Employees Still Perplexed by HSA Plans During Open Enrollment

Misunderstandings keep many from maximizing health savings accounts

[Editor's note: This article has been updated from a previous version.]

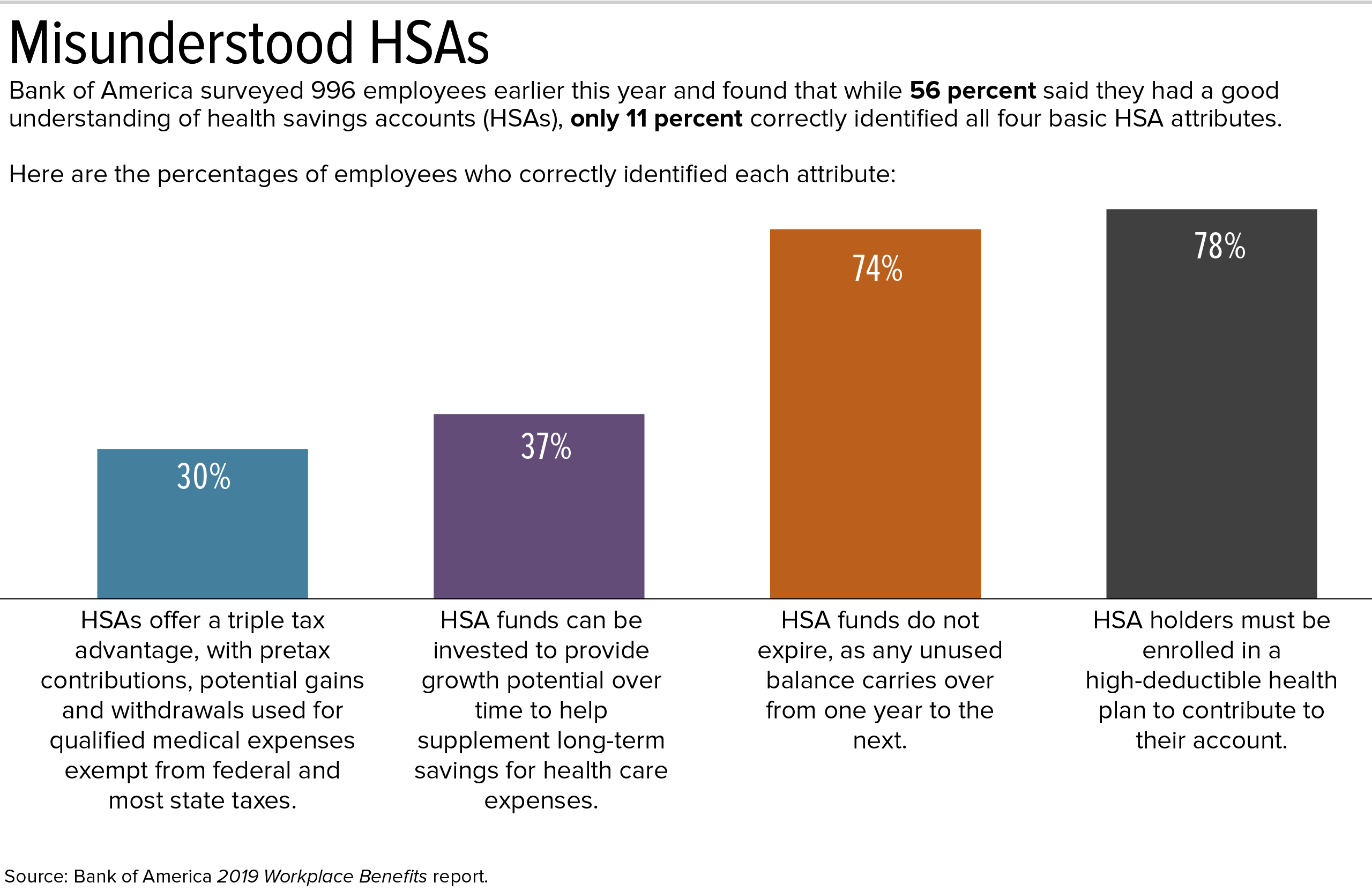

Employees often don't know how to use health savings accounts (HSAs) and the high-deductible health plans (HDHPs) the accounts are coupled with. This leads some to bypass an HSA option during their employer's annual open-enrollment period, while others who enroll in HSA-eligible plans often fail to take full advantage of them.

Approximately 1 in 3 adults enrolled in an HDHP haven't opened an HSA, according to a national survey of 1,637 respondents. Among those with an HSA, most had not contributed money into it in the past year, the study, published on the JAMA Network website in July 2020, showed. "These findings suggest that ... targeted interventions could enhance uptake of and contributions to health savings accounts," the study authors concluded.

Overlooked Advantages

HDHPs have lower monthly premiums than traditional health plans, making them less expensive for employers and a cost-effective option for many employees—who can also open an HSA to help pay the higher deductibles and take advantage of the triple tax-saving opportunities:

- HSA contributions are free of payroll and income taxes when deducted from employees' paychecks.

- Account funds can be invested and grow tax-free.

- No taxes are owed on withdrawn funds if used for qualified medical expenses.

