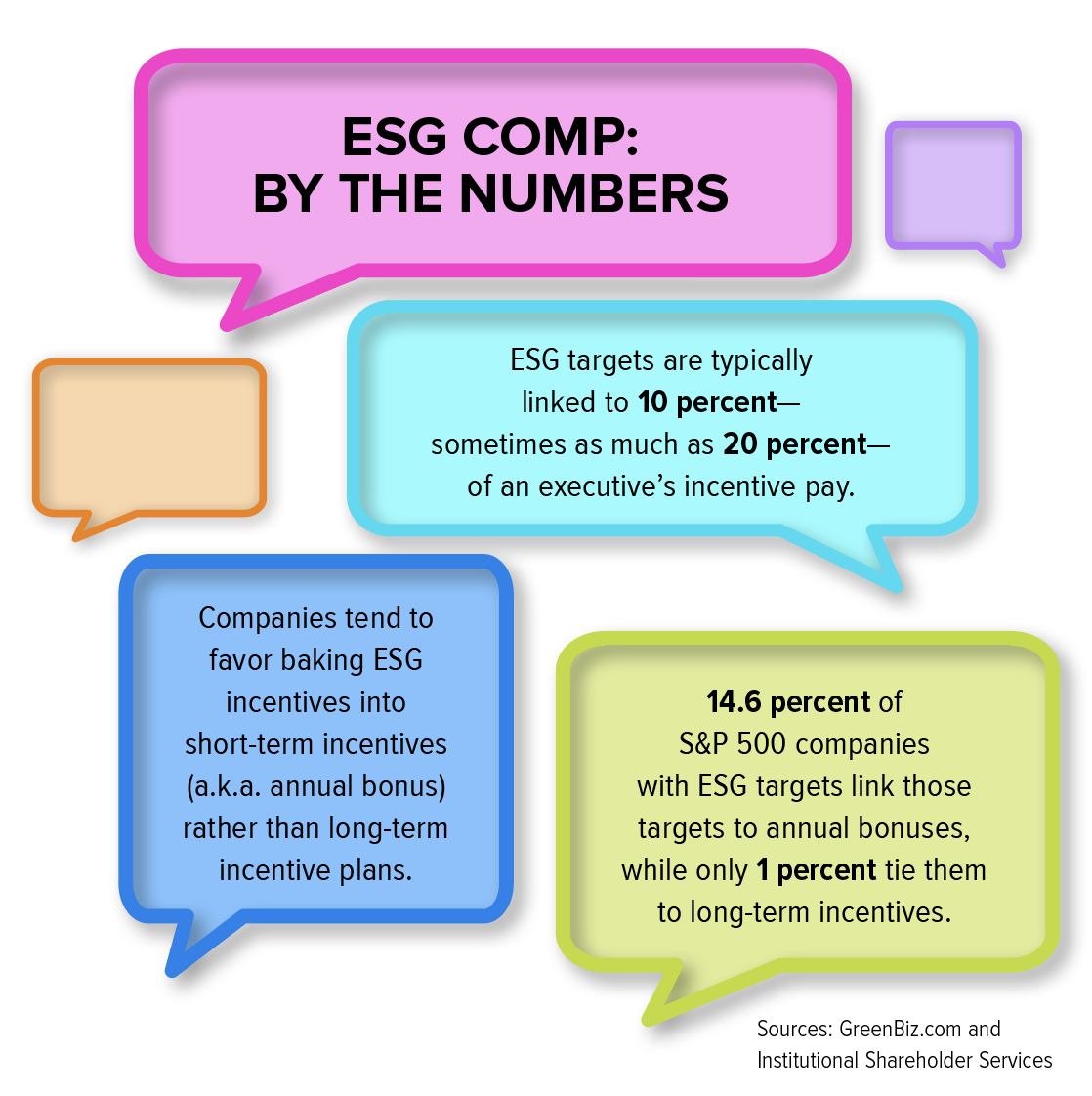

C.J. Clouse, a senior writer for GreenBiz.com, notes that ESG targets are typically linked to 10 percent, sometimes as much as 20 percent, of an executive's incentive pay. And companies tend to favor baking ESG targets into short-term incentive plans (i.e., annual bonuses) rather than long-term incentive plans.

Analysis by ISS shows that 14.6 percent of S&P 500 companies with ESG targets link those targets to annual bonuses, while only 1 percent tie them to long-term incentives. This is something investors and advocates would like to see change, because it often takes time—five years or more—for shareholder value and ESG outcomes to align. This can be especially true when you're talking about climate and other environmental targets.

However, since fixed accounting requires that specific and quantifiable goals for performance shares be set in advance, it is more likely that long-term ESG metrics will focus mostly on operational metrics, such as customer satisfaction—at least for now.

This is the antithesis of what one would expect, as environmental progress takes years of focus and dedication. Perhaps if the environmental goals can be broken down into annual milestones, we could see a shift over time to milestone metrics included in long-term incentive design.

At the end of the day, pay for performance will always be the key metric by which investors will invest. Pay for performance compares executive pay to the company's absolute financial performance. Without success, there will be little shareholder support for companies, regardless of their ESG focus.

It is my view that executive compensation should include some company-appropriate ESG goals that are tied to the agreed-upon values and that will enhance the company's appeal to great talent. Many of these goals will continue to focus on social impact, leadership, employee and customer satisfaction, to name a few. Goals that have few underpinnings to the strategic business priorities will continue to be debated.

Financial performance has, and will continue to be, the measuring stick for continued investment decisions. For this reason, the effect of these goals on one's compensation is not likely to exceed 20 percent of their total compensation. Overweighing ESG can result in a misalignment of executive pay to company performance, something intolerable to shareholders.

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.