Help Employees Turn Retirement Savings into Lifetime Income

Part 3: Employees are often uninformed about how to create income that can last throughout retirement

Part 1

Easing into Retirement

Targeted Benefits for Aging Workers

Part 3

Lifetime Income Prospects

On average, people in the U.S. are living longer, healthier lives, but "most people are not financially prepared for the good news of living longer," said Yanela Frias, head of investment and pension solutions at Prudential Retirement.

In the U.S., she noted, "the retirement age was set at 65 back in 1934, when people expected to live only 10 years or less in retirement. Today, most people still expect to retire at 65, and yet few people have the security of lifetime income, whether in the form of a pension or annuity, to fund a retirement that could last anywhere between 10 to 40 years."

To meet this challenge, more U.S. employers are adding lifetime income tools, such as annuities, to their 401(k) or other defined contribution retirement plans.

"Plan sponsors can help their older plan participants invest and draw down their savings in retirement in conjunction with collecting Social Security benefits," said Bob Melia, executive director of the Institutional Retirement Income Council, which promotes income solutions in retirement plans. "This can help reduce the stress and anxiety that older workers may feel about retirement."

Employees, however, often don't know how to create retirement income from their savings. "Many employees don't understand how minimum required distributions work for 401(k) plans," said Jeanne Thompson, who leads the workplace solutions thought leadership team at Fidelity Investments in Boston. "They need a lot of education."

Nobel Prize-winning economist Richard Thaler recently told the magazine 401(k) Specialist, "We help people accumulate assets and leave them on their own to wind things down, even though that problem is even more difficult."

Help with Payouts

Sponsors of 401(k)s and similar retirement plans "are in a perfect position to help older workers who are intimidated by retirement planning decisions," such as by sharing strategies for withdrawing funds from retirement accounts, said Steve Vernon, research scholar at the Stanford Center on Longevity. Vernon co-authored a study that analyzes ways to help pre-retirees decide when they can afford to retire and how much money they need.

The study suggests that plan sponsors give pre-retirees a retirement income menu featuring options like these:

- Installment payments using the employee's required minimum distributions to calculate withdrawal amounts from his or her 401(k) or similar plan.

- Extra scheduled payouts, as necessary, to act as a bridge to delayed Social Security payments. Delaying Social Security benefits until age 70 results in a 132 percent increase in monthly Social Security payments.

- A rollover of account funds to an annuity bidding platform, where retiring employees can purchase a single, premium immediate annuity that provides fixed payments throughout their lifetime.

Employers are responding to the needs of retired employees, in part to keep retirees' dollars invested through the employer's plan, where larger asset sizes help plan sponsors to manage costs and keep participant expenses low.

Fidelity reports that more than half (55 percent) of retirees on its platform keep their savings in a previous employer's retirement plan past the first year of retirement, and more employers are providing online tools that plan participants can use to evaluate and compare withdrawal strategies and select the option that best suits their needs.

As part of this trend, Fidelity just launched a series of managed retirement funds intended as part of an employer's 401(k) or 403(b) plan investment line-up for retirees, with features to help manage withdrawal payouts during retirement.

[SHRM members-only toolkit: Designing and Administering Defined Contribution Retirement Plans]

Annuities and Other Options

But despite greater awareness that retirees need dependable income beyond Social Security—and tools and resources to help them navigate through available options—retirees overwhelmingly are left on their own to meet this challenge, as most lack access to retirement income products within their employer's plan.

As Dana Hildebrandt, director of investments at global advisory firm Willis Towers Watson in New York City, pointed out, "While many employers are making headway to help workers save more, their efforts to transform individual savings into a consistent flow of income that will last a lifetime remain a work in progress."

