Employee Financial Stress Peaks

Employers try to ease workers’ rising financial concerns with new benefits.

Leaders at Reid Health knew they needed to act when they noticed a spike in workers seeking loans against their retirement accounts. The increased demand started during the COVID-19 pandemic, when many employees were left without paychecks after the Richmond, Ind.-based health care system was forced to suspend or limit certain hospital services.

In 2020, Reid gave employees access to Kashable, a business that offers short-term loans to those who have difficulty getting other types of financing. The loans can carry lower interest rates than other forms of debt. About 18 months ago, Reid added the DailyPay app that gives employees access to their earnings before payday, as well as the SmartDollar program from personal finance guru Dave Ramsey’s company to teach individuals about budgeting and saving.

“Finances are a big stressor for employees,” says Karen Martin, Reid’s benefits manager. “We believe that if employees are financially sound, they’re going to be more productive at work. They’re going to be happier, and retention is going to be better.”

Workers’ financial stress is growing and becoming a significant problem for their employers. Only 42 percent of U.S. employees rate their financial health as good or excellent, a 10-year low, according to a study released last year by Bank of America.

Why should employers care? Nearly 45 percent of U.S. employees who are struggling with their finances say their concerns distracted them while they’re at work, a 2023 PwC survey found. Of that group, only 54 percent feel there is a promising future for them at their employer, compared to 69 percent of employees who feel financially secure. Financially insecure employees are also twice as likely to seek new employment.

Finances are a big stressor for employees. We believe that if employees are financially sound, they’re going to be more productive at work. They’re going to be happier, and retention is going to be better.”

Karen Martin

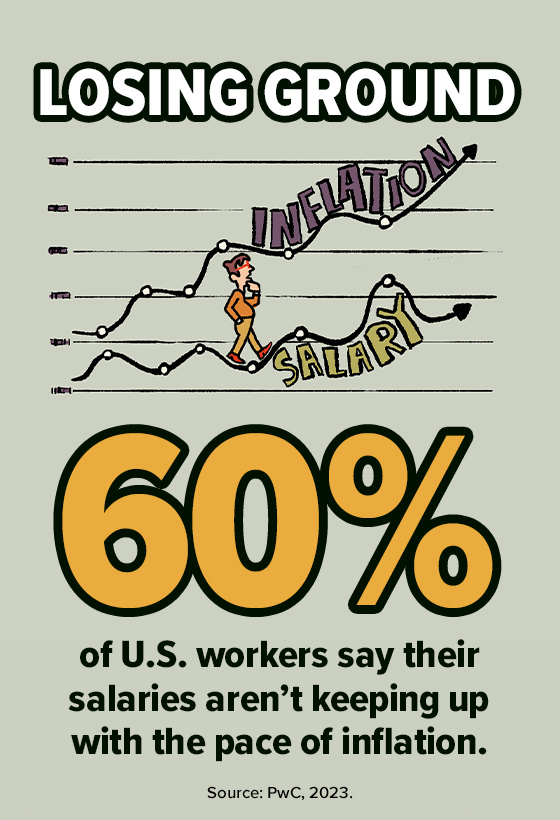

High inflation and interest rates, along with lackluster raises, are the main drivers of financial stress, experts say. Nearly 60 percent of employees said their salaries weren’t keeping up with the pace of inflation last year, according to PwC. That’s up from 41 percent in 2021. Additionally, many younger employees are burdened by large amounts of student loan debt. Roughly one-third (34 percent) of those ages 18-29 report having student debt, as do 22 percent of those ages 30-44, according to the Education Data Initiative, a nonprofit.

A Persistent Problem

Even though inflation has fallen and wages for many workers have started to outpace it, many employees continue to find it difficult to make ends meet. Total U.S. household debt in the fourth quarter of last year rose by $212 billion, or 1.2 percent from the third quarter, according to the Federal Reserve Bank of New York. Balances now stand at S17.5 trillion. Meanwhile, delinquencies have started to rise on all types of loans except for student loans, the bank said.

“Inflation is slowing, but it’s not like we can just turn it off and all the prices will decrease and credit card interest rates are going to be cut in half,” says Anthony Abbatiello, workforce transformation leader and partner at PwC U.S. “We are going to be grappling with this for some time.”

Employers are taking action. More than half of employers (54 percent) offer financial wellness tools, according to a 2023 survey by the Employee Benefit Research Institute. What’s more, roughly 30 percent of employers said they were planning to implement such tools, up from 25 percent in 2022. And almost 40 percent of company officials ranked employees’ financial health as a high concern, an increase from 29 percent in 2022. Employers are adding benefits such as financial counseling, student loan repayment plans and emergency savings options. Provisions from the SECURE Act 2.0, which President Joe Biden signed into law in 2022, are designed to increase retirement savings. They also make it easier for employers to contribute to student loan repayment and emergency savings accounts.

But some people aren’t impressed by employers’ efforts. “It’s just a gimmick,” says Elise Gould, senior economist at the Economic Policy Institute, a left-leaning think tank in Washington, D.C. “I think most people just need a raise.”

Gould says that many low-income employees don’t need advice on budgeting because they’ve learned to do it out of necessity. “I’m impressed they can put food on the table,” she says. “They probably know how to budget better than people who make more money.”

And while earnings have begun to outpace inflation, Gould says that low-wage workers are still behind due to years of being underpaid.

