Mastering the Hardware and Software of Sustainable ESG

An effective ESG framework is similar to the components of a computer. A business's financial performance constitutes your company's “hardware& while people-related factors are the “software."

March 2020 will go down in corporate history as a moment when the failure to plan for a global catastrophic event became visible to companies and individuals. A few years from now, we will continue to reflect on the unprecedented heroism of healthcare workers and the impact of the Zoomosphere on every corner of society. We already joke about best practices for keeping kids and barking dogs away from videoconferencing.

More importantly, we are beginning to acknowledge a new era of uncertainty that requires a balance between the competing challenges of innovation and stability, agile growth models and sustainable targets.

Companies are recognizing it is a business imperative to turn what were once seen as contradictions into a new set of trade-offs. At its core, this presents a sustainability challenge for leaders balancing short-term deliverables with long-term strategy.

For many organizations, this has placed sustainability and ESG (environmental, social, governance) discussions in a prominent place on their agendas. From boardrooms to investor days to meetings at Davos, it has become clear we don't fully understand ESG's impact on the short-term goals of enterprises, communities and individuals. This article is about the hidden side of sustainability.

This is still a new muscle for many organizations, considering there is still only a relatively small number of for-profit companies that have positioned ESG as the foundation of their business. For example, Patagonia and BoKlok, a Sweden-based homebuilder, have made sustainability their primary lens as they review their product design, product access and operational footprint. Sustainability is organic to their corporate leadership.

Most companies, in contrast, make ESG part of a long list of other priorities, with marginal and questionable impact on the environment or for advancing social change. Though well-intended, we as board members and leaders tend to fall into old corporate habits—continuing to make capital allocation and budgeting decisions that might lead to environmental and social damage.

For most of the past 50 years, enterprises predominately have operated with low corporate social responsibility budgets, relying on philanthropic giving for arms-length community impact, and outsourcing the handling of environmental, social or governance scandals to PR professionals. It would be naïve to think this long-held muscle memory would disappear in a matter of two years, simply because the term ESG has landed on our agendas.

Similarly, ESG investment funds have not had the impact many had hoped for in terms of influencing change. Often, they invest in technology stocks without adequate understanding of the companies' environmental and social footprint. The risk is that labeling something "sustainable" might disappoint retail investors and pension funds once the shortcomings of such practices become apparent, increasing already burgeoning cynicism in the marketplace.

Operationalizing sustainability can be problematic because it requires foresight on investment risks that may or may not result in long-term positive results for a company's position in a community, market and the environment. Adding to that risk is the reality that scalability of business models and operational execution has never been more difficult, given the complexity of supply chains, geopolitical risks and reporting costs.

Building a drone enterprise for transporting blood samples to a lab in a catastrophe-stricken region might be profitable and beneficial to communities, but can it become a kernel of a future Fortune 1000 company? Using information from mobile devices to extend microcredits in rural India can help people out of poverty and bring decent returns to shareholders, but will it contribute to preventing failures in finance systems?

We face a paradigm change in terms of what constitutes excellence and success in individual businesses and entire economic systems. Companies can be celebrated as excellent only if they master balancing short-term targets with long-term strategies. The ability to calibrate and balance conflicting targets for sustainable business development is fast becoming a necessary skillset for an effective leadership team.

Given the complexity of the challenge, it can be useful to break it down into its key components. In broad brush, an effective ESG framework is similar to the components of a computer—hardware and software. A business's financial performance, with a solid track record in data technologies and clarity over all components of ESG, constitute your company's "hardware," which will provide a solid base for sustainable competitiveness. People-related factors—their sense of business ownership, engagement, and alignment around ESG goals—are the "software."

The 'Hardware' of ESG: Financial Performance

Leaders can't deliver on sustainability targets if their companies fail financially, of course. Stable financial success will not come from maintaining the status quo. It requires a permanent culture of transformation, including:

- Investing in new technologies and business partnerships.

- Identifying common ground for lobbying with competitors to increase political bargaining power.

- Building financial reserves to offset the adverse effects of miscalculations and future "black swan" events.

FIGURE 1

Examples of Questions to Practice Radical Candor in an ESG Context

- Do market analysts have a different view of our business and financial profile than the executive leadership team and board of directors? What are the gaps, and do the competing points of view have merit?

- Did we implement share buy-back programs in the past that hurt our ability to invest now?

- Can we learn lessons from prior capital allocation and investment decisions, particularly decisions that seem misguided in hindsight?

- How can our product design and market entry decisions be improved?

- Did our procurement practices put any suppliers and vendors out of business, or break trust with key partners?

- Can we explain our rationale for any transformation or reorganization in simple terms every employee can understand?

- Did we think through the impacts to our business continuity plans before announcing corporate reorganization?