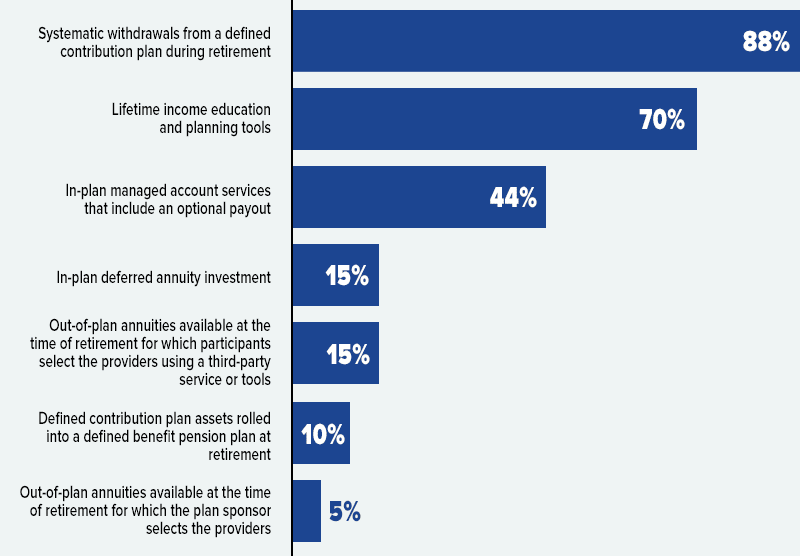

That could be changing, albeit slowly. The consultancy's 2019 Lifetime Income Solutions Survey—conducted in May and June 2019 with HR and finance executives at 164 U.S. companies with 1,000 or more employees—found that 30 percent of large employers offer one or more lifetime income solutions, up from 23 percent in 2016.

These benefits include planning tools to help participants decide how to spend down their savings during retirement and annuity options to create steady streams of income from retirement plan assets, such as in-plan annuities offered as a plan investment choice or resources to help employees buy out-of-plan annuities at retirement.

LIFETIME INCOME TOOLS AND RESOURCES

Large employers offer these options for turning retirement plan savings into

retirement income.

Source: 2019 Willis Towers Watson Lifetime Income Solutions Survey of employers with 1,000 or more employees.

When asked why they either adopted or are currently considering lifetime income solutions, 3 in 4 respondents (74 percent) cited concern over an aging workforce and increasing longevity—a sharp increase from 45 percent in 2016.

"While it's encouraging that more employers are embracing various lifetime income solutions, it's disappointing relatively few have adopted what the industry sees as more effective income-generating solutions, such as annuities and other insurance-backed products," Hildebrandt said. However, she added, "employer interest in these options may pick up steam as they better understand the value and associated benefits."

Public-Policy Challenges

Legal and regulatory changes are also needed to foster lifetime income options within retirement plans, as many plan sponsors have found the regulatory environment "unfriendly to that idea, and the Department of Labor has struggled to find a good way to offer safe harbor guidelines," Thaler told 401(k) Specialist.

However, if the Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed by the House in May but stalled in the Senate, were to be enacted, it would go far toward resolving these issues, retirement advisors say. The legislation would create a safe harbor, with specified provider-selection rules, that employers can use when choosing a group annuity to include as an investment within a defined contribution plan. [Update: President Donald Trump signed the SECURE Act into law on Dec. 20, 2019.]

Participants could choose between an immediate annuity, which provides guaranteed income beginning at retirement, or a deferred annuity, which starts at a later age.

Dissenting Voices

While there is an emerging consensus for helping employees plan for retirement income beyond Social Security, such as by managing withdrawals from retirement accounts, not everyone is on board with in-plan annuities. "Many remain critical of the idea of using annuities in defined contribution plans, pointing to their complexity and high fees," wrote Brian Anderson, managing editor of 401k Specialist.

And Barbara Roper, director of investor protection at the Consumer Federation of America, told the New York Times, "There will come a time where we will point back to this as the start of a trend toward high-cost annuities being offered in 401(k) plans to the detriment of retirement savers."

PART 4: Preparing for Health Care in Retirement

| Related SHRM Articles: House Passes SECURE Act to Ease 401(k) Compliance, Promote Savings, SHRM Online, May 2019 Risk vs. Readiness: The 401(k) Plan Annuity Conundrum, SHRM Online, February 2018 Employers Cautious on 'Lifetime Income' Options in 401(k) Plans, SHRM Online, August 2016 |