6 Simple Ways to Improve Open Enrollment

These tips will improve the way HR conducts open enrollment for employee benefits.

Introduction

It’s that time of year again. There’s a crispness in the air combined with an energy that is simultaneously exciting and scary. As the shadows cast longer and the kids head back to school, HR professionals face their own early-fall ritual: open enrollment.

If you’re like many of your colleagues, you confront this annual exercise with a mixture of enthusiasm and dread. It’s a busy time that is undeniably stressful and exhausting. Yet it also gives HR an opportunity to make vital contributions to the business and to help people navigate decisions that will significantly impact them and their families.

“The success or failure of open enrollment can make the employer more or less competitive” in the labor market, says Robert Miller, SHRM-CP, HR manager for Chapman/Leonard Studio Equipment Inc., a manufacturer of custom camera equipment in North Hollywood, Calif. That’s why smart HR leaders are continually looking for new and different ways to engage workers during this period. To that end, here are some tried-and-true tips to make the most of this crucial time.

1. Get Employees Ready

The annual benefits-election process starts well before any forms are filled out. “You need to disseminate information to make sure employees understand what’s available,” Miller says. “They shouldn’t be asking basic questions about their coverage options in open enrollment meetings; that should happen before open enrollment occurs.”

Provide materials ahead of time so individuals can review their options and formulate questions before open enrollment begins. Delivery of these materials can occur through all available channels, including any online portals maintained by the employer or by insurance carriers, brokers, consultants and other vendors.

Also, “Look to new options like Text2Engage [mobile messaging] and social media to provide reminders and support,” suggests Peter Marcia, CEO of YouDecide, a Duluth, Ga.-based company that manages employer group voluntary benefits and work/life programs.

Marcia says employees want to know four things for each program:

- Why do I need the coverage?

- Which features fit my needs?

- What value does the program provide?

- How much is this going to cost me per paycheck?

Gamification and other cutting-edge educational innovations hold promise but aren’t always widely available and dependable, so focus on maximizing what current technology can provide and addressing areas where it is falling short. “Find ways to simplify enrollment,” Marcia advises. He suggests that companies use tech options that:

- Auto-fill fields.

- Allow users to easily move from one application to another.

- Provide a single landing page for all enrollment applications.

While the latest technology often gets a lot of attention, don’t overlook more inexpensive—and effective—methods to prepare and engage employees. Easy ways to get their attention include by putting notices in paycheck envelopes and making videos available via YouTube or Facebook or on screens in offices and cafeterias.

Alternatively, try creating a one-page information sheet that defines key terms and publicizes contact names and numbers, important websites, and a list of all the information needed to complete required forms. That’s the approach favored by Nicole Ojakian, SHRM-CP, director of human resources for financial services firm Hanweck in New York City.

Alternatively, try creating a one-page information sheet that defines key terms and publicizes contact names and numbers, important websites, and a list of all the information needed to complete required forms. That’s the approach favored by Nicole Ojakian, SHRM-CP, director of human resources for financial services firm Hanweck in New York City.

Cortland Partners has a slightly different focus when it comes to educating employees about open enrollment benefits. Trina White, SHRM-CP, vice president of talent resources at the Atlanta real estate business, has one goal: to help employees use their benefits effectively. The company can take this tack because it now offers its 1,500 workers only high-deductible health plans (HDHPs) with a health savings account (HSA) to control costs and encourage more consumer-oriented health care spending. This makes the benefits selection process much less complex.

It also means the bigger challenge for Cortland is helping people leverage the wellness program, health care pricing data and supporting activities, such as completing personal health profiles that can earn them bonuses for their HSAs. White estimates that 40 percent to 50 percent of workers have completed profiles, but she and her team are working to raise that to 80 percent to 90 percent.

Education efforts started early in the year, well before open enrollment. The business provided short videos in English and Spanish, a dedicated space on the company’s intranet, and reminders to reinforce previous messages about the importance of using urgent care centers rather than the emergency room and how to use health care pricing data to shop for, say, a cost-effective MRI provider.

