Employers Adjust Pay and Incentives Amid Economic Turmoil

Metrics for incentive pay plans get a makeover

New research reveals the coronavirus is prompting employers to upend their compensation plans for 2020 and beyond.

During the first week of April, the Society for Human Resource Management (SHRM) polled more than 2,200 HR professionals from SHRM's membership about their pay programs. The findings, highlighted in How the Pandemic Is Challenging and Changing Employers, show that:

- 38 percent of employers have decreased employee work hours.

- 31 percent have laid off workers.

- 19 percent have decreased pay rates, and another 21 percent are considering that measure.

- 15 percent have permanently cut headcount with no intent to rehire.

Food and accommodation services have experienced the most significant setbacks during the pandemic, the poll showed: 76 percent of businesses in these sectors are laying off employees (versus an all-industries average of 31 percent), and 56 percent have decreased pay (versus 19 percent overall).

"Business is not as usual," said SHRM President and Chief Executive Officer Johnny C. Taylor, Jr., SHRM-SCP. "It's going to take business and HR leaders on the front lines of workplaces to be strong, innovative and agile as we all fearlessly face this hardship together."

Similar findings were reflected in a survey by global consultancy Aon, which was conducted April 7-10 and drew 1,469 responses from North American employers and 1,889 responses from organizations around the world. The survey followed an initial study conducted March 17‑20.

Between Aon's March and April surveys, a span of three weeks:

- The percentage of North American companies delaying or canceling salary increases for employees grew to 32 percent from 14 percent.

- This trend mirrors Europe, where the percentage of companies making the same pay adjustments grew to 35 percent from 17 percent over the same period.

- North American companies asking employees to voluntarily take reduced salaries to avoid layoffs reached 7 percent, while 10 percent of firms made involuntary pay reductions. Executive officers were most likely to be affected by these actions, but roughly 40 percent of firms cut pay across their full workforce.

"We know companies have a strong desire to help their people as much as possible, yet many firms also face very difficult economic conditions," said Alex Cwirko-Godycki, chief strategy officer for the rewards practice at Aon.

Compensation for Higher-Risk Roles

Companies are continuing to offer additional pay to support employees working in front-line or essential roles, said Kelly Voss, a partner in the rewards practice at Aon. "While these actions have commonly been referred to as 'hazard pay,' companies are reluctant to use this term given the level of protections in place, instead opting to call programs enhanced pay, pay premiums or special pay to recognize their contributions," she noted.

In North America, 18 percent of firms now put additional compensation programs in place, with another 15 percent of firms considering doing so.

Reviewing Incentive Pay Plans

More companies say COVID-19, the respiratory disease caused by the coronavirus, will upend their incentive pay plans, according to a late-March survey by consultancy Willis Towers Watson. Eighty-five percent of compensation leaders at 775 mostly large U.S. employers said the pandemic would reduce payouts from their company's short-term incentive plan, such as annual bonus programs. Most respondents also expected the coronavirus to negatively impact their performance-based long-term incentive plan (69 percent of those operating one) and sales incentive plan (63 percent of those with an applicable plan).

In light of the economic crisis, many employers are adjusting these programs, with design changes more likely to be made for short-term incentive plans (43 percent) than performance-based long-term incentive plans (15 percent) or sales incentive plans (20 percent).

