IRS Raises PCORI Fee, Due July 31 for Self-Insured Health Plans

Dollar amount per covered person raised to $2.54, up from $2.45

The IRS issued Notice 2020-44 on June 8 to adjust the fee paid by insurers or self-insured health plan sponsors to fund the federal Patient-Centered Outcomes Research Institute (PCORI) trust fund. The fee must be paid to the IRS by July 31.

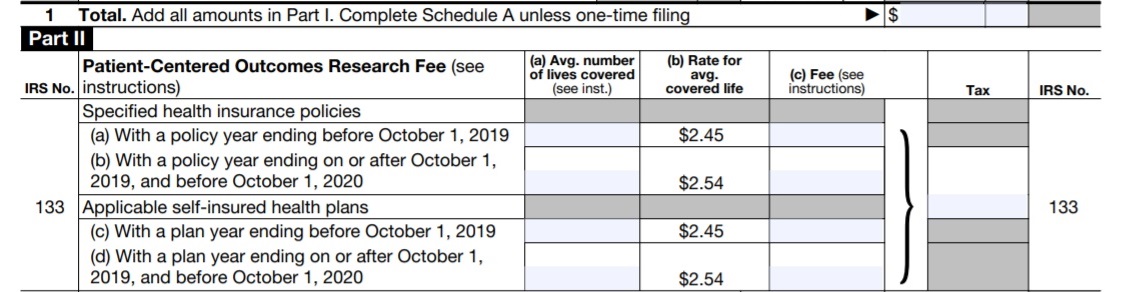

The new amount used to calculate the PCORI fee for plan years that end on or after Oct. 1, 2019, and before Oct. 1, 2020, is $2.54 per person covered by the plan. The fee for plan years ending prior to Oct. 1, 2019, was $2.45 per person.

The fee is paid annually by self-insured employers. For fully insured employers, the fee is paid by the insurance provider, although the cost may be factored into premium increases.

The IRS provides self-insured employers with transition relief for calculating the average number of plan enrollees, which the IRS refers to as covered lives—employees, spouses and dependents covered by the health plan.

Fee Extended for 10 Years

For plans with terms ending after Sept. 30, 2012, and before Oct. 1, 2019, the Affordable Care Act mandated the payment of an annual PCORI fee to provide initial funding for the Washington, D.C.-based institute, which conducts research on the comparative effectiveness of medical treatments. As part of the Bipartisan Budget Act of 2019, the PCORI annual filing and fees were reinstated for an additional 10 years, through 2029.

"That means that all employers (or their insurers in fully insured group health plans) must file the annual IRS Form 720 by July 31, regardless of their plan year," wrote Gary Kushner, president and CEO of Kushner & Company, an HR strategy and employee benefits consulting firm in Portage, Mich.

Plan Dates Affect Payment

Payment due on any given July 31 covers the plan year that ended in the preceding calendar year, so the fee payable by July 31, 2020, is for plan years ending in 2019.

The amount of the fee varies, however, depending on when the plan year ended:

- The fee is $2.54 per covered life for plan years ending between Oct. 1, 2019, and Sept. 30, 2020. This includes calendar-year plans that ended Dec. 31, 2019.

- The fee remains at $2.45 per covered life for non-calendar-plans whose plan year ended between Jan. 1 and Sept. 30, 2019.

The increase is based on the projected rise in national health spending this year. The U.S. Department of Health and Human Services published the projections in February.

