2022 Salary Increases Look to Trail Inflation

Despite pay raises, employees' 'real' compensation expected to fall

Employers Revise 2022 Salary Budget Projections Editor's note: The salary budget projections in the story below are no longer current. For an update on salary increase budget forecasts in response to higher inflation, see the December 2021 SHRM Online article Revised 2022 Salary Increase Budgets Head Toward 4%. |

Pay raises in the U.S. are returning to pre-pandemic levels but rising prices mean higher salaries aren't likely to keep pace with inflation, new research shows.

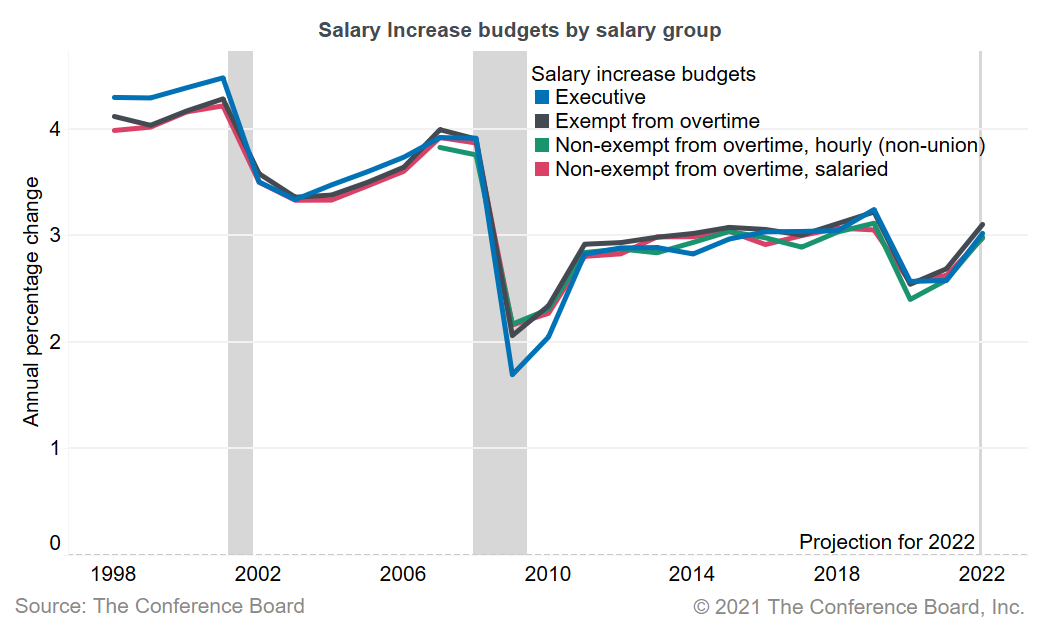

The median total U.S. salary increase budgets for 2021 are 3 percent, on par with the previous 10 years, and projections for 2022 are also 3 percent, The Conference Board reported in June.

The 3 percent median increase for 2022 is expected to hold steady across employment categories (i.e., nonexempt hourly, nonexempt salaried, exempt and executive), according to Judit Torok, a senior research analyst at The Conference Board, a large-business membership and research association.

The findings are based on The Conference Board's long-running Salary Increase Budget Survey, which includes more than 180 organizations and was updated in April and May 2021.

In an e-mail, The Conference Board's Gad Levanon, vice president for labor markets, said changes were more visible over time when looking at salary budget increase averages (the mathematical mean) rather than medians (the middle value after listing expected budget increases in successive order). He shared that according to The Conference Board's survey:

- The average salary increase budget was lower this year than in pre-pandemic years. (SHRM Online previously reported that salary increase budgets for 2021 declined for the first time in 12 years.)

- Average raises in 2022 are likely to be higher than in 2021, returning to pre-pandemic rates.

- Inflation in 2021 is likely to be well above salary increase budgets.

"After being a nonissue in wage determination for several decades, strong inflation in 2021-2022 could lead to greater demand from workers and unions for a cost-of-living adjustment in 2022," Levanon said.