2. Keep the Focus on People

While technology is changing how employees learn about and choose benefits, remember that open enrollment remains a people-oriented process. With that in mind, Cincinnati-based Paycor, an online payroll and HR services provider with multiple offices nationwide, is enlisting the help of key “influencers” in its 1,400-member workforce—that is, certain individuals who hold a lot of sway over their peers. These workers may not be the best performers in the company, but they tend to be the most connected, based on interdepartmental network data. “These are people other employees go to for advice, with work-related questions, and for friendly or pick-me-up conversations,” says Bekki O’Brien, benefits analyst with Paycor.

To improve engagement in offices with low benefits utilization, O’Brien is attempting to identify the influencers and tap them to find out why workers are not more engaged. “We would then target communication to that office with the influencer in mind,” she says. She also plans to follow up to find out how these key individuals feel about the process and to determine what other employees are saying about it.

To improve engagement in offices with low benefits utilization, O’Brien is attempting to identify the influencers and tap them to find out why workers are not more engaged. “We would then target communication to that office with the influencer in mind,” she says. She also plans to follow up to find out how these key individuals feel about the process and to determine what other employees are saying about it.

3. Identify Your Workers' Needs

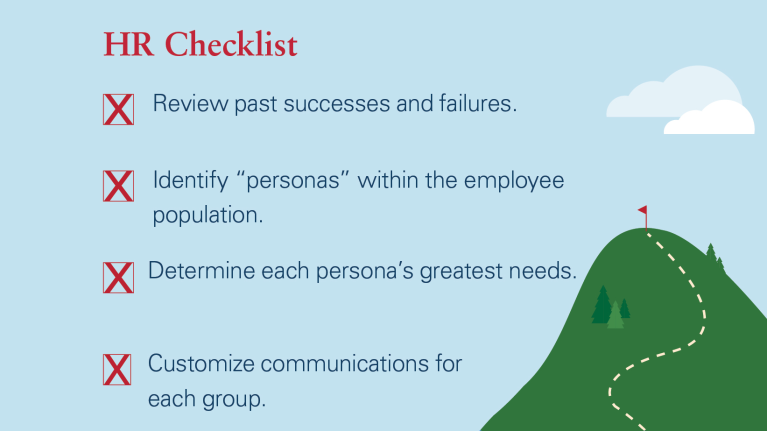

Review the results of previous years’ open enrollment efforts to make sure the process and the perks remain relevant and useful to workers. How effective were various approaches and communication channels, and did people give any feedback about the process itself? Marcia suggests these additional questions: Where are our employees finding information? What were their top 10 questions? And what’s new for 2018?

For employers to innovate and improve the process, they need to understand their employees. Every workforce is unique, and what makes your group special will largely determine how best to manage the process. For example, law enforcement agencies can use the daily roll call to communicate important details about benefits options, Miller notes.

And when faced with an employee population made up primarily of European expatriates, Florida-based HR executive Christine Taylor, SHRM-SCP, had to provide some basic information about how benefits work before she could move on to more-specific communications.

[SHRM members-only resource: Guide to Open Enrollment]

This type of customization requires research. “Employers can slice and dice their data to develop personas that represent different subsets of their population and then craft specific messages to each persona,” says Randy Carter, national communications practice leader with The Segal Co. in New York City. “As plan designs become more complex and require participants to shop around and take a more active role in maximizing the benefits available to them, employers can rely more heavily on infographics and online modeling tools to help people make smart choices.”

Tailoring open enrollment materials to these employee segments is crucial. “If you have a large percentage of single, early-career-stage Millennials, don’t build all your sample calculations around a family,” says Adam Calli, SHRM-SCP, a principal with HR consulting company Arc Human Capital in Woodbridge, Va. He recommends customizing information sessions and webinars to specific groups. They do not necessarily have to be defined by age or gender; categorizing by benefits status makes the most sense. For example, you might offer information sessions for people buying single coverage or spousal or family coverage. “In this way, each hears what matters most to them,” he says.