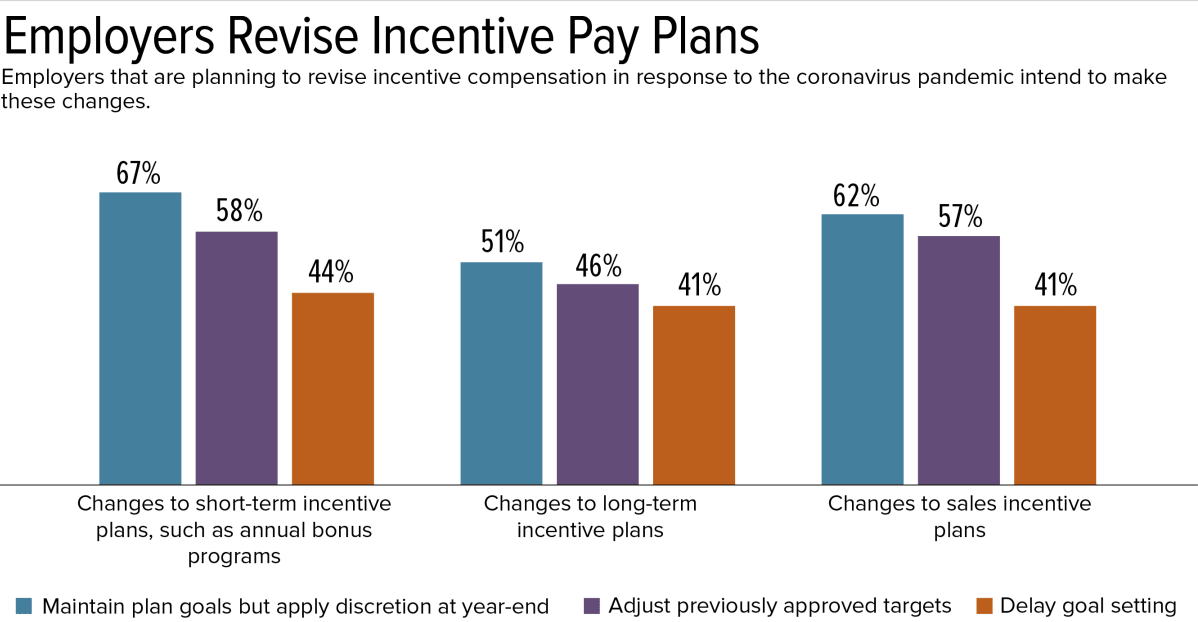

Of organizations reporting an intent to make plan changes, most are maintaining existing goals but expect to apply discretion at the end of the performance period, have adjusted or will adjust previously approved target goals, or have delayed or will delay goal setting until a later date.

Source: Willis Towers Watson.

Changes to plan metrics, such as lowering threshold performance levels, is influenced in part by the timing of an organization's financial year-end and the point at which plans, goals and awards for the year are due to be approved, the survey showed.

For sales incentive plans, discretionary or sales-goal adjustments are the most prevalent changes.

"With the economic challenges evolving, organizations must also grapple with how to effectively manage risks to the business," wrote Heather Marshall, senior director of executive compensation, and Derek Mordente, director of executive compensation, at Willis Towers Watson. "Against this backdrop, it remains as important as ever to effectively and fairly motivate and reward employees."

Sales compensation was also the focus of an April poll by WorldatWork, an association of total rewards professionals, in partnership with consultancy SalesGlobe. This poll, which received 372 responses from WorldatWork members and SalesGlobe clients, showed that companies are most often looking at adjusting sales compensation quotas (46 percent), performance measures (44 percent) and other plan thresholds (36 percent).

"It makes sense that sales compensation is a major focus right now, as businesses have been hit hard in recent months," said Scott Cawood, president and CEO of WorldatWork. "The impact has been sudden and extreme, and in every industry sector the scales have been tipped."

[SHRM members-only toolkit: Designing and Managing Incentive Compensation Programs]

Executive Pay Advice and a Warning

A late-March Pearl Myer survey of board directors at 86 companies was focused on executive pay. Twenty-five percent of respondents said they will freeze executive salaries, but more than 70 percent have not finalized plans on this issue.

"Like the COVID-19 pandemic itself, executive pay decision-making remains very fluid," noted Brett Herand, a principal in Pearl Myer's Chicago office.

Consultants at advisory firm Korn Ferry advised, "Just as CEOs and other senior leaders must carefully weigh their decisions and approaches to implement pay cuts for the broad employee population, compensation committees must do the same with executive pay."

When reviewing executive pay, the firm recommended that compensation committees carefully consider the following:

- How the company will likely need to evolve to compete on a radically different business landscape.

- The implications for the kinds of leaders it will need moving forward.

- The elements of the new rewards philosophy that align with the roles the company needs its executives to play.

Shareholder advisory firm Glass Lewis recently warned public companies against executive pay changes that are inconsistent with the challenges workers are facing. The firm said it is most likely to support changes that "take a proportional approach to the impacts on shareholders and employees."

Moreover, "trying to make executives whole at even further expense to shareholders and other employees is a certainty for proposals to be rejected and boards to get thrown out—and an open invitation for activists and lawsuits onto a company's back for years to come."

Related SHRM Articles:

Pay Cuts Become More Common in Pandemic Downturn, SHRM Online, May 2020

Use Caution When Cutting Exempt Employees' Salary, SHRM Online, April 2020

Pandemic Forces Employers to Cut Pay, SHRM Online, April 2020

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.