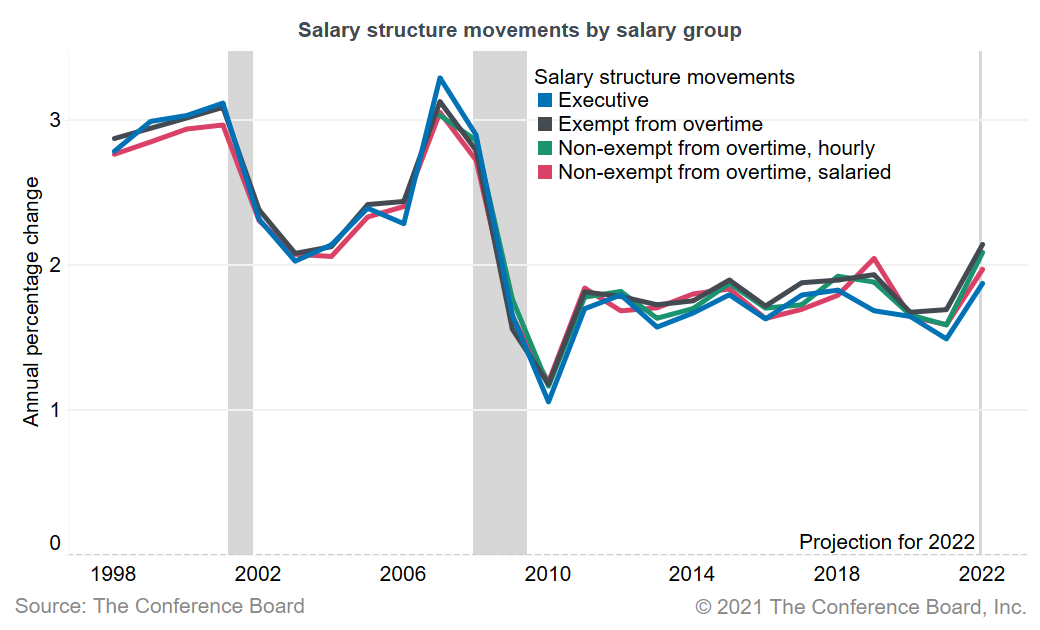

Salary structure changes, such as adjustments to pay ranges for specific job positions, also dipped but are projected to return to pre-pandemic rates next year.

Drop in 'Real' Wages

"Inflation has increased notably and will likely remain elevated in coming months before moderating," Federal Reserve Board Chair Jerome Powell said during a press conference on July 14.

Judy Shelton, an economist and senior fellow at the Independent Institute, a free-market think tank, wrote in a July 25 Wall Street Journal column that "nominal wage gains are an illusion when inflation wipes out real gains." While last year's inflation rate was 1.7 percent, she noted, this June the federal government reported a year-over-year inflation rate of 5.4 percent.

As a result, an average 3 percent base pay increase would represent a decrease in purchasing power for employees.

Already, inflation has resulted in a nearly 2 percent pay cut from June 2020 to June 2021, despite modest gains in hourly wages, according to the U.S. Bureau of Labor Statistics.

PayScale, a compensation data and software firm, released its second quarter 2021 PayScale Index in July, showing that wages are rising 0.6 percent quarter-over-quarter and 2.6 percent year-over-year. Wages are rising particularly fast for occupations such as:

- Food services (up 4.1 percent).

- Transportation (up 4 percent).

- Retail (up 3.9 percent).

However, real wage growth adjusted for inflation declined -0.6 percent overall in the second quarter and increased only 0.3 percent year-over-year.

The index tracks quarterly changes in total cash compensation for full-time, private industry employees in the U.S., drawn from the firm's database of more than 35 million employee profiles.

Employers, facing economic uncertainties—made worse by the threat of new economic shocks due to the COVID-19 Delta variant—may lack the means to provide across-the-board pay raises that keep pace with inflation. This could drive up already high turnover rates if employees can find better-paying positions elsewhere.

Most workers in the U.S. will get an average of a 5.8 percent raise by changing jobs, according to data reported by the ADP Research Institute.

Fewer Frozen Salaries

In other new survey data, only 3 percent of companies don't plan to boost salaries next year, a drop from 8 percent that didn't give raises this year, according to Willis Towers Watson's (WTW's) latest General Industry Salary Budget Survey.

The consultancy's salary budget projections are in the same ballpark as The Conference Board's, showing that:

- For executives, management and professional employees, and support staff in 2022, U.S. companies project average salary increases of 3 percent, up from the average 2.7 percent increases companies granted this year.

- Production and manual labor employees are in line to receive average increases of 2.8 percent next year, higher than the average 2.5 percent increases this year, based on WTW's research.

Salary increases had hovered around 3 percent for the past decade until the pandemic forced companies to trim budgets, WTW noted. Its survey was conducted in April and June, and 1,220 companies representing a cross section of industries participated.

"Companies are between a rock and a hard place when it comes to compensation planning," said Catherine Hartmann, North America Rewards practice leader at WTW. "On the one hand, employers need to continue effectively managing fixed costs as they rebound from the pandemic. On the other hand, companies recognize they need to boost compensation with sign-on, referral and retention bonuses; skill premiums; midyear adjustments; or pay raises."

Top Performers Reap Rewards

The WTW survey found employers are continuing to recognize their high-performing employees with significantly larger pay raises than average-performing employees.

Management and professional employees receiving the highest possible performance rating received an average increase of 4.5 percent this year, up from the 2.6 percent increases granted to those receiving average ratings last year, WTW found.

Support staff and hourly workers who received the highest ratings also saw bigger raises than average-performing peers.

The survey also looked at bonuses tied to company and employee short-term performance goals:

- Annual performance bonuses this year, based on 2020 performance, were awarded by 91 percent of responding companies, up from 76 percent of companies that awarded them last year.

