Inflation's Return Will Affect Compensation

Resurgent inflation means employers are revisitng pay budgets and planning

[This article is the first in a three-part series. Part two focuses on inflation and health care. Part three discusses inflation and retirement savings.]

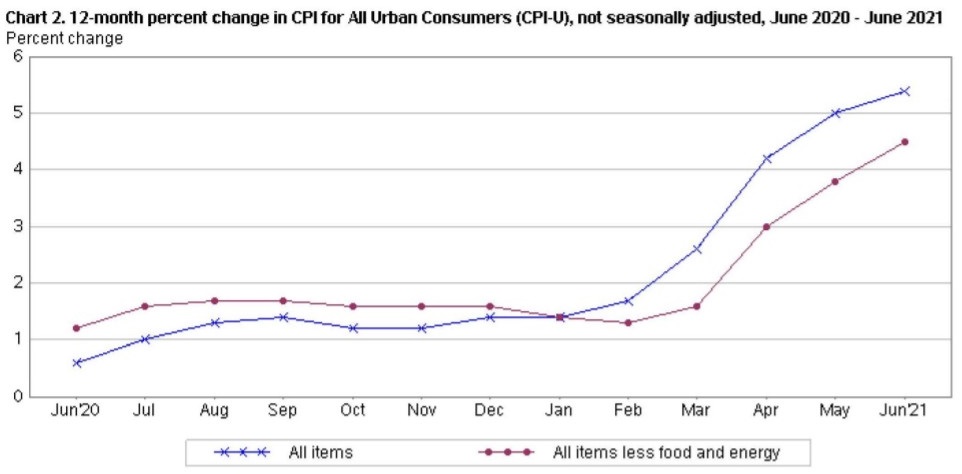

The Consumer Price Index for All Urban Consumers (CPI-U) rose 5.4 percent year-over-year in June 2021, the largest 12-month increase since August 2008, the U.S. Bureau of Labor Statistics reported on July 13. The CPI-U increased 0.9 percent in June after rising 0.6 percent in May. Source: U.S. Bureau of Labor Statistics, July 2021. In comparison, average hourly earnings rose 3.6 percent year over year in June, above the trend before the pandemic, CNBC reported. |

A recent spike in prices is expected to drive salaries and hourly wages higher next year. If rising inflation is sustained, employers will need to alter their anticipated budgets for benefits and compensation costs going forward.

A tighter labor market and disruptions within supply chains as economies and societies reopen at different rates have brought "inflationary pressures on prices and perhaps on wages," said Catherine Hartmann, North America rewards practice leader at Willis Towers Watson.

"We are not yet certain if this will be a more temporary or longer-term phenomenon," she added.

While some economists expect the recent surge in prices to moderate, others warn that inflation may still be significantly higher this year and next—and over the coming years—unleashed by heavy government spending.

The Federal Reserve System "has had almost no success gently bringing down inflation once an economy starts to overheat," Larry Summers, who served as Treasury Secretary under Bill Clinton and director of the National Economic Council under President Barack Obama, told Time after President Joe Biden released his $6 trillion proposed budget. "I have expressed the concern for some months now that we are overheating the economy," Summers said. "And unfortunately, the inflation data has come in way above consensus forecasts."

Evidence of Rising Prices—and Wages

According to the Federal Reserve Bank of New York, the average lowest wage that U.S. job seekers would be willing to accept for a new job was $71,403 in March 2021, up from $61,737 in March 2020 (at the start of pandemic lockdowns) and $62,365 in March 2019. The findings are from the New York Fed's ongoing Survey of Consumer Expectations (SCE) labor market survey, with approximately 1,000 respondents.

Along with labor shortages, rising inflation is helping to drive compensation higher. For instance:

- The consumer price index (CPI) in May rose 5 percent from 12 months earlier, which is the largest yearly gain since August 2008, the Labor Department reported on June 10. In comparison, the CPI rose 1.6 percent year over year for 2020.

- From April to May, the CPI grew 0.6 percent, representing the second-largest month-over-month advance in over a decade.

On June 18, the Federal Reserve Bank of St. Louis President James Bullard said the economy is seeing more inflation than he and his colleagues expected, which could lead to an interest rate increase late next year, Bloomberg reported.

While the CPI measures a fixed basket of goods, the Federal Reserve's preferred price measure, the personal consumption expenditures (PCE) index, takes into account consumption changes that people make as prices rise—such as substituting chicken for beef. As a result, the CPI tends to report higher inflation.

