Time to Pass Tax Relief for Student Loan Repayment Benefits, SHRM Says

Legislation needed to ensure tax equality with tuition aid

When employers help employees repay their student loans, this money is treated as taxable income. But when employers reimburse employees as part of a tuition assistance program, those dollars are not taxed under Section 127 of the federal tax code. The unequal tax treatment for pre- and post-employment education expenses has long rankled employers and workers with student debt.

In February, members of Congress reintroduced legislation that would let employers give tax-free student loan assistance up to $5,250 a year per employee. That's the same amount that Section 127 of the tax code now treats as tax-exempt for employer-provided tuition assistance.

The Society for Human Resource Management (SHRM) supports the Employer Participation in Repayment Act (H.R. 1043), which is co-sponsored by a bipartisan group of 142 House members. A companion bill (S. 460) is before the Senate with 27 bipartisan co-sponsors. Sen. Mark Warner, D-Va., has released a one-page summary of the legislation.

"While more employers could offer student loan debt repayment as a benefit, an obstacle is that the payments are considered taxable income for the recipients, and employers can't claim a deduction for these payments," explained Chatrane Birbal, SHRM's director of policy engagement.

There was a substantial uptick in co-sponsors of these bills following SHRM's Employment Law & Legislative Conference Advocacy Day on March 20, when SHRM members visited Capitol Hill and asked lawmakers to support tax equality for student loan benefits.

"Expanding employer education assistance helps address the skills gap, which is holding back both workers and employers," said SHRM President and Chief Executive Officer Johnny C. Taylor, Jr., SHRM-SCP. "When employers are able to help workers pay off student debt, more people will have confidence to pursue higher education and be better prepared to fill high-skilled fields."