Employees may not realize that payroll-deferred HSAs contributions are not subject to Social Security and Medicare (FICA), and federal unemployment (FUTA) taxes. In other words, when employees contribute to their HSA through a payroll deduction, the money is excluded from federal income taxes and FICA/FUTA taxes. Two states—California and New Jersey—tax HSA contributions at the state level.

During open enrollment for the upcoming plan year, employers should highlight the unique tax advantage given to HSAs in their communications about HSA-eligible health plans, pointing out why this health insurance option now may be more appealing, benefit experts advise.

"With employees choosing their 2021 health care plans in the coming weeks, employers should take the opportunity to emphasize health-related savings vehicles," including HSAs, health reimbursement arrangements (HRAs) and flexible spending accounts (FSAs), said Kim Buckey, vice president of client services at DirectPath, a benefits education, enrollment and health care transparency firm based in Burlington, Mass.

HR managers should also remind employees that "their contributions to—and reimbursements from—these accounts are tax free and, because contributions are made on a before-tax basis, can reduce overall taxable income and even slightly increase take home pay," she said.

Buckey also pointed out that 2021 changes to HSA contribution limits and changes to eligible expenses (medically necessary telehealth visits, over-the-counter meds, as well as menstrual supplies, described below) may have confused employees, "and with no end to the COVID pandemic in sight, employees are more concerned than ever about covering unexpected health expenses."

Most enrollment materials have been finalized and distributed, she noted, "so employers should leverage more immediate communication channels—such as e-mail, social media and websites—to get the word out."

CARES Act Expands HSA-Eligible Purchases As part of the Coronavirus Aid, Response and Economic Security (CARES) Act signed into law in March 2020, account holders can now use HSAs, HRAs or FSAs to pay for over-the-counter medications without a prescription. The coronavirus-related legislation also allows HSAs, HRAs and FSAs to pay for certain menstrual care products, such as tampons and pads, as eligible medical expenses. These are permanent changes and apply retroactively to purchases beginning Jan. 1, 2020. Being able to use an HSA to pay for over-the-counter medications "empowers individuals to better manage their own health care needs and reduces the administrative load on doctors' offices facing a strain on resources," said Alison Moore, vice president of marketing at HealthSavings Administrators, a firm that manages consumer-directed health accounts. In addition, the CARES Act allows HDHPs to cover telemedicine free of cost sharing through year-end 2021. A new safe harbor permits HDHPs to cover telehealth and other remote care services before participants have met their deductible without affecting their eligibility to make HSA contributions. These provisions are temporary and will sunset Dec. 31, 2021, unless Congress extends them or makes them permanent. "Altering the rules to include telehealth during the COVID-19 crisis will help to ease the burden on in-person facilities and help limit the spread of the virus by allowing people to receive care remotely without exposing themselves unnecessarily," said Chatrane Birbal, director of policy engagement at the Society for Human Resource Management. |

Coverage for Chronic Conditions

Effective as of July 2019, IRS regulations allowed HDHPs to pay for more chronic-condition treatments before enrollees met their plan deductible. HR benefit managers should inform employees how this expanded coverage makes HSA-eligible plans a more attractive choice, said Paul Fronstin, director of the health research program at the nonprofit Employee Benefit Research Institute (EBRI) in Washington, D.C., during an EBRI webinar.

Notice 2019-45 added 14 cost-effective items and services to the types of medical care that the plan can pay for, in whole or in part, outside the deductible. These treatments include beta blockers for coronary artery disease, insulin for diabetes and statins for heart disease, as well as devices such as blood pressure monitors for hypertension and glucometers for diabetes.

Allowing HDHPs to pay for these expenses before the employee meets the deductible "will accelerate enrollment in the plans," Fronstin expected. "I think you'll see both more people enrolling in them and more employers offering them because of this."

[SHRM members-only HR Q&A: Are employer contributions to an employee's health savings account (HSA) considered taxable income to the employee?]

Targeted HSA Communications

Employees often confuse HSAs with FSAs, which have annual "use it or lose it" restrictions on unspent funds; however, HSAs have no such restrictions.

"We'll often hear people confidently say that HSAs are 'use it or lose it' in focus groups or when we do interviews," said Jennifer Benz, national practice leader at benefits communications firm Segal Benz in San Francisco.

Creating clear examples of how HSA/HDHPs work in different situations "can help tremendously in overcoming initial hesitations about enrolling in a high-deductible plan," Benz said. "Targeted messages can show how these plans work for people in different situations."

Create tailored communications for situations such as when "someone is currently in family coverage or just covering themselves, whether they are heavy or light users of their health plan, and whether they've participated in well-being programs," Benz suggested. Targeting messaging "makes it feel more personal."

Benz led a team that helped software firm Adobe roll out its HSA/HDHP option a few years ago and encouraged employees to select the new, lower-cost plan. The campaign presented the math in a simple way, so people could see exactly how the new plan compared to traditional coverage, and it included an infographic showing the HSA's tax advantages in a visual format, she said. As a result, she explained, "we were able to move 62 percent of their employees into their HSA-eligible plan in the first year."