Tailoring open enrollment materials to these employee segments is crucial. “If you have a large percentage of single, early-career-stage Millennials, don’t build all your sample calculations around a family,” says Adam Calli, SHRM-SCP, a principal with HR consulting company Arc Human Capital in Woodbridge, Va. He recommends customizing information sessions and webinars to specific groups. They do not necessarily have to be defined by age or gender; categorizing by benefits status makes the most sense. For example, you might offer information sessions for people buying single coverage or spousal or family coverage. “In this way, each hears what matters most to them,” he says.

4. Include an Element of Surprise

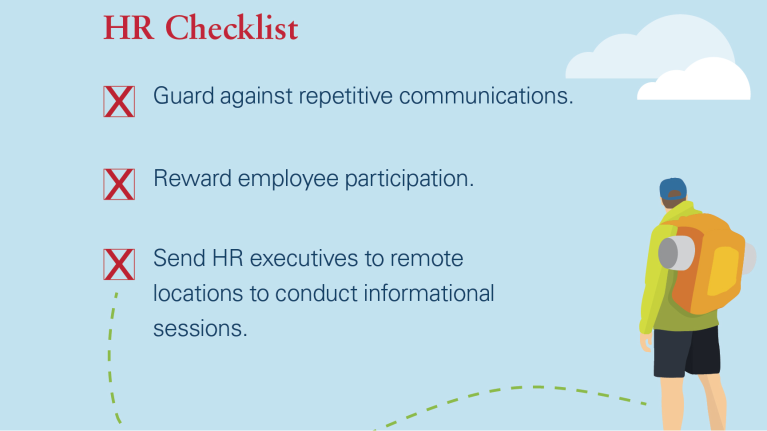

Don’t overwhelm the workforce with repetitive communications. “Be careful of engagement for engagement’s sake,” says Sarahjane Sacchetti, senior vice president of marketing at Collective Health, a health benefits provider based in San Francisco. For each effort you consider, ask yourself, “Does it convert to meaningful action and help people understand their benefits and how they work?” She suggests that companies do the unexpected to regain workers’ attention. Offer detailed information about certain perks that are particularly important to employees, such as family leave and fertility-related coverage, for example.

In an effort to increase participation in its HDHP option, Chicago-based Muscular Dystrophy Association uses testimonials (without names) from individuals who have chosen high-deductible plans in the past. They talk about their experiences and how they use the plans. “These testimonials focus on how employees manage their deductibles and HSAs, emphasizing the pretax nature of both deposits and withdrawals and the importance of having a lower payroll deduction for these plans,” says Eileen Timmins, the organization’s chief people officer. “This has been a big plus because the information is coming from someone outside of HR.”

As a government contractor with workers scattered in military bases and other locations that don’t allow for face-to-face meetings, Newport News, Va.-based Spectrum Comm Inc., a logistics, engineering and cybertechnology business, must make remote communications work. “We focus on communicating early and often, starting in September for open enrollment in mid-November, even if insurance premium rates are not yet available,” says LoriAnn Penman, SHRM-SCP, director of human resources.

Of course, nothing gets people’s attention like free stuff. To encourage employees to sign up for benefits as soon as possible, Penman introduced a raffle last year and held drawings every day during open enrollment, with workers entered only after they had completed their paperwork. If they finished their paperwork the first day, their names were in the raffle for two weeks during the enrollment period, she says. The prizes became better as time went on, with the last drawings for $100 gift cards.

Generating reports on who has enrolled and then following up with anyone who has not yet done so can also help spur people to sign up on time.

A personal touch is also important, so some HR executives and their staffs make sure they show up at remote worksites. “Roadshows are very important,” says White, of Cortland Partners, which has more than 100 locations. “We need to be onsite to answer questions about how to maximize the available plans and the tools and resources the company provides.” To supplement existing HR staff, the business also trains local workers to fulfill some of these duties.