- Do we run our business functions (e.g., HR) like businesses, with a disciplined approach involving metrics and concrete outcomes?

- Do we have cash reserves to survive a major crisis?

Focus on data and digital technologies

Data now makes up 90 percent of any company's assets, regardless of industry or geography. In 2012, this figure was just 12 percent. Over the past decade, data has become a proven driver of growth and profitability. However, most companies are still in the relatively early stages of experimenting with data technologies. As a result, they are still developing their ability to identify opportunities or implement scalable solutions.

Internalizing and disseminating data and digital technology know-how is a crucial task of every leader. Yet data sophistication is not a part of most organizations' curriculum for developing leaders. Data unleashes growth and improves the bottom line. As cybercrime markets grow quickly as companies engage in data businesses, implementation of good cybersecurity risk management becomes integral to reaping the benefits of the information age and properly managing risks to a company's reputation.

The fusion of data science and advanced computing (including quantum computing) with industrial know-how will help solve the climate crisis while reshaping automation to better address the needs of shifting demographic groups.

Resilient organizations play an active role in identifying—and developing—leaders who invest in increasing the digital literacy of themselves and their teams. Such leaders understand that data can enable better decisions and lead to more efficient problem-solving. At the organizational level, companies that can systemize these ways of thinking and working can start to apply a more advanced systems thinking to the complexities of delivering on short-term performance and ESG goals. That combination enables true sustainability.

This is not to suggest a single focus on technology is sufficient to achieving sustainability. Merely that digital fluency is often missing, at the systems level, from how organizations evaluate and develop leaders who must help the organization navigate an ever-more-complex landscape.

Achieving clarity on ESG

Alignment around ESG targets happens when people understand the practical action and measurability behind each letter in the acronym. This alignment is critical because some environment-related programs might decrease short-term profitability, highlight risks in the supply chain, deprioritize local communities' investments in favor of companywide programs or change how governance between different legal units of a business works.

The following provide actionable, practical definitions of each letter:

E: Sustainable leaders consider the environmental impact when designing products and services, making pricing decisions, selecting providers and changing business models.

S: Businesses need to clarify how they define the communities in which they plan to have an impact. For example, creating partnerships with universities could be a good investment for a pharmaceutical company that depends on recruiting scientists. If your products and services are for seniors, it makes sense to donate money to care centers and explore ways to improve the quality of life for older people. Investment decisions depend on the business mission and organizational alignment.

G: Good governance increases a company's stability. It includes clarifying the processes of cooperation among the company and its ecosystem of stakeholders, as well as risk monitoring. Company boards and internal governance committees must ensure adequate time and diverse expertise are brought to bear to make decisions for internal and external stakeholders.