Don't overlook text messages and phone-friendly apps, said Eric Record, well-being and benefits leader at Steel Dynamics Inc., a Fortune 500 steel producer in Fort Wayne, Ind. "Up to three-quarters of the enrolled members in our health plans now use mobile devices to get access to information about their HSAs and other benefits."

Another point to clarify: Although HSA participants aren't eligible to also contribute to a full-purpose FSA, they can contribute, up to the annual limit, to a limited-purpose FSA for dental and vision care, which can help them to keep money in their HSA for long-term savings or investing.

Financial preparedness for health issues remains concerning, especially amid a pandemic, according to Alegeus, a consumer directed health care solutions provider. According to data from the firm's platform, two-thirds of HSA account holders wouldn't have enough funds in their account to cover an emergency, and another 18 percent don't have enough to cover an ER visit or a surprise medical bill.

"With a heightened awareness around health care … we have a real opportunity here to help people make better, more informed decisions about their care and coverage," said Alegeus CEO Steven Auerbach.

HSAs for Saving, Not Just Spending

A common misstep made when communicating HSA information to employees is that "we often gloss over the long-term savings potential of the HSA during enrollment," said Benz. "One of the greatest mistakes we made was introducing HSAs as a souped-up version of a flexible spending account instead of as a health care 401(k). We now have to correct that by being very clear about the long-term benefits."

Just over half of 181 surveyed employers position HSAs as an opportunity to increase retirement savings as well as a means to save for current health care expenses, according to the nonprofit Plan Sponsor Council of America's (PSCA's) 2020 HSA benchmarking survey, reinforcing the notion that HSAs can be a powerful retirement savings tool.

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2020 may need approximately $295,000 saved (after tax) to cover health care expenses in retirement.

"While the retiree health care cost estimate has reached an all-time-high at $295,000, this isn't about 'sticker shock.' This is about helping [people to] think through their own health needs and make informed financial decisions about their futures," said Hope Manion, chief health and welfare actuary at Fidelity Workplace Consulting. "Educating employees about these potential costs could help drive smarter choices during annual enrollment about their health plans and a better understanding of the impact opening a health savings account could have on their future financial well-being," she said.

A 2020 report by the Defined Contribution Institutional Investment Association (DCIIA) advised, "Using HSA funds during retirement for certain recurring medical expenses—such as Medicare premiums and long-term care insurance—can help them ensure that their other retirement savings are used for the primary goal of maintaining their standard of living in retirement."

HSA Investing

Once people have sufficient funds in their HSA to meet their deductible, Benz advises urging them to consider investing their remaining HSA funds by "helping people to see the power of long-term investing."

Investing a portion of HSA funds, as most HSA administrators now permit, "could help individuals fund these significant retirement medical expenses from money saved during their working years," the DCIIA report said.

Record suggested clarifying that "once participants invest HSA money, it's not like a 401(k), where they have to jump through a hoop to get those funds out if they need them. Make sure to educate employees that HSA funds can be moved back and forth for investment and spending" within the account.

Communications should make clear that "the invested portion of the funds are subject to short-term losses, as any investment would be within their 401(k) plans," he advised.

Offering the same, or some of the same, investment options in the HSA program as in the 401(k) plan can help ease the education barrier around HSA investing. However, only 4 percent of employers are currently doing so, according to PSCA's survey.

The Step That's Right for Them

"Help people take that next step that's going to be right for them," said Benz, which can mean first saving enough in their HSAs to pay for care up to the deductible. If they need to achieve a higher balance, "work with them through financial-wellness programs," she advised, noting how employees might be able to save in both their 401(k) and HSA. If they're at the point when they're able to invest HSA funds, "show them how to do that," she said.

Fronstin added, "Let's recognize that there are going to be those who cannot afford to contribute to the HSA [and invest for future expenses] because of their income. The advantage of the account for them may be the ability to put money in," deferred automatically from their paycheck and not subject to payroll and income taxes, he said, so that they can "at least benefit from the tax break that they get by using the account to pay for expenses they incur."

Next-Generation HSA Platforms "The best way to make HSAs more effective is to make it as easy as possible for employees to get the answers they need, not only to decide to enroll but to maximize the benefits of HSAs once enrolled," said Tom Torre, CEO of HSA administrator Bend Financial in Boston. "Employers should work to get technology in their corner," he advised. Online platforms make HSAs easier for participants to use by automating enrollment and showing:

HSA platforms also let participants adjust their contributions and manage investments in mutual funds offered through the HSA administrator. "Enrollment periods can always be chaotic, but platforms that incorporate technology such as chatbots can answer employees' routine questions, freeing up HR staff to provide more challenging assistance," Torre said. |

Related SHRM Articles:

IRS Announces 2021 Limits for HSAs and High-Deductible Health Plans, SHRM Online, May 2020

Health Care Consumerism: HSAs and HRAs, SHRM Online, updated May 2020

Address HSA Misconceptions During Open Enrollment, SHRM Online, October 2016

How to Explain High-Deductible Plans, SHRM Online, October 2016

Related SHRM Resource:

Open Enrollment Guide & Resources

[Visit SHRM's resource page on Open Enrollment.]

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.