Consider 401(k) True-Up Payments for Employer Matching Contributions

Employees won't miss out on the full match but employers should budget for added cost

As open-enrollment season approaches and the year winds down, employers are reviewing their benefits, introducing new offerings, or making changes to existing plans and programs. Adding a "true-up" payment provision helps ensure that retirement plan participants don't miss out on the full extent of their employer's matching contributions if they meet the annual IRS employee contribution limit before their final paycheck of the year. But employers should be sure to balance the value of helping employees grow their retirement savings against the added expense of doing so through true-up payments.

Too Soon to the Goal Posts

Here's the problem that true-up payments address: Most 401(k) and similar plans that offer employer matching use a per-paycheck formula, such as an employer contribution equal to 3 percent of each paycheck for employees who contribute at least 6 percent of their pay to their 401(k). But when employees make large contributions from each paycheck into their account, they're likely to hit the annual employee contribution limit before the end of the year. These employees have to stop contributing to their 401(k) for the rest of the year, and thus the employer stops making matching contributions. At year-end, these employees will have missed out on the full annual match.

With a true-up provision, at year-end the employer makes good on the full promise of the employer's match, regardless of when employees reached the annual contribution limit.

Jack Towarnicky, executive director of the Chicago-based Plan Sponsor Council of America, a coalition of employers that sponsor retirement plans, is an advocate of true-up payments.

"Many plans have adjusted their employer-matching contribution plan provisions to calculate the match based on what was contributed during the entire plan year, regardless of the timing," he explained. "If your plan calculates the employer match based on each payday contribution, you have an opportunity to add value, to prompt greater participation—and greater deferrals—by adding a true-up provision."

Maria Hurd, a CPA with Wilmington, Del.-based accounting firm Belfint Lyons & Shuman, noted: "Payroll-by-payroll computations are beneficial when administrative simplicity and predictable, even contributions are important to the employer, but they also eliminate the ability for employees to contribute unevenly throughout the year as their circumstances permit, including making large contributions out of bonus payments."

In other words, if plan participants calculate their per-paycheck account contributions to reach the annual 401(k) contribution limit at the end of the year, they may not realize that adding a deferral from their bonuses to their account will mean reaching the limit before year-end—especially when employees contribute most or all of their bonus to their 401(k), as financial advisors may encourage them to do.

Also, with a true-up provision, employees who join the plan midyear can get as much in matching contributions as they would have received had they spread contributions evenly over each payday, Towarnicky pointed out. "Similarly, those who start slowly but increase their savings rate will also get the same match for the year, compared to those who spread contributions evenly over all paydays."

[SHRM members-only toolkit: Designing and Administering Defined Contribution Retirement Plans]

Steps to Take

Towarnicky advised plan sponsors to do the following when offering true-up payments:

- Re-examine your plan document, specifically the employer-matching provisions, to reconfirm that the match is calculated separately for each payday. Change the match provision to include a true-up, which can be calculated based on contributions at any time during the plan year.

- Announce the change with great fanfare, targeting communications to those who might benefit.

- If your plan already has this provision in place, remind participants that paying more into their 401(k) early in the year won't mean they'll risk forfeiting the full employer match.

Employers can handle true-ups differently. Many wait until after the plan year has ended before they process true-up payments, while others make true-up matching contributions throughout the year, per paycheck, after a participant reaches the IRS maximum contribution limit (although due to the nature of true-ups, some must occur after the plan year has ended).

Employer Considerations

While employees are likely to embrace the added flexibility of adjusting the size of their plan contributions without losing the full employer match, employers should be mindful of the added cost and administrative complexity that come with offering true-up payments, Hurd advised.

"It's important for the plan sponsor to understand and budget for an additional contribution that will need to be made at the end of the year," she said. "Whether a true-up is a good idea depends on each employer's goals and limitations," such as corporate budget, the administrative capabilities of the company, internal plan personnel and the type of contract with the plan's service providers.

Sometimes, she added, the benefit of letting employees contribute unevenly throughout the year without loss of an expected match "outweighs the detriment of additional administrative and budget burdens. Sometimes it doesn't."

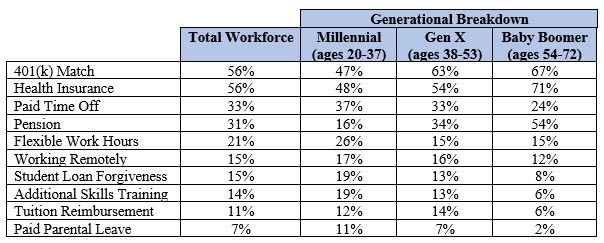

401(k) Match Is Among Most Valued Benefits When asked which three workplace benefits would help them reach their financial goals, more than half of Americans cited a 401(k) match or health insurance, while around a third cited paid time off, according to a 2018 American Institute of CPAs survey of more than 2,000 U.S. adults. By a 4 to 1 margin, respondents said they would choose a job with benefits over an identical job that offered 30 percent more salary but no benefits. |

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.