The percentage of U.S. workers in private-sector self-insured health plans has been increasing. In 2011, 58.5 percent of workers with employer-provided health coverage were in self-insured plans, up from 40.9 percent in 1998, according to a November 2012 report on the prevalence of self-insured plans by the not-for-profit Employee Benefit Research Institute (EBRI).

With a self-insured plan, the employer assumes most of the financial risk related to health insurance, often securing stop-loss coverage from an insurer only to cover unexpectedly large or catastrophic claims; the plan is managed by a third-party administrator, typically an insurance company.

With a fully insured plan, an insurer is paid to assume the risk, as well as manage the plan.

Historically, large employers have been far more likely to self-insure than have been small employers, the EBRI report noted, and there are significant incentives for them to do so: Large multistate employers can provide uniform health benefits across state lines if they self-insure (lowering administrative costs) and are not required to cover state-mandated health care services—as are fully insured plans.

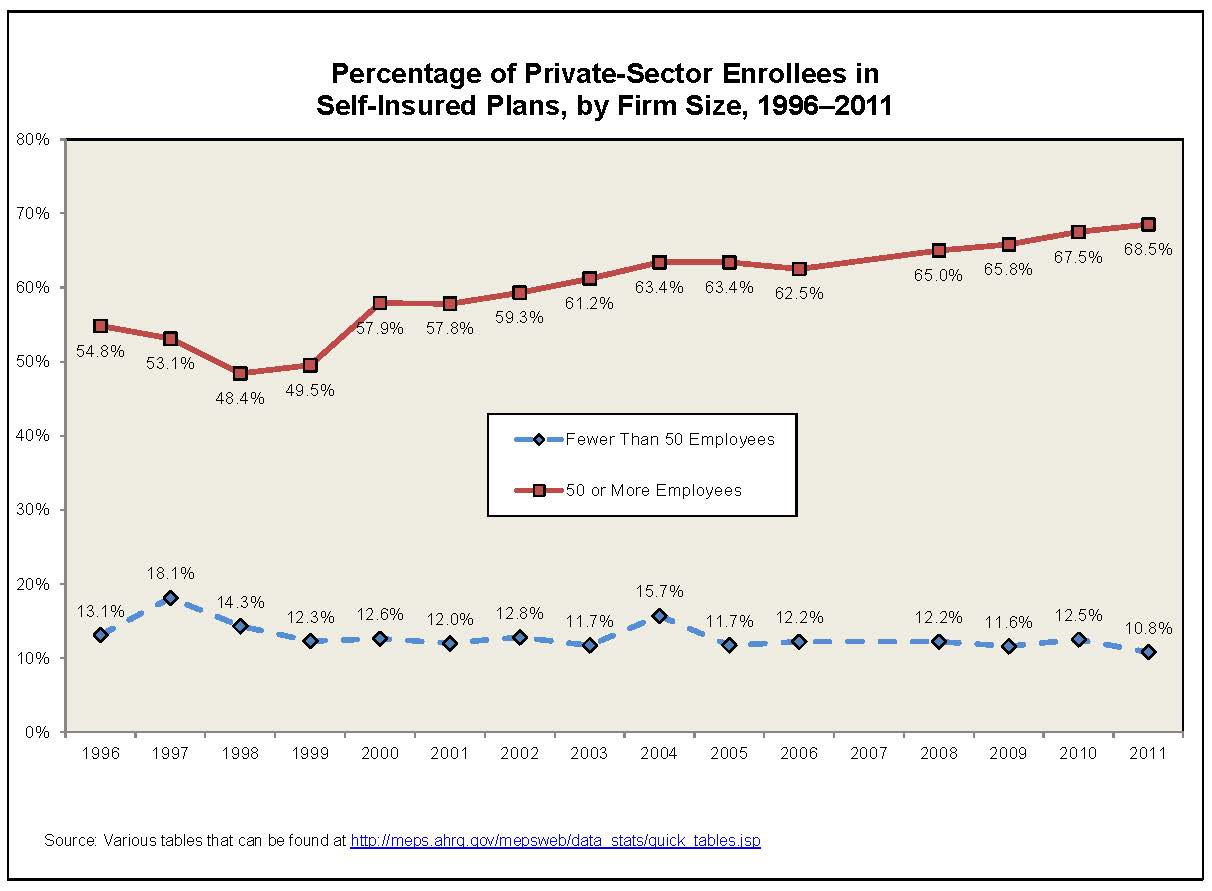

To date, large employers (with 1,000 or more workers) have driven the upward trend in overall self-insurance. The percentage of workers in self-insured plans in firms with fewer than 50 employees has remained close to 12 percent in most years examined.

(click on graph for larger view)

Impact of Health Care Reform

Following the passage and implementation of the Patient Protection and Affordable Care Act (PPACA), there has been speculation that an increasing number of smaller employers would opt for self-insurance. One reason is a widespread presumption among employers that the PPACA’s coverage requirements, and the new taxes the statute imposes, will work to drive up the cost of health coverage. “Employers generally, and small employers particularly, are concerned about the rising cost of providing health coverage and may view self-insurance as a better way to control expected cost increases,” noted Paul Fronstin, director of EBRI’s health research and education program.

Massachusetts as Bellwether

Massachusetts, the only state to have enacted health reform similar to the PPACA, has seen an increase in the percentage of workers in self-insured plans among all firm-size cohorts, except among workers in firms with fewer than 50 employees. Overall, 73.8 percent of workers in Massachusetts were in self-insured plans in 2011, the highest rate in the nation.

Since 2006, when Massachusetts passed its health care reform law, the percentage of workers statewide in self-insured plans has increased as follows:

- In firms with 50-99 employees, from 54.4 percent in 2006 to 67.2 percent in 2011.

- In firms with 100-999 employees, from 16.6 percent to 29.2 percent.

- In firms with 1,000 or more employees, from 74.1 percent to 86.4 percent.

If Massachusetts proves to be a model for the nation, more employers will shift to self-funding as health care reform is implemented.

Stephen Miller, CEBS, is an online editor/manager for SHRM.

Related SHRM Articles:

- Is Self-Insurance for You?, HR Magazine, May 2011

- More Employers Weigh Self-Funded Health Plans, SHRM Online Benefits Discipline, August 2009

- Health Care Self-Funding and Stop-Loss: Small Employers Balancing Risks and Rewards, SHRM Online Benefits Discipline, September 2008

Quick Links:

SHRM Online Benefits page

SHRM Online Health Care Reform Resource Page

• Keep up with the latest news. Sign up for SHRM’s free Compensation & Benefits e-newsletter |

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.