The 'Software' of ESG: People Factors

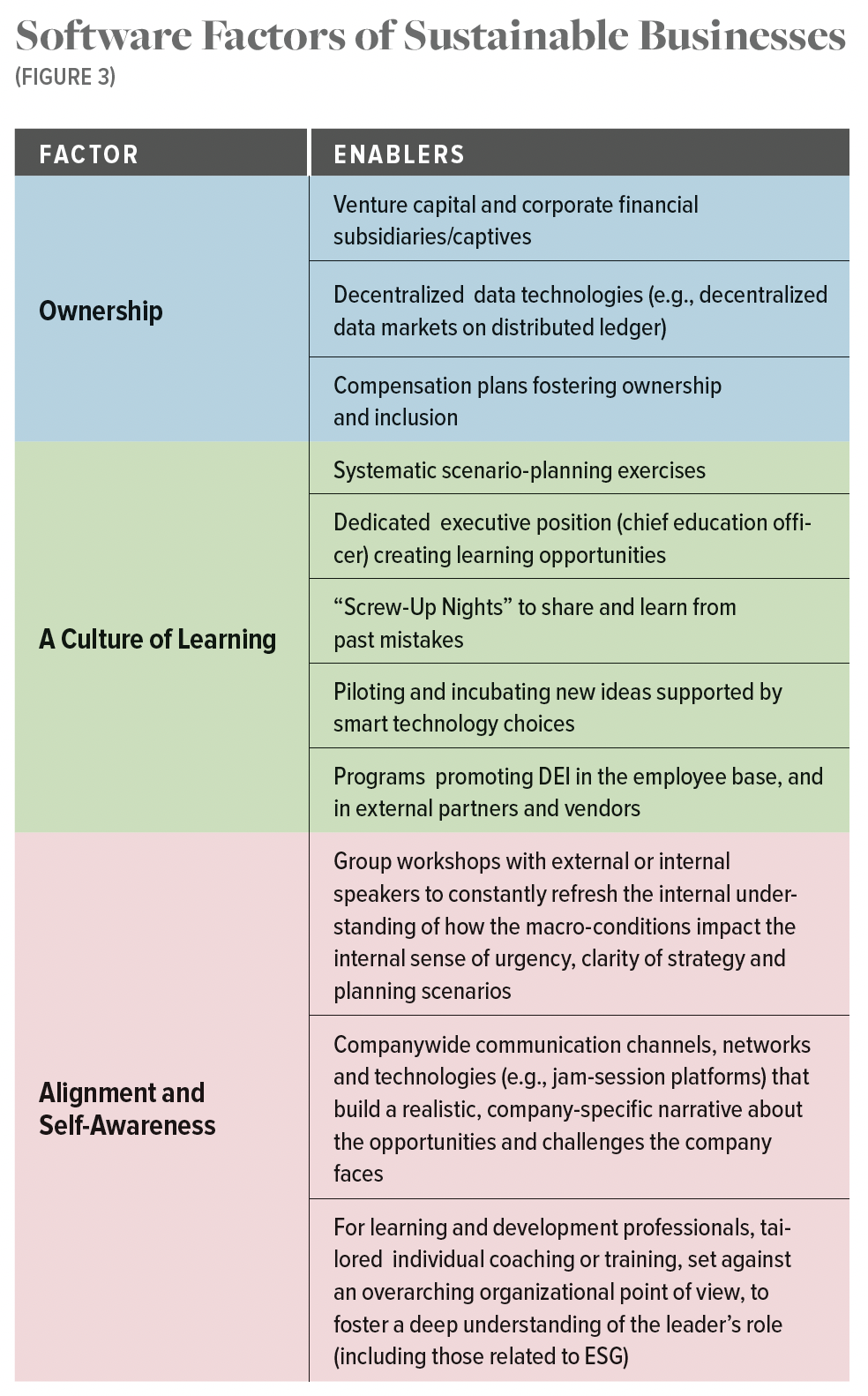

If the prior section can be taken as the organizational "hardware" required for achieving sustainability, then the people inside the organization are its software. Focusing on them requires, as a first step, leaders to own their responsibility as the chief communicators in the organization, so everyone understands the collective narrative behind the shared ESG goals.

We have all seen or been part of organizations undertaking massive changes—from technology platforms to business models—where the underlying logic behind the change was sound or even impeccable, but the actual implementation became a fiasco. Similarly, many of us have seen or witnessed suboptimal solutions implemented to significant positive effect due to how an organization's (or a country's—observe Ukraine's fight against Russian troops) people have rallied behind the cause despite sub-par tools or technology.

A leader must steer people toward being the best version of themselves. People can do their best if they are proud of their work and understand how their contribution serves a bigger purpose. The software (the "how") of any successful business depends on three people-related factors—an ownership mindset, a culture of learning and alignment linked to awareness.

FIGURE 2

Critical Questions to Address Digital and ESG Readiness Through a Sustainability Lens

- What is the data governance framework of the business to facilitate innovation and competitive-scenario building at every level of your organization?

- Does the leadership framework of my organization include ESG? If so, how are we developing leaders to advance our performance and create insights within that framework?

- How does the company define the communities in which it plans to have an impact?

- What do leaders in the organization do to help their communities?

- Does the company have a full understanding of its environmental footprint? How is this measured, and how well understood are they at various levels inside the company?

1. An Ownership Mindset

American entrepreneur Marc Andreessen wrote about how U.S. economic and political system failed to prepare for the pandemic and the subsequent fractures in globalism, supply chain and economic resilience. At some point, "we decided not to build," says Andreessen. He goes on to point out that, as leaders and a society, we chose not to invest in pandemic prevention. We chose not to keep jobs close to home, because we wanted to take advantage of cheap labor in China and the Philippines. Similarly, when Putin took Crimea, we decided to close our eyes.

While these shortfalls are perhaps easier to see in hindsight, Andreessen's points raise an imperative for today's leaders and directors: What aren't we asking

ourselves about how we continue to innovate, take risks and bounce back from mistakes to ensure long-term sustainability?

In 1941, James Burnham, a European politician, spoke of the end of capitalism. He argued it would not be replaced by socialism but rather by the rule of administrators in companies and governments. "Owners"—those who'd built some of the most iconic organizations in the world—had retired. They were being replaced by "Managers."

Interestingly, within 15 years, a host of consultants and thinkers, such as Peter Drucker, ushered in a managerial revolution. Scaling and spreading best practice techniques and management frameworks undoubtedly improved organizations' capabilities and corporate governance.

A downside of conferring such discipline upon managers over the past 70 years, especially within the context of a narrow focus on share price and efficiency, was establishing a cultural expectation that we didn't need employees to act as entrepreneurs. We needed them to "do," to be efficient.

In today's world, that expectation must change. Sustainable leaders in sustainable organizations are now engaging with employees throughout their organizations to feel a sense of ownership, and to engage each other to contribute to better sensing of risk and opportunity within their ecosystems.