- For management and professional employees, bonuses averaged 16 percent of salary.

- For support staff, bonuses averaged 8 percent of salary.

- For production and manual-labor employees, bonuses averaged 5.5 percent of salary.

Additional research by PayScale shows that 51 percent of workers believe they are paid below market even when they are paid at or above market. "Workers who perceive they are underpaid are more likely to seek new opportunities in the next six months, showing that pay perception and pay communications have a measurable impact on retention," the firm noted.

WorldatWork's Salary Budget Forecast: 3.3% Growth WorldatWork's 2021-2022 Salary Budget Survey found that salary increase budgets are projected to grow to 3.3 percent on average in 2022, up from 3 percent in 2021. "This data signals continued economic recovery and an increasingly tight labor market," the organization reported. The survey, which closed in June, received responses from 4,085 WorldatWork members, who are total rewards professionals. In the table below, the mean is the mathematical average, and the median is the middle value after listing expected budget increases in successive order. Outliers, or extreme values on either the high or low end, have the bigger effect on the mean and less on the median, although for this data there was little difference between the two measures. Total U.S. Salary Budget Increases

Source: WorldatWork Salary Budget Survey 2021-2022: Top Level Results. While the pandemic negatively impacted about 30 percent of salary increase budgets in the U.S., fewer than 10 percent of organizations expected their salary budget increases to be negatively affected by the pandemic in 2022, the survey showed. "With differences in how and when organizations and industries recover from the pandemic, and with labor shortages across various industries, we anticipate a great deal of flux in salary budgets over the next few years," said Sue Holloway, WorldatWork's director of executive compensation strategy. |

---

PayScale Pegs 2022 Salary Budget Growth at 3.3% According to compensation data and advisory firm PayScale's 2021-2022 Salary Budget Survey, conducted from May through July 2021 with responses from 736 U.S. employers, businesses offered over 80 percent of nonexempt and exempt non-management employees base salary increases of 3 percent on average in 2021, a jump from the average planned increase of 2.6 percent last year. "Going into 2022, businesses are planning to further expand salary increases to 3.3 percent on average," PayScale found. "Tight labor markets in 2021 are likely forcing employers to expand their promotional increase budgets going into 2022," the survey report noted. "Increasing demand for scarce employees, in combination with the labor hardships endured through the pandemic, may encourage larger percentages of employees to self-advocate for compensation increases in this ever-evolving economy." |

---

Empsight Forecasts 2022 Merit Budget Increases of 3% Compensation survey and consulting firm Empsight's 2021 Policies, Practices & Merit Survey report, which includes 2022 forecasts, projects median salary budget increases of 3 percent across all employee classifications, based on employer responses received between April and July 2021. Responses below, from 225 companies, include those not planning merit increases.

Source: Empsight. Responses below, from 221 companies, exclude those not planning merit increases, although the overall difference is negligible.

Source: Empsight. Among surveyed companies, 87 percent were able to forecast merit budgets for 2022, while only 70 percent provided forecasts last year, "suggesting that more companies are more confident in forecasting a budget for 2022 as opposed to taking a 'wait and see' approach," Empsight's report noted. Empsight also projects median salary structure increases of 2 percent for 2022, based on 206 employer responses. |

---

The 2-3 Percent Raise is on the Decline While the prevailing salary increase rate remains at 3 percent, the percent of organizations giving 2-3 percent increases has dropped to its lowest point since 2019, according to Salary.com's U.S. and Canada National Salary Budget Survey, which closed June 30, 2021. Over 900 human resource professionals across 20 diverse industries participated in this year's survey. For 2022, 12 percent of organizations intend to give 4-5 percent increases, versus just 7-8 percent of organizations in 2021. Of note, these 4-5 percent planned increases hold steady across all job categories, from hourly employees up to the executive level. "This is the first sign of a notable shift in salary budget increases in 10 years, particularly for hourly employees who have long experienced stagnant pay," said Chris Fusco, senior vice president of compensation at Salary.com, a provider of compensation data and analytics. "Minimum wage legislation sweeping the country is a big factor. But the re-emergence of lower-level workers executing their market power is undeniable. Aging Baby Boomers and pandemic-related worker shortages have created this scenario where we have more jobs than we have people willing, or able, to work." |

Related SHRM Resource:

Salary Increase Projections 2022, SHRM Express Request

Related SHRM Articles:

Revised 2022 Salary Increase Budgets Head Toward 4%, SHRM Online, December 2021

Turbulence Ahead: Will 2022 Break Compensation Budgets?, SHRM Online, December 2021

Navigating Post-Pandemic Compensation Challenges, SHRM Online, July 2021

Inflation's Return Will Affect Compensation, SHRM Online, June 2021

[Need real-time, HR-reported compensation reports? Check out the SHRM Compensation Data Center]

Advertisement

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

Advertisement