Targeted Solutions

Business leaders counter that they spend significant time and money to analyze their pay and benefits structures to ensure they’re competitive within their industry and areas of operation. Experts say that employers can delve into data, such as how many employees may be taking early withdrawals from retirement accounts or are having their wages garnished, to determine what types of financial tools to offer employees. Research has shown that even some employees who earn $100,000 or more annually are having a tough time paying the bills.

“With a rich set of information, you can make decisions on what benefits and services to provide and also build trust with employees by showing you are looking at how best to support them,” says Mark Smrecek, senior director, financial well-being market leader at WTW in Chicago.

I think most people just need a raise.”

Elise Gould

Smrecek says employers are especially interested in finding ways to give employees access to low-interest loans and helping them build emergency savings. That’s an acute need: Only 32 percent of Americans could cover a $500 emergency out of their savings, according to a 2022 study by the Federal Reserve. Personal finance education is also critical, Smrecek says, because teaching employees about managing money means they either won’t get into trouble or will avoid repeating past mistakes.

Experts say it’s critical for employers to ensure their workers know what financial tools are available to them. That may sound obvious, though some employers concede that the amount of information they give employees can be overwhelming. Therefore, targeted campaigns are key.

For example, the Bank of America study found that women are more financially stressed than men. That’s especially problematic because women tend to live longer than men. Experts say that sharing information about financial wellness benefits through employee resource groups for women could help emphasize the importance of money management. Similarly, employers may want to provide LGBTQ+ employee resource groups with information about the costs associated with surrogacy or adoption, so members know what to expect if they want to start families.

Clear Communication

At UPS, communication was key for increasing participation in a savings plan offered for nonunion employees, says B.J. Dorfman, director of global retirement strategy and U.S. benefits at the Atlanta-based company. For years, UPS had a plan that allowed post-tax money to be automatically deducted from employees’ paychecks, though few people took advantage of it and those who did tended to be high-income workers.

That started changing after UPS agreed to participate in the BlackRock Emergency Savings Initiative. In 2019, the social impact team at BlackRock began working with three nonprofits, including Boston-based Commonwealth, to develop programs that would encourage workers to set money aside for unexpected expenses. Around the same time, Dorman says UPS learned through a study with credit bureau Equifax that a significant number of its employees were carrying high levels of credit card debt and missing payments.

Atlanta-based UPS took several steps to increase participation in the savings plan. It created a new landing page with details about the option, started webinars about financial planning and sent direct mail pieces. The company was careful to avoid sending information about the program when it knew employees would be receiving materials from the company about other matters. In the first year, participation in the program increased 39 percent to 4,155 individuals and brought in an additional $10 million in savings by employees.

In 2021, UPS doubled to 10 percent the amount employees could have deducted from their pay to put in the savings plan. Last year, it began matching 50 percent of employees’ contributions up to 6 percent—the same match offered on its traditional and Roth 401(k) retirement plans.

“We want to give them flexibility with their investment options,” Dorfman says. “We wanted to remove barriers that may have prevented them from additional savings.”

Flexible Options

Savings accounts administered through employers are important, especially for low-income workers, because traditional banks often impose minimum balances and fees that prevent or deter individuals from setting money aside, says Nick Maynard, senior vice president at Commonwealth, which aims to help vulnerable people build financial security.

“Emergency savings are not widely available,” Maynard says. “But they’re actually a high-quality benefit that people want.”

Student debt repayment is also a highly desirable benefit, particularly for young people. This year, Kimley-Horn, an engineering, planning and design consultancy with headquarters in North Carolina, began offering a benefit that allows eligible employees to direct up to 4 percent of their compensation into repaying their student loans while still qualifying for the company’s 401(k) matching contribution. Previously, employee contributions would have needed to be deposited into a 401(k) account to get the match.

Kimberly Plessinger, benefits manager at Raleigh, N.C.-based Kimley-Horn, says many employees expressed an interest in student debt repayment in informal surveys, which wasn’t too surprising because the company’s average employee age is about 35. Plessinger says allowing employees to earmark money toward student loan repayment instead of retirement gives them the ability to choose what’s best for them at various stages of their life.

“For us, it boils down to flexibility,” Plessinger says. “I think it is going to be a phenomenal recruiting and retention tool.”

Theresa Agovino is the workplace editor for SHRM.

Explore Further

Employee Financial Wellness Drops to New Low

Although inflation has recently abated, employees’ financial wellness is still suffering. Recent research goes even further, indicating that financial wellness is at an all-time low.

Leveraging SECURE 2.0 into Greater Financial Wellness

At first glance, the SECURE Act 2.0 has something for everyone. For employers interested in helping employees improve their financial well-being, these provisions can be a compelling starting point for establishing a new financial wellness program or enhancing an existing one.

On-Demand Pay Broadens Workers’ Financial Well-Being

New payment systems are disrupting traditional weekly, biweekly and monthly payment schedules.

As Open Enrollment for 2024 Neared, Employees Voiced Cost Concerns

Ahead of open enrollment last year, employees were preparing for a rise in their benefits costs in 2024, with more worrying about having to pay more.

UK: How Can Employers Help Staff Experiencing Financial Difficulties?

There are some simple things employers can do to reduce the financial burden on employees and ease the stress associated with financial concerns.