Concretizing and increasing ownership in times of democratization of corporate governance and rising demands from retail shareholders and stakeholders are difficult. Organizations are using decentralized data technologies and increasingly agile compensation instruments to make new ownership a reality.

As just one example of building a culture of shared ownership of all the leadership challenges, recently a CEO asked her direct reports to write down everything they wanted to change and accomplish in their business units but were uncertain about the path to execution. That exercise led to 80 questions, which the CEO posted on the company's internal website. She engaged her HR leaders to develop a bonus program to incentivize everyone to answer these questions. She received answers to all questions within eight months and built a new strategy and operating playbook from the information.

2. A Culture of Learning

The development of a culture of learning in organizations requires continuous training. Best-in-class companies implement sophisticated scenario-planning exercises with entire management teams to ensure all arguments are on the table. Inspiration for scenario-building might come from unusual but perhaps uncannily prescient sources.

For example, one leading glass manufacturer established business continuity plans to respond to a power outage after their COO read the disaster thriller Blackout by Marc Elsberg. Published in 2012, the book detailed the catastrophic consequences of a compromised power grid long before Russia's current attack on Ukraine, which has forced European nations and industries to rethink their approach to energy resources.

As another strategy to foster a culture of learning, many companies, especially in the software industry, have created positions of chief education officers. As a best practice, this person ideally has operational experience and understands what it takes to resolve problems in real-world operating environments.

Bringing the company's strategy together with its sustainability plans, the CLE is responsible for driving initiatives to increase skills that will help drive deliberate impact on the things the organization has said will factor most heavily into its long-term performance. This might include digital and financial literacy, communication and conflict management.

Learning is not limited to new developments. It can also apply to reviewing failed initiatives. For example, in Germany and Austria, many founders meet in "Screw-Up Nights" to share and learn from past mistakes.

As an analogue to this model of rapid learning, technology companies use dedicated software and hardware environments, as well as tools and procedures, to build minimum viable products, pilot them and kill or productize the results depending on the outcomes. Legacy businesses must develop the ability to do the same.

FIGURE 4

Examples of Questions to Facilitate Self-Awareness

- How does what I do reflect on who I am?

- How will I know when my job is done?

- When did I last acknowledge to my stakeholders that I made a mistake?

- What do I believe about vulnerability and how might that serve me?

- What am I not saying that needs to be said?

- How do I listen more effectively?

- What is being said to me that I am not hearing?

- How do I handle disagreements?

- What did I do to contribute to complacency?

3. Alignment and Self-Awareness

Ravi Chaudhry, a former CEO and chairman of Tata Industries, said organizations have to become like streams, built on continuous change and fluidity. A successful CEO of such a business excels in creating a fully aligned leadership team. Alignment doesn't mean forced consensus or everyone starting from the same belief set. It means people engage and listen to each other. "What they know is never an impediment to what they don't know," as Chaudhry said.

Companywide communication channels and platforms become increasingly necessary in a world where individual employees may, outside of work, be part of very siloed communities and networks, especially on social media. The employees might bring utterly conflicting views of reality into the workplace every day. The organization's job is to create a shared narrative and common perspective on the "real" factors a business seeks to solve, including clarity on the success factors and measurements.

Leadership style is a byproduct of our self-awareness. How well do we face uncomfortable truths about our past? Why do we resolve conflicts? Do we communicate differently with people depending on their status? Radical self-inquiry is essential to leading well. (Find questions to facilitate self-awareness in Figure 4.)

It is natural to think at a very high altitude about big questions surrounding ESG and leadership. Our economies are unsettled and changing. Opposing outcomes—good and bad—both seem highly possible. Current approaches to ESG are still characterized by a focus on reporting instead of long-term thinking and engaging in potentially polarizing debates.

Working on the software—the people side—of the equation and encouraging bottom-up initiatives, ownership, thoughtfulness, agility and perpetual education could empower businesses to overcome long-term threats and risks. The quality of leadership will decide our advances or our collective failure.

Anastassia Lauterbach is a seasoned global senior executive and the managing director, EMEA, of The ExCo Group. A global strategist and ICT industry thought leader, she brings a deep understanding of the high-tech ecosystem. Lauterbach is also an experienced board member who has been involved with CEO succession and legacy turnaround.

- Ariel Evans, Enterprise Cybersecurity in Digital Business: Building a Cyber Resilient Organization (Routledge, 2022)

- Marc Andreessen, It’s Time to Build, Andreessen Horowitz, a16z podcast, episode 544

- ExCo Insights articles page (articles to be published)

- Adam Bryant, Organizations Are Now Like Streams, Always in a State of Flow and Change (March 30, 2022), LinkedIn

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.