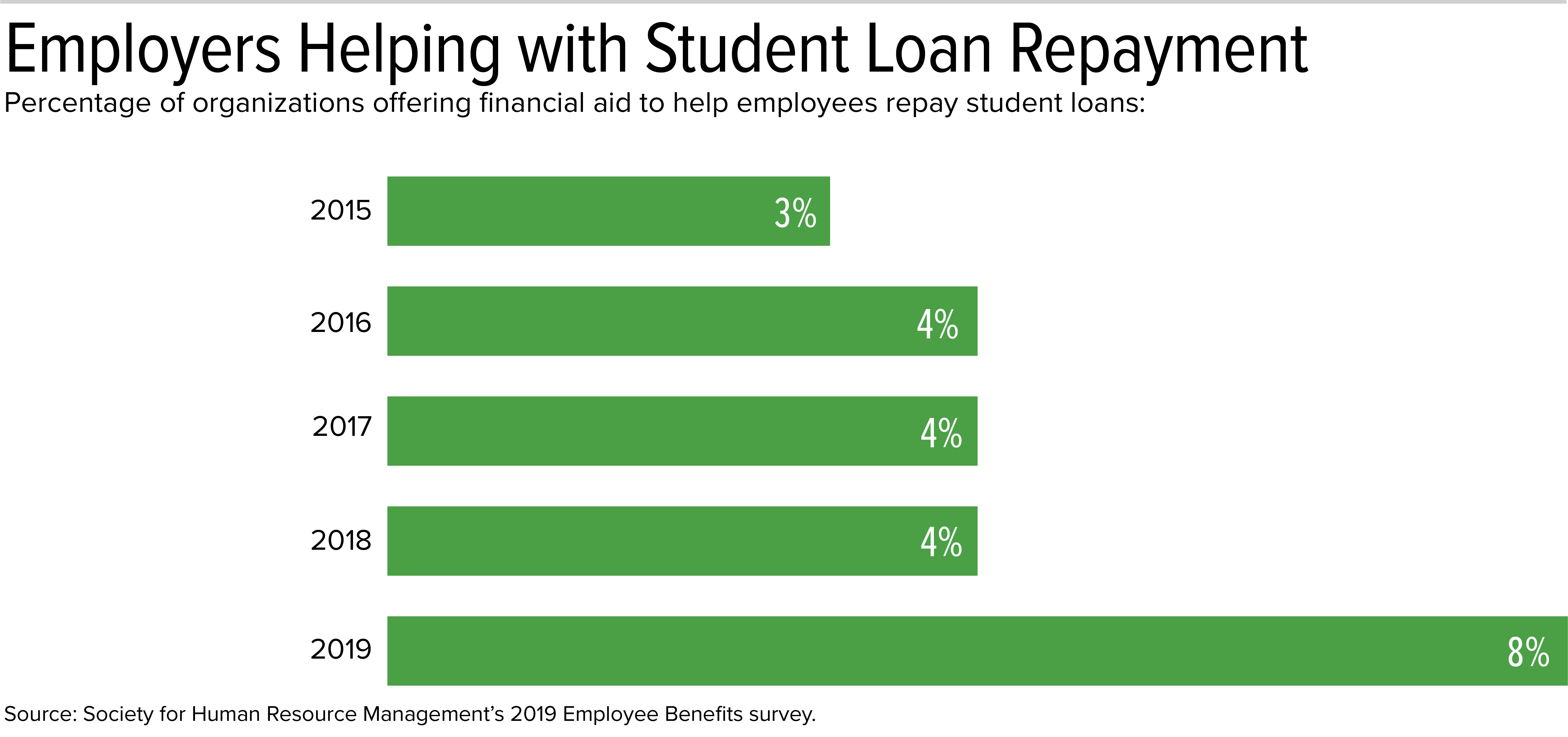

Eight percent of organizations offer taxable contributions to help employees repay student loans, up from 4 percent from 2016 through 2018, according to SHRM's 2019 Employee Benefits survey results, derived from responses from more than 3,500 HR professionals. By comparison, more than half of organizations surveyed (56 percent) provide tax-exempt undergraduate or graduate education assistance. The survey findings will be officially released in June.

The U.S. Chamber of Commerce has put together a webpage with the latest student debt statistics.

Raising Section 127 Limit

SHRM also supports increasing to $11,500 per calendar year the annual dollar limit on tuition and related expenses that employers can reimburse tax-free and indexing this cap to the inflation rate going forward.

"SHRM supports efforts to increase the monetary limits and scope of Section 127 to include student loan repayment," Birbal said. "Providing employers with the flexibility to offer support throughout a variety of stages in the education life cycle gives employees choices when making education-related decisions. Additionally, providing tax-free education assistance is an important tool for furthering higher education, allowing employers to attract the best employees and building an educated workforce to continue to position the U.S. to compete globally."

SHRM chairs the Coalition to Preserve Employer Provided Education Assistance, which brings together a broad cross section of nearly 100 organizations representing employers, labor and higher education. The coalition is committed to expanding Section 127 to include student loan repayment and raising the annual limit on employers' tax-free contributions.

[SHRM members-only toolkit: Designing and Managing Educational Assistance Programs]

Watching State Actions

Absent federal action to harmonize the tax treatment of employer-provided student loan repayment benefits and existing education-assistance benefits, states are pursuing their own proposals to address the issue, Birbal noted. HR benefit managers should understand and inform employees of any tax relief available for loan repayment and tuition costs at the state level.

At least 36 states allow residents to claim a state income-tax deduction or offer a state tax credit for interest paid on student loans. So far in 2019, at least 24 states have introduced bills to create or expand existing state tax deductions or tax credits for student tuition costs or student loan debt repayment, according to the National Conference of State Legislatures.

Related Resources:

Transforming the Workforce in 2019, SHRM Government Affairs, May 2019

Podcast: Student Loan Repayment Programs & Other Education Benefits, with Crystal Frey, SHRM-SCP, May 2019

Related SHRM Articles:

Billionaires Paying Off Student Loans Isn't a Solution to Debt Problem, SHRM Online, May 2019

In a Tight Talent Market, an Employer's Help with Education Expenses Can Turn a Candidate's Head, SHRM Online, May 2019

Fine-Tune Tuition Benefits to Meet Talent Goals, SHRM Online, March 2019

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.