Form 720 Now Updated

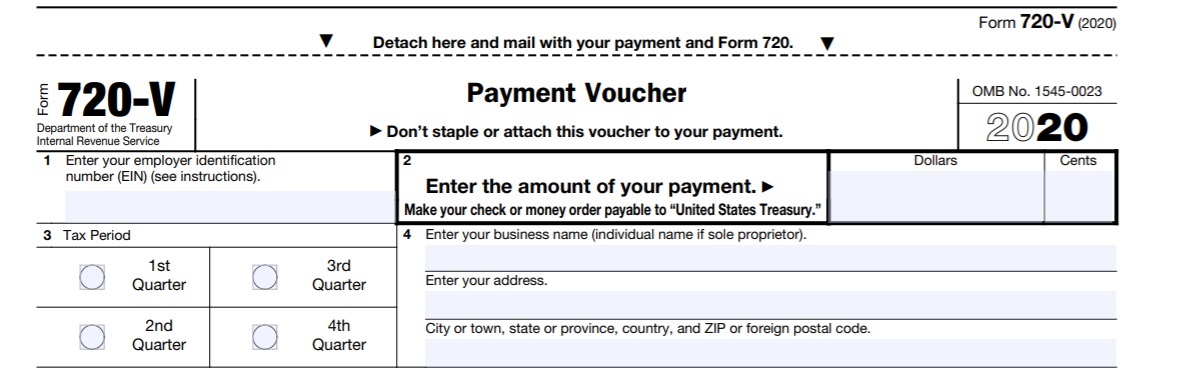

The IRS views the PCORI fee as an excise tax to be paid once a year by July 31. Payment is sent to the IRS with Form 720.

Until it was posted online June 12, the Form 720 available on the IRS website did not have this year's plan year dates under Part II—Patient-Centered Outcomes Research Fee. The form is now up to date, however, for this year's filing. Although the top of the form indicates it was revised April 2020, the IRS apparently delayed posting the form until after Notice 2020-44 was issued.

The Instructions for IRS Form 720 have also been updated and correctly state that the fee payable by July 31 is for plan years ending before Oct. 1, 2020.

Payers should remember to check "2nd Quarter" on the Form 720-V voucher so their payment is processed properly.

Transition Relief

Because the PCORI fee was set to expire for plan years ending after Sept. 30, 2019, sponsors of self-insured health plans may not have anticipated the need to subsequently identify the number of covered lives in their plans. In Notice 2020-44, the IRS acknowledged this problem.

"In addition to the fee update, the IRS also provided some welcome transition relief for those that may have been caught unaware of the PCORI fee's survival," noted John Kirk, an attorney at law firm Graydon in Cincinnati.

IRS regulations generally allow four methods to calculate the average number of covered lives when determining the PCORI fee: the actual count, the snapshot, the member months and the state form. The IRS describes these methods on its website.

While, as in years past, insurers and self-insured plan sponsors may use one of these four methods to calculate the fee, the IRS is temporarily permitting the use of any "reasonable method" to calculate the fee due. The transition relief applies to plan years ending on or after Oct. 1, 2019, and before Oct. 1, 2020.

"If a reasonable method is used to calculate the average number of covered lives, then that reasonable method must be applied consistently for the duration of the year," Kirk pointed out.

[SHRM members-only toolkit: Communicating with Employees About Health Care Benefits Under the Affordable Care Act]

FSAs and HRAs

"Generally, health care flexible spending accounts (FSAs) are not required to file a Form 720 unless the employer (and not just the employee) makes contributions to it that exceed the lesser of $500 annually or a dollar-for-dollar match of the employee's contribution," Kushner wrote on his company website. "In that event, those FSAs must also be included in filing the Form 720."

For health reimbursement arrangements (HRAs), employers should "first look at the integrated group health plan. If that plan is fully insured, then the employer must file the 720 and pay the $2.54 fee [for each employee with an employer-funded HRA] for plan years that end on or after Oct. 1, 2019, but before Oct. 1, 2020," Kushner wrote. In this case, the fee is paid per employee, not per covered life, so spouses and children covered by the health plan are not included in the fee calculation.

"If, however, the underlying group health plan is self-funded, then no separate 720 need be filed for the integrated HRA, but rather, one filing and fee for the self-funded group health plan is due" based on covered lives, not just employees, Kushner noted.

The PCORI fee does not apply to health savings account (HSA) participants, as HSAs are individual accounts, not group health plans.

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.