A personal touch is also important, so some HR executives and their staffs make sure they show up at remote worksites. “Roadshows are very important,” says White, of Cortland Partners, which has more than 100 locations. “We need to be onsite to answer questions about how to maximize the available plans and the tools and resources the company provides.” To supplement existing HR staff, the business also trains local workers to fulfill some of these duties.

By expanding open enrollment to seven weeks last year, up from two weeks in previous years, Veterans United Home Loans in Columbia, Mo., made 300 slots available to employees for individual 20-minute sessions to discuss their unique benefits questions and concerns with HR. The company, which has a workforce of 2,400 in 20 states, had introduced HDHP insurance options with an HSA, and some leaders were concerned that people might avoid choosing those plans simply because they did not understand them. Although Meggie Hess, manager of benefits and HR information systems, was uncertain how many workers would sign up for the sessions, every slot was filled.

“A group meeting to explain benefits is a tempting option, but it does not encourage conversation because employees are less likely to ask questions about their specific needs,” she says.

5. Leverage All Available Resources

Budget constraints are a reality for every company. To maximize available resources during open enrollment, savvy HR and benefits executives look for partners inside and outside the organization. Penman, for example, works with her firm’s marketing department to develop customized internal employee communications. “In my experience, it is not unusual for HR to partner with marketing. They offer a unique perspective that is very helpful,” she says. For example, the group has contributed graphics and copy to make e-mails more compelling and has created a “storefront” on the firm’s intranet that explains each element of the benefits package and provides links for more information.

Brokers, insurance carriers and other vendors can also be important partners, especially for smaller organizations that may not have a lot of internal staff to help with the process. Ojakian relies on her firm’s broker to be available when employees want to discuss sensitive topics and questions with someone outside the company. “That provides an extra level of confidentiality,” she says.

Brokers, insurance carriers and other vendors can also be important partners, especially for smaller organizations that may not have a lot of internal staff to help with the process. Ojakian relies on her firm’s broker to be available when employees want to discuss sensitive topics and questions with someone outside the company. “That provides an extra level of confidentiality,” she says.

Penman also holds a virtual benefits fair where individuals can go online to get more information about specific benefits programs. She sends gift bags to all workers made up of the merchandise they would have received at an in-person fair. “It’s a good way to connect with employees” who are all working in remote locations, she says.

6. Get Spouses Involved

Benefits enrollment is a family affair, so getting spouses involved is critical. “Help employees talk to their spouses at home,” for example, by providing a list of issues and topics to discuss with family members, Miller says.

Spouses can also be included in informational sessions. These meetings can be held after work hours and on weekends when they are more likely to be able to attend. “It is important for spouses to hear the presentation directly and ask their own questions,” Calli says. “If you have the space and the personnel, employers can allow kids to attend with a room and an attendant where they can color, watch movies and so on.”

If in-person meetings are not possible, offer evening or weekend webinars so that spouses can be more involved. This is the approach Hanweck took for its 30-person workforce. “We offer meetings that include spouses and they are free to come in to speak with me directly or call me with questions,” Ojakian says.

If in-person meetings are not possible, offer evening or weekend webinars so that spouses can be more involved. This is the approach Hanweck took for its 30-person workforce. “We offer meetings that include spouses and they are free to come in to speak with me directly or call me with questions,” Ojakian says.

However, you may need to provide additional support for some spouses, including expanded foreign language options in communications and enrollment forms. After all, workers may be fluent in English, but that does not mean family members are.

Benefits enrollment strategies are always evolving. What worked last year may not be relevant this year. But you can’t go wrong by putting employees’ needs first.

Joanne Sammer is a New Jersey-based business and financial writer.

Illustration by Anca Popa for HR Magazine.

Was this article useful? SHRM offers thousands of tools, templates and other exclusive member benefits, including compliance updates, sample policies, HR expert advice, education discounts, a growing online member community and much more. Join/Renew Now and let SHRM help you work smarter.