Core PCE prices in the U.S., which exclude volatile food and energy costs, increased 3.1 percent year over year in April, the highest rate since the 1990s.

Bullard foresees 3 percent core PCE inflation for 2021, moderating to 2.5 percent in 2022, Bloomberg reports. Even so, "If that's what you think is going to happen, then by the time you get to the end of 2022, you'd already have two years of 2.5 to 3 percent inflation," he said, up from 1.4 percent core PCE inflation in 2020.

Hedge fund manager Dan Niles warns of "a persistent, not 'transitory,' increase in inflation" ahead, given that once inflation takes hold, it is difficult to curtail. "The last time the Fed used the word 'transitory' was in 2004 … but then they had to raise [interest] rates 17 times over two years because inflation proved to be anything but transitory," he told Fox Business News.

Another indication of inflation's resurgence: Packaged food giant General Mills recently announced it is raising prices across nearly all its grocery products and expects its overall costs, including labor, to increase about 7 percent over the next year or so, The Wall Street Journal reported.

[Want to learn more about benefits and compensation? Join us at the SHRM Annual Conference & Expo 2021, taking place Sept. 9-12 in Las Vegas and virtually.]

Pay Raise Expectations

How large a pay raise might employees be expecting, just to keep pace with rising prices?

Trading Economics, an online platform that provides historical data and economic forecasts, projects long-term U.S. wage and salary growth to trend around 3.6 percent in 2022 and 4 percent in 2023, according to its econometric models.

An economic forecast sees compensation trending up 3.6% in 2022 and 4% in 2023.

Another signal: While the Social Security cost-of-living adjustment (COLA) for retirees was 1.3 percent for 2021, Kiplinger reports it's likely to tick up to 4.5 percent next year, the largest increase since 2008.

[Update: Based on the June CPI data, the Senior Citizen League projects Social Security benefits could increase 6.1 percent in 2022, nearly five times the 1.3 percent cost of living increase in January 2021. "If current inflationary trends continue through September, the result could be the largest annual cost-of-living increase in Social Security benefits since 1983," reported InvestmentNews.]

That's an indication of what employees also might be looking to receive—especially if they saw no raise in 2020 due to the pandemic's disruption of business revenues.

Rising Labor Costs Worry CFOs U.S.-based chief financial officers see inflation as the biggest external risk factor that their businesses face, surpassing COVID-19, cybersecurity and consumer demand, according to the CNBC Global CFO Council survey for the second quarter, conducted June 1-16 among 41 U.S. council members from large public and private companies. Over the next six months, the largest group of U.S. CFOs (57 percent) expect cost of labor to increase more than other business expenses, with cost of raw materials cited by 38 percent of CFOs. Cost of labor forecasts in the U.S. far exceed the cost expectations in other regions of the world, CNBC reported. |

Compensation Considerations

Still, unanswered questions could effect employers' strategic planning around compensation, Hartmann noted, such as:

- Does the inflation we are now seeing have the potential to slow down by the fall, as supply and demand issues are resolved, or will inflation continue through the end of the year?

- Will the cost of labor increase because supply issues will continue for talent at particular levels and professions regardless of inflation?

At the moment, she added, "we are seeing these factors impact the compensation for lower-level hourly workers. The recent publicly announced increases in starting hourly rates being provided within the food service industry, manufacturing environments and banking are leading to these workers receiving higher base salaries."

Employers that cannot afford to immediately increase starting pay levels may need to phase in hourly wage raises, "with $1 to $2 increases every three to six months as a retention tool," she advised.

For professional and management-level roles that are in high demand, "we are seeing an increase in retention bonuses and sign-on bonuses to either keep or lure away workers," she said.

The increase in employee bargaining power, Hartmann noted, "could be long-lasting. However, whether the current spike in inflation has the opportunity to impact salaries further remains to be seen."

Rich Luss, a senior economist at Willis Towers Watson, observed that "in the long run, employees are paid approximately what they are contributing to the organization. If demand for labor remains high and supply growth is sluggish, we would expect organizations to feel the pressure to increase compensation to attract the employees they need—or to increase automation."

Rising prices also will require employers to revisit their total rewards strategy, as "there is still the question of how compensation is paid," Luss explained. "The answer companies come to will depend on the rate of inflation in health care costs versus other prices, versus productivity growth."

Those factors, he added, will affect how much of rising total compensation "is reflected in increases in salaries or hourly rates, and how much shows up in increased employee benefits."

[The second part of this series is Inflation, Other Factors, Drive Up Health Care Costs; the final part is Inflation Could Bite into Retirement